[세종=뉴스핌] Reporter Eun-Seok Lim = KEPCO posted an operating profit of 4.1 trillion won last year due to low oil prices.

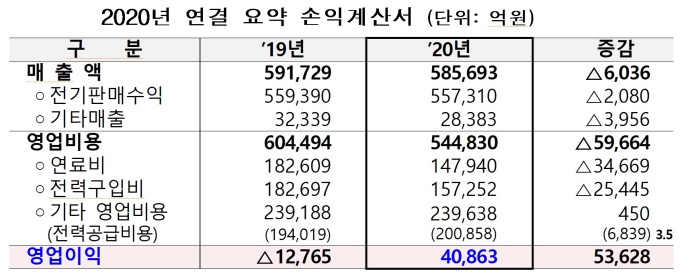

On the 19th, KEPCO announced on the 19th that it recorded KRW 58 trillion in consolidated sales and KRW 4.1 trillion in operating profit last year. It rebounded from the deficit of 200 billion won and 1.3 trillion won respectively in 2018 and 2019 to a surplus after three years.

As international fuel prices fell in the aftermath of’Coronavirus Infectious Disease-19 (Corona 19),’ fuel costs for power generation subsidiaries and electricity purchase costs for private power generation companies fell 6 trillion won from 36 trillion won a year ago to 30.5 trillion won last year.

|

| 2020 KEPCO Consolidated Income Statement [자료=한국전력] 2021.02.19 [email protected] |

Subsidiary fuel costs declined by 3.5 trillion won compared to the previous year due to falling fuel prices such as oil and bituminous coal prices. Electricity purchase cost increased by 2.0% from private power generation companies, but decreased by 2.5 trillion won due to liquefied natural gas (LNG) and falling oil prices.

The use rate of nuclear power plants with low power generation costs was 75.3%, up from 70.6% last year, which seems to have had an impact. This is due to the reduction in preventive maintenance days for nuclear power plants and the operation of Shin-Kori Unit 4 However, the coal use rate fell from 70.8% in the previous year to 61.2% last year.

KEPCO explained that “operation performance is more affected by fluctuations in international fuel prices such as oil prices than the rate of nuclear power or coal utilization.”

Meanwhile, electricity sales fell 2.2% due to the re-proliferation of Corona 19 and consumption contraction due to prolonged rainy season, and electricity sales revenue decreased by 200 billion won.

KEPCO said, “We will reduce the cost of electricity supply through management efficiency along with the reorganization of electricity rates, minimize the factors for raising electricity rates, and continuously promote profit improvement efforts.” “KEPCO and its power group companies will increase the rate of electricity supply cost per 1 kW of sales. We will manage it within 3% per year by 2024.”