|

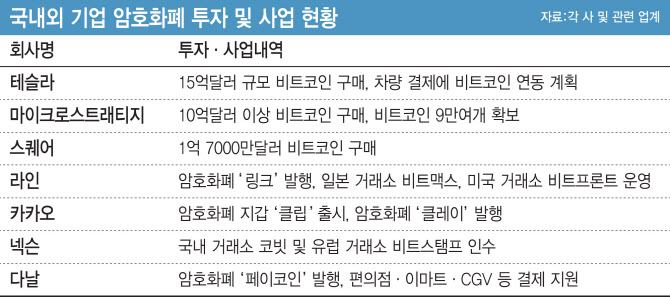

As cryptocurrency has become an investment asset, domestic and foreign innovative companies are investing in cryptocurrency and expanding their business. The era of buying Tesla’s electric cars with bitcoin and paying with cryptocurrency at domestic convenience stores and theaters is opening up. It is an evaluation that an ecosystem like the real economy is being created in the digital world.

According to related industries on the 28th, movements by domestic and foreign companies to introduce cryptocurrency as a payment method are spreading. Tesla, which bought 1.5 billion dollars (about 1.7 trillion won) of bitcoin, added bitcoin as a payment method for electric vehicles. Bitcoin payments started in the US from the 24th (local time), and plans to expand to other countries by the end of this year.

In Korea, Paycoin issued by Danal Fintech allows payment at major convenience stores, as well as franchise companies such as Domino’s Pizza, BBQ Chicken, Kyobo Bookstore, and Golf Zone. E-Mart 24 and CJ GCV are also expected to expand the number of uses, and we are promoting a business so that payments can be made in foreign countries through the Paycoin app.

Professor Park Soo-yong of Sogang University, who is the chairman of the domestic blockchain society, said, “The demand for cryptocurrency payments from consumers with procurement is increasing. In addition, the economic system in the digital world is getting harder and harder. Companies’ movement to introduce cryptocurrency in payment methods will continue.”

As the value of cryptocurrencies including bitcoin soared, companies’ cryptocurrency investments have become active, and they are also attracting them as payment methods and seeking new business opportunities. In particular, IT companies are taking the lead in cryptocurrency investments and actively entering the cryptocurrency business, such as operating exchanges.

In the United States, software (SW) company MicroStrategy has purchased more than $1 billion of bitcoins, securing more than 90,000 bitcoins, and fintech company Square also bought $170 million worth of bitcoins. It is speculated that Oracle, whose board member Larry Ellison, Tesla’s board member, is chairman and chief technology officer (CTO), will also join the bitcoin investment procession. Here, as Morgan Stanley announced that it will launch the first Bitcoin fund on Wall Street, there is an expectation that institutional investors will inflow a large amount of funds through the ETF.

|

Domestic companies that are unable to invest directly due to regulations are eager to invest in cryptocurrency exchanges. Nexon invested $400 million in Bitspam, a European exchange, following the purchase of Corbit, a domestic exchange. Naver operates Bitmax, a Japanese exchange, and Bitfront, a U.S. exchange through its Japanese subsidiary Line. Nexon and Naver are also mentioned as candidates for the acquisition of Bithumb, the largest exchange in Korea.

In particular, Naver Line is interested in whether it will enter the domestic exchange business by sharing the order book (transaction ledger) as the special money law is implemented. The revised bill of the Supervisory Regulations of the Special Act stipulates that order book sharing is limited if certain requirements are met, so LINE can broker cryptocurrency trading and exchange with domestic exchanges like Huobi Korea.

However, a line official said, “It is not a step in which we can clearly talk about the plan for Korean business,” and “it is still impatient to say how to move according to the special law.”

Nevertheless, companies’ cryptocurrency investment and business expansion in Korea is already becoming a trend. In the case of Kakao, which operates the blockchain platform Clayton through its affiliate Ground X, the market capitalization of its own cryptocurrency Clay is estimated to have exceeded 38 trillion won. This is close to 86% of the Kakao market cap.

Professor Park said, “The domestic blockchain technology has developed sufficiently, and companies like Tesla are fully motivated to engage in business.” Yes,” he diagnosed.