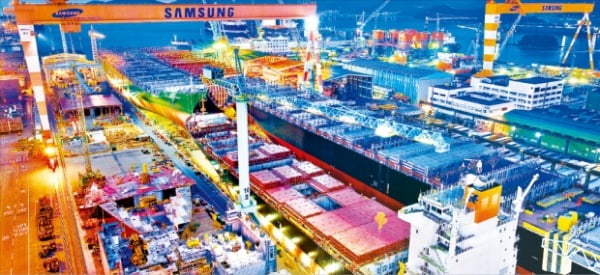

The Geoje Shipyard of Samsung Heavy Industries is lighting up the lights for the construction of a super-large container ship. This year, Samsung Heavy Industries won 34 orders, more than half of the total 66 of the world’s largest container ships (over 12,000 TEU). Hankyung DB

The Korean shipbuilding industry, which was evaluated as “out of date” due to China’s pursuit, is firing a clear signal of resurgence. Despite the severe order drought in the first half of last year, since the second half of the year, it has been preparing for a solo run by sweeping high-value ships such as liquefied natural gas (LNG) propulsion ships and super-large container ships.

It is analyzed that the strengthening of environmental regulations around the world and the competition for the expansion of container ships have created a favorable plate for domestic shipbuilders who are advanced in technology. ‘Chosun Big 3’plans to widen the’super gap’ with China and Japan by developing innovative technologies such as hydrogen-powered ships and autonomous ships.

○ The Suez Incident Increases Korea’s Confidence

According to the industry on the 26th, the order rally of Korean shipbuilders this year is closely related to the super boom in the shipping industry. A’container shortage’ (short supply) occurred as the volume of cargo increased rapidly thanks to economic stimulus from around the world. The Shanghai Container Freight Index, which is an indicator of the global shipping market, remains at a record high of 2570.68 as of the day.

In the container ship market, China, with its price competitiveness ahead, was dominant, but the atmosphere has changed recently. This is because shipping companies are competing for mega-size in order to realize’economy of scale’. Until the 1990s, 4000TEU (1TEU = one 20ft container) class was classified as a super-large classification, but now 24,000TEU class, the size of four soccer fields, has become a trend.

Because ultra-large container ships require high technology, global shipping companies are entrusting construction to Korean shipbuilders. This is the background that Samsung Heavy Industries received a single order for a total of 2.8 trillion won for 20 ultra-large container ships from Taiwan’s shipping company Evergreen. Initially, while competing with China’s Hudong China Shipbuilding and Japan’s Imabari Shipbuilding, it was expected that Korea and China would receive half of the volume, but Samsung Heavy Industries won all orders.

‘Big 3’, including Hyundai Heavy Industries Group, Daewoo Shipbuilding & Marine Engineering, and Samsung Heavy Industries, has won orders for 55, 83% of the total 66 super-large container ships (over 12,000 TEU) ordered around the world this year. It is also a good thing that container ship prices are rising 3% every month this year. An industry insider said, “As the Evergreen container ship built by Imabari Shipbuilding was stranded on the Suez Canal, trust in Korean shipbuilders increased.”

○ Expected to win orders for LNG carriers and plants in the second half of the year

Although the first quarter is not over, orders for the big 3 ships have already reached half of last year. According to Clarkson Research, a UK market research firm, Korea has won an order of 3.91 million CGT (standard freighter equivalent tonnage) by the 18th of this year. It is analyzed that if an extra-large order contract is added on this day, it will far exceed 4 million CGT. It achieved half of the 8.80 million CGT orders received over the past year in just three months. In terms of amount, it amounts to 11.9 billion dollars (about 13 trillion won).

The outlook is strong that the order rally will continue in 2H. This is because there is a high possibility that LNG projects will resume in Qatar, Russia, Mozambique, etc. The Qatar project is expected to place an order of KRW 10 trillion. LNG carriers have traditionally been monopolized by Korea.

It is also good news that the demand for ships equipped with eco-friendly LNG propulsion engines instead of bunker C oil is increasing due to the strengthened International Maritime Organization (IMO) environmental regulations since last year. An official from the shipbuilding industry said, “A growing number of global shipping companies are trying to replace old ships currently in operation with LNG propulsion ships or dual fuel propulsion ships.”

It is analyzed that offshore plant orders, which have been sluggish over the past few years, will regain vitality thanks to the rise in international oil prices this year. Offshore plants are equipment for exploration, drilling, excavation, and production of oil and gas buried in the seabed. Profitability is guaranteed only when international oil prices exceed $60 per barrel. The domestic shipbuilding industry is looking forward to winning orders for floating crude oil production, storage and unloading facilities (FPSO) for the Bonga offshore project in Nigeria and floating offshore production facilities (FPU) for the Jansio project in Australia. According to foreign media, Samsung Heavy Industries has recently been mentioned as an Australian plant hull builder.

Reporter Mansu Choi/Gyeongmin Kang [email protected]