118 out of 135 companies announced the results… 17 companies excluded due to reasons such as inadequate audit opinion

Advances in the manufacturing industry… Last year’s operating profit increased by 207.4% compared to the previous year

[아시아경제 공병선 기자]Thanks to the advancement in the manufacturing industry, the KONEX market’s performance improved last year. Overall operating profit, which was in the red in 2019, turned to black last year.

On the 4th, the Korea Exchange announced the financial results of the KONEX market for the 2020 fiscal year. The target audience is 118 among 135 companies with settlement accounts for December.

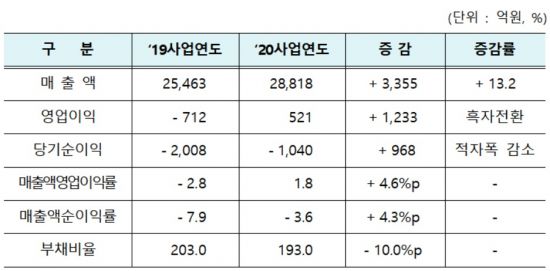

Last year, the overall performance of the KONEX market improved compared to 2019. Sales amounted to 2,881.8 billion won, an increase of 13.2% over the previous year. Operating loss from 71.2 billion won in 2019 turned to a surplus and recorded 52.1 billion won. The net loss for the year decreased sharply from 2008 billion won to 104.0 billion won. The debt-to-equity ratio was also 193%, down 10 percentage points from the previous year. Both the operating margin of sales and the net margin of sales, which are profitability indicators, rose compared to the previous year. The operating margin of sales recorded 1.8%, an increase of 4.6 percentage points from the previous year. The net profit margin on sales was -3.6%, an increase of 4.3% compared to the previous year.

Consolidated performance of 31 of the 34 companies that can be compared with the previous year also improved. The 31 companies’ sales increased 14.8% compared to 2019, and their debt-to-equity ratio decreased by 43.7 percentage points. Operating profit also increased by KRW 66.9 billion, turning to the black. Net loss for the year also decreased from 57.1 billion won in 2019 to 2.7 billion won.

In the KONEX market, the improvement in the manufacturing industry, which accounted for 32.2% of all companies, was noticeable. The sales of 38 manufacturing companies last year stood at 1.272.8 billion won, up 26.4% from the previous year. In particular, operating profit rose 207.4% year-on-year to KRW 113.5 billion, turning net profit into a surplus. Last year, the net profit of the manufacturing industry was 27.5 billion won. However, the debt-to-equity ratio recorded 209.2%, up 7 percentage points over the previous year.

Unlike the manufacturing industry, the bio and IT-related industries were sluggish. Both the bio-up and IT-related businesses increased their sales, but both operating and net losses increased significantly. Bio-up’s operating loss recorded 77.5 billion won, and the deficit continued following 2019. The net loss for the year also reached 101.6 billion won, a nearly three-fold increase compared to 2019. The operating loss of IT-related industries recorded 9.5 billion won, and the deficit continued last year. Net loss for the year also recorded 46.4 billion won, which was in the red for the second year in a row. However, the debt-to-equity ratio in both the bio and IT-related sectors decreased by 19.0 percentage points and 7.3 percentage points, respectively.

As for accounting standards, companies that adopted the Korean International Accounting Standards (K-IFRS) performed better than those that adopted the General Accounting Standards (K-GAAP). The 69 companies that introduced K-IFRS recorded sales of KRW 1956.5 billion, operating profit of KRW 68.8 billion, and net loss of KRW 39.8 billion. On the other hand, 49 companies that introduced K-GAAP recorded sales of KRW 9252 billion, operating loss of KRW 16.7 billion, and net loss of KRW 64.2 billion.

17 companies were excluded from the analysis of financial results due to reasons such as inadequate audit opinions. ▲ Goose & Home ▲ Nara Soft ▲ Miaebu and other 11 companies received non-appropriate opinions, such as refusal of opinion. ▲Myungjin Holdings ▲Hubexel ▲Sunbio, etc., did not submit audit reports. A-One R-Form was selected as the subject of the delisting substantive review.

By Gong Byung-seon, reporter [email protected]