#The B Foundation, an affiliated public interest corporation of Group A, a corporate group limited to mutual investment, has held more than 5% of its affiliate stocks since 1996. At the time, the amendment of the law prevented a public interest corporation from holding more than 5% of the shares of a company, but the B Foundation continued to hold more than 5% of shares according to the clue that it could hold more if it was recognized as a sincere public interest corporation.

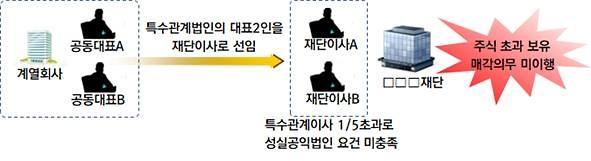

However, during the recent verification process, the National Tax Service confirmed that two joint representatives of Group A affiliates served as directors of the B Foundation, failing to meet the requirements of a sincere public interest corporation. The National Tax Service levied an additional tax of tens of billion won, equivalent to a market price of 5%, for stock holdings exceeding 5%.

The National Tax Service announced on the 9th that it plans to expand individual verification of public interest corporations affiliated with large corporations and large public interest corporations suspected of insincerity.

Since the second half of 2018, the National Tax Service has been verifying the performance of tax obligations of all public interest corporations affiliated with large corporations. This is to prevent large corporations from using affiliated public interest corporations for expedient inheritance and donation or to use contributing property irregularly. Even if it is not affiliated with a large corporation, the public interest law, which has a large amount of assets and income and is suspected of insincerity, is also subject to individual verification.

An official from the National Tax Service pointed out, “There are cases of’unfaithfulness’ that violates legal obligations such as excessive holdings of specific corporate stocks or providing unfair profits to affiliates while public interest corporations enjoy tax benefits.”

Representative public interest corporations affiliated with large corporations with large stocks are the Samsung Cultural Foundation, the Hyundai Chajeong Mongkoo Foundation, and the Lotte Scholarship Foundation. As of last year’s disclosure, the Samsung Cultural Foundation owns stocks in Samsung Life Insurance (4.68%), Samsung Fire & Marine Insurance (3.06%), Samsung C&T, and Samsung SDI.

In addition, starting this year, all public interest corporations for December settlement except for religious organizations must disclose their settlement documents through Hometax by April 30th. Until last year, a’small public interest corporation’ with a total asset value of less than 500 million won and the sum of income and contributions of less than 300 million won was not obligated to disclose. Small public interest corporations may be disclosed in a simplified form.

Prior to the public announcement, public interest corporations settled in December by the end of this month must submit financial statements submitted to the competent authorities, such as’reports on assets contributed by public interest corporations’ and’external expert tax confirmation’, to the competent tax office in writing or hometax.

The amount of donations raised, disclosure of usage results, and the performance of obligations under the corporate tax law, such as opening and using dedicated accounts, must also be reported to the competent authorities by April 30th.

On the other hand, non-profit corporations that want to be designated as public interest corporations to raise donations should apply for designation recommendation to the competent tax office, not the competent authority, starting this year. In order to be designated as a public interest organization this year, applications must be made by October 10th.

The National Tax Service urged, “In accordance with laws and regulations, academic research, scholarship, and art organizations that have received donations without designation of public interest organizations must also be designated from this year, so the application for designation should not be omitted.”