Interest income, etc. increased by 4% in a year… 4th quarter net income of 577.3 billion, 8% ↑

Dividend payout ratio of 20%, dividend per share 1,770 won… 20% decrease from 2019

KB Financial Group achieved the highest profits in history last year thanks to increased loans and stock investments in the aftermath of the novel coronavirus infection (Corona 19).

Last year’s dividend payout ratio (shareholder’s dividend out of current net income) fell to 20% according to the recommendations of the financial authorities, and accordingly, dividend per share decreased by about 20% from 2019.

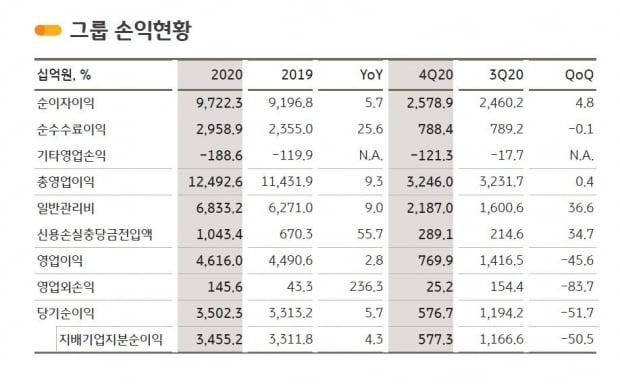

KB Financial Group announced on the 4th that last year’s total net income (based on the net income of the controlling company’s equity) was totaled at 3.45 trillion won.

This is the highest record in history, up 4.3% from 2019 (3,311.8 billion won).

An official of KB Financial Group said, “Last year, the Bank of Korea’s base interest rate cut and the prolonged COVID-19 outbreak were concerned about damaging the bank’s profitability, but interest income steadily expanded based on the bank’s solid loan growth and net commission income from the non-bank sector This has increased significantly, maintaining solid profit and stamina,” he explained.

As of the end of last year, the group’s total assets (610 trillion won) rose 17.8% (92 trillion won) from the end of 2019 (518 trillion won) due to the increase in loan receivables and the incorporation of Prudential Life Insurance affiliates.

KB Financial Group’s additional credit loss provisions accumulated to preemptively respond to the Corona 19 hit were totaled at 377 billion won last year (26 billion won in the second quarter and 171 billion won in the fourth quarter).

By subsidiary, the bank’s net profit fell 5.8% year-on-year to KRW 2.2 trillion.

Net interest income increased 6.1% from 6.36 trillion won to 6.75,548 billion won, but the amount of provisions for credit losses increased from 143.6 billion won to 4843 billion won.

An official from KB Financial Group said, “Even though interest income increased due to loan growth and efforts to reduce procurement costs, and profits related to securities, derivatives, and foreign exchange increased, the cost increased due to the expansion of retirement and preemptive transfer of provisions related to Corona 19. “He explained the background behind the decline in bank net income.

KB Securities’ annual net income for the year was 425 billion won, up 65%.

This is due to a 143% increase in commissions from 255.1 billion won to 5953 billion won as stock trading volume and customer trust increase.

However, KB Insurance’s net income (163.9 billion won) has decreased by 30% (70.4 billion won) in one year.

KB Financial explained that this is because the investment environment has deteriorated due to Corona 19 and the operating profit of investment has decreased.

Looking at the results of the fourth quarter of last year alone, the total net profit of KB Financial Group was KRW 577.3 billion, up 8% from the fourth quarter of 2019.

However, it is 50.5% less compared to the previous 3rd quarter (KRW 1.16 trillion).

An official from KB Financial Group said, “The 4th quarter hoped retirement cost (about 249 billion won after tax) and additional provisions related to Corona 19 (approximately 124 billion won after tax) were incurred. 145 billion won) was recorded, so the’base effect’ was also shown in the fourth quarter.” “Excluding these factors, ordinary net profit is similar to that of the third quarter.”

In addition, KB Financial Group held a board of directors meeting in the morning prior to the announcement of the results of the day, and decided on a dividend payout ratio of 20% and a dividend per share of 1,770 won in 2020.

This is in accordance with the guidelines for’dividend payout ratio within 20%’ recommended by the financial authorities last month.

The dividend per share of 1,770 won is 20% less than that of 2,210 won in 2019.

An official from KB Financial Group said, “In preparation for the economic downturn and uncertainty caused by the prolonged Corona 19, the dividend level has been temporarily reduced, but we will implement various shareholder return policies such as dividend expansion and treasury stock purchase.”

/yunhap news