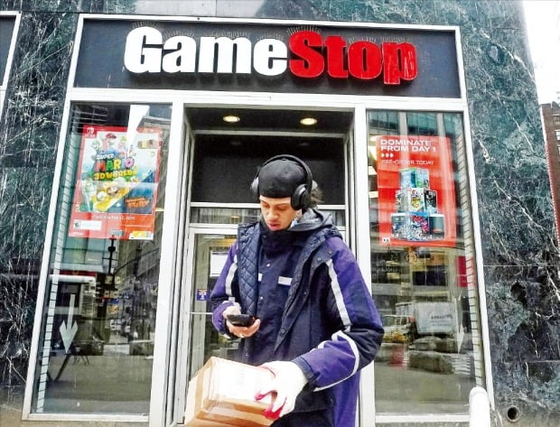

On the 27th, in the New York Stock Exchange in the US, GameStop stocks surged 133.13% to 344.99 dollars. Hedge funds, which had been short selling due to the surge in GameStop’s stock price, were on the verge of bankruptcy. There is also an analysis that individual dissatisfaction with the short-selling forces accumulated over a long period of time is an organized result. yunhap news

Storage scale 324 million dollars (approximately 360 billion won)

15th among listed stocks in the US stock market

This is the current status of Korean investors’ possession of’Game Stop’ in the US, which can be checked on the securities information portal’SEIBro’ provided by the Korea Securities Depository. On the 2nd (local time) in the US market, GameStop stock price plunged by 60% from the previous day to close at $90, increasing concerns among domestic investors.

Gamestop, 4 minutes 1 piece in 2 days

The stock price of GameStop, an offline game retailer in the US, soared regardless of the value of the company. This is because short-selling hedge funds have been rumored to have short-selled more stocks than their total stock circulation, and US ant investors have been buying them. Ant investors bought stocks in anticipation of a short squeeze. Short squeeze refers to a case in which a short hedge fund, which makes money only when the stock price falls, buys stock to reduce losses when the stock price rises contrary to expectations. In the process, the stock price rises as the buying trend rushes, and ant investors rush to GameStop stocks aiming for this.

Gamestop’s stock price, which was only around $17-18 until the first week of last month, soared to $347 on the 27th of last month. During the market, it was overheating, hitting $483. It is known that the short selling hedge fund suffered enormous losses while the stock price rose due to the investment of ants. GameStop became a symbol of the ant’investors’ rebellion’ against short-selling hedge funds.

However, the uprising is showing signs of being overpowered in two weeks. The stock price, which ended at $325 on the 29th of last month, fell sharply to $225 on the 1st. On the 3rd, it was pushed to $90. According to S3 Partners, a financial information analyst firm, the loss of short-sell hedge funds also fell sharply from $20 billion last week to $13.4 billion on the same day as GameStop shares plunged one after another.

The desperate voice continues in the discussion room of the online community Reddit’s’wallstreetbets’, which is the protagonist of the gamestop stock buying craze. An ant investor wrote, “We must cooperate to succeed,” and “this movement is not over.” It is an appeal not to sell stock to those who own GameStop stock. Over 10,000 comments were posted under this post.

Another investor argued that the short-selling force still remaining in GameStop had to wait for a short squeeze, saying that the proportion of shorts to be liquidated amounts to 122% of all circulating stocks.

However, the opinions of experts are different. There is an analysis that the increase of more than 1625% last month could be the short squeeze waiting for ant investors. Jim Kramer, a former hedge fund manager who runs’Mad Money’ at CNBC, said on the 1st, “Please, please. Don’t be greedy.” He said, “It’s not convincing that the gamestop stock price is over $60.” Do not expect another short squeeze that has already passed, and if you have made a reasonable profit at this point, it is realistic advice to sell your stock and exit.

The sign of GameStop, an offline retailer of American games. AP=Yonhap News

Korean ants bought more than Tesla

Unlike US investors who participated early in the game stop fever, mainly Reddit, domestic investors who jumped relatively late in the rally are expected to see a significant increase in losses.

According to Savero, the total amount of gamestop purchases made by domestic investors in January this year was $ 767 million. Of these, more than 80% of the $636 million value was settled (27-28 days from the purchase date) on the last 1-2 days after the gamestop stock price reached its highest and turned downward.

Since the fourth week of last month, Gamestop stocks based on purchase and settlement amount have been bought by Korean investors more than Tesla. Currently, the amount of stocks stored by domestic investors is 324 million dollars (15th), more than other high-end stocks such as Alibaba (18th), AT&T (20th) and Qualcomm (25th).

Many online communities where stock investors gather are posting a number of “loss verification” posts from the dawn of the 3rd as the game stop stock price has been falling. It seems that there are a number of people who have lost several million won to tens of millions of won.

One investor complained, “I had to quit when I lost about 800,000 won on Friday (seeing profit and selling),” and said, “I lost about 5 million won now.”

Reporter Oh Wonseok [email protected]