Last year’s operating profit of listed companies on the securities market increased by more than 3% compared to the previous year. However, except for’semiconductor two-top’ such as Samsung Electronics and SK Hynix, the operating profit of the remaining companies decreased by close to 10%, demonstrating the shock of the Corona 19 crisis. The operating margin of sales, which shows the basic strength of a company, was also sluggish compared to the average year. The net profit margin increased due to the austerity management.

Experts, however, expect companies’ profits to improve significantly this year. This year’s consensus on operating profits for companies listed on the securities market (average of estimates of three or more securities companies) is about 50% higher than last year.

○ Excluding Samsung Electronics, operating profit 6.4%↓

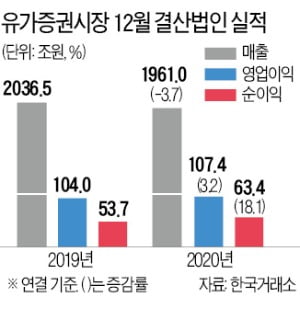

According to the Korea Exchange and the Korea Listed Companies Association on the 4th, last year’s sales (consolidated basis) of 597 companies listed on the stock market for December settlement (excluding financial industry, etc.) totaled 1961.763 billion won. This is a decrease of 3.7% from the previous year. However, operating profit increased by 3.2% during this period to 107.2 trillion won. Net profit increased 18.1% to 63,453.3 billion won. The increase in net profit is the effect of firms’ tightening management in a difficult business environment.

Overall, profitability seems to have improved, but there is also an optical illusion caused by the semiconductor effect. Excluding Samsung Electronics, the operating profit of companies listed on the securities market last year was KRW 71,4133 billion, down 6.4% from the previous year. Excluding SK Hynix, it recorded 6.6 trillion won, a decrease of 9.8% during this period.

2019, which is the target of comparison, was a year when corporate performance was record-low. At that time, the operating profit of 583 listed companies on the stock market was 102.2 trillion KRW, a whopping 37.0% decrease from the previous year. It is evaluated that the situation has worsened last year due to the effect of Corona 19.

In the semiconductor industry, the situation was good due to the arrival of the rising point in the economic cycle and the increasing demand for non-face-to-face, but most other industries are interpreted as the result that the adverse effects of the Corona 19 crisis were inevitable.

○The ability to generate corporate profits also deteriorated.

The operating margin of sales, which is an indicator of a company’s ability to generate profits, was also sluggish. Last year, the operating margin of sales of listed companies on the securities market was 5.5%, a slight improvement from the previous year (5.1%). However, it is still low compared to the average. The operating margin on sales of companies listed on the securities market was around 8% in 2018, but dropped sharply to 5.1% in 2019, and remained at around 5% last year.

Looking at last year’s sales by industry, five sectors, including pharmaceuticals (13.5%), medical precision (11.0%), food and beverages (5.9%), electrical and electronic products (4.3%), and telecommunications (2.7%), showed an increase. On the other hand, the number of sectors declined was as much as 12. Transportation and warehouse (-16.4%) declined the most, followed by chemicals (-12.3%), steel and metals (-8.2%), distribution (-6.3%), electricity and gas (-6.2%), paper and wood (-6.2%), and service (-5.0%). %), in that order, sales decreased a lot.

The net profit of 42 financial companies with consolidated financial statements increased 8.4% from 22,724.7 billion won in 2019 to 24,634.3 billion won last year. Insurers (3,963.8 billion won) and securities companies (4,313 billion won) saw a significant increase in net profit, which increased 35.0% and 31.0%, respectively. On the other hand, the bank’s net profit decreased by 4.7% to only 1.56 trillion won. This is interpreted as the impact of poor profitability due to low interest rates.

○This year’s earnings rebound… The stock price is unknown

Investors’ attention is focused on how much earnings will improve this year. There are many people in the stock market who are optimistic about the situation. This is because the corona 19 vaccination is in full swing, and consumption is rising accordingly. Due to the rapid increase in trade between countries, exporting companies are unable to find container ships.

According to F&Guide, a financial information company, the operating profit of 253 companies with an earnings consensus this year is estimated at 188 trillion9166 billion won. This is an increase of 48.3% compared to last year (127 trillion 398.5 billion won). Excluding Samsung Electronics and SK Hynix, the increase is expected to increase by 52.4%.

Seo Cheol-soo, head of Mirae Asset Securities Research Center, said, “The trend of improving corporate performance is continuing worldwide, and the situation is particularly good for Korean companies.”

Reporter Yang Byung-hoon [email protected]