Input 2021.02.09 12:00

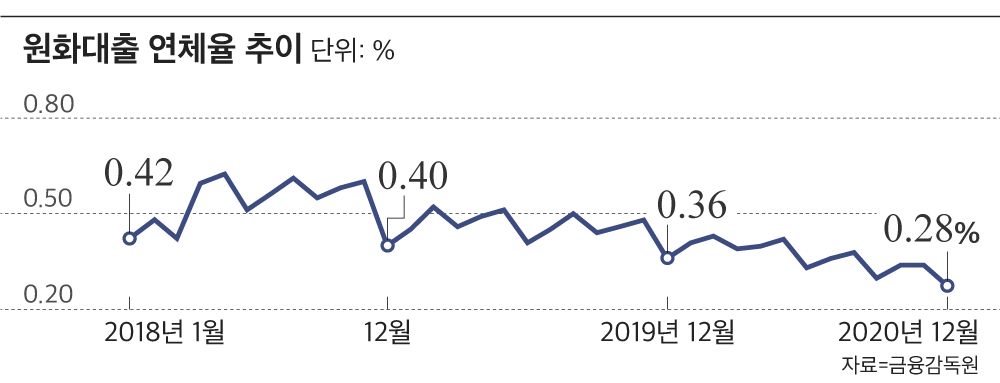

According to the Financial Supervisory Service announced on the 9th,’The delinquency rate of Korean banks’ loans in KRW at the end of December 2020′, the delinquency rate of loans in KRW (based on principal and interest delinquency for more than one month) was 0.28%, compared to the end of the previous month (about 0.34%). It fell by 0.07% point (P). This is the lowest of the Korean won loan delinquency rates, which began to be counted in January 2007, and again hit the lowest level since the end of June (0.33%) and September (0.3%) of last year.

The delinquency rate of all borrowers, including companies and households, fell. The corporate loan delinquency rate was 0.34%, down 0.08%p from the end of the previous month (0.43%). Among corporate loans, loans to large corporations fell by 0.01%P to 0.27%, which was insignificant, while loans to SMEs fell 0.1%P to 0.36%. Among SMEs, loans to small and medium-sized corporations and private business owners fell 0.14%P and 0.06%P respectively from the end of last month to 0.48% and 0.21%.

The household loan delinquency rate was 0.2%, down 0.04%p from the end of the previous month (0.24%). Among household loans, the delinquency rate for home mortgage loans fell by 0.02%p from the end of the previous month to 0.14%, and the delinquency rate for household loans such as credit loans excluding mortgage loans was 0.34%, down 0.09%p from the end of the previous month.

An official from a commercial bank said, “The actual insolvency has not been revealed because the loan maturity has been extended or interest repayment has been delayed for the victims of SMEs or small business owners.” “Corona has increased corporate and household loans and the repayment ability has deteriorated due to the economy. I guess it is, but it is difficult to measure the risk by the delinquency rate anymore.”