[서울=뉴스핌] Reporter Lee Jung-yoon = Even if the year changes, the household loans did not know that it would break, and as of January, it reached a record high in 17 years. In addition to mortgage loans, other loans such as credit loans and negative bankbooks also increased dramatically.

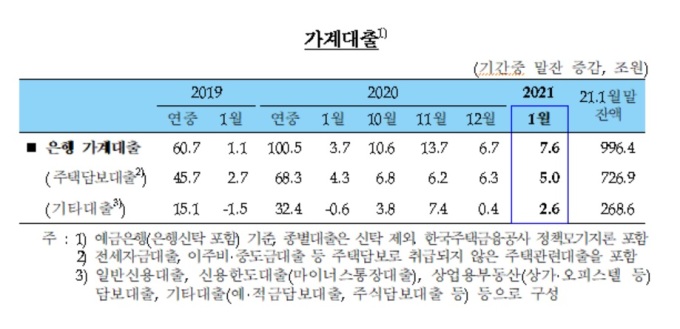

According to the’Financial Market Trends in January 2021′ announced by the Bank of Korea on the 10th, the balance of household loans by banks increased by 7.6 trillion won to 99.6 trillion won last month. The scale of the increase increased from 6.7 trillion won in December of last year, and it is the largest increase since 2004, when statistics began to be organized as of January.

Among household loans, home mortgage loans increased by 5 trillion won in the past month, the largest ever in January. The increase is continuing from the increase of 6.30 trillion won last month. In particular, the jeonse loans increased by 2.3 trillion won and steadily maintained around 2 trillion won.

Deputy General Manager Yoon Ok-ja of the Financial Markets Bureau’s Market Supervisory Team said, “Because it is a low season for moving in January and bonuses come in, it is not a period that usually increases household loans, but is unusual compared to the previous year.” It is interpreted as leading to the demand for loans. In fact, the nationwide apartment sales volume last year was 67,000 in October, 89,000 in November, and 83,000 in December.

|

| (Photo = Bank of Korea) |

Other loans, including general credit loans and credit limit loans (minus bankbook), also increased by 2.6 trillion won to 268 trillion won. As of January, it recorded the largest increase. Other loans are analyzed to be affected by demand for funds related to housing transactions and stock investment. Deputy Deputy General Yoon said, “Banks have resumed some of the loans that were blocked at the end of the year, and the increased demand to receive them in advance due to the government’s lending regulations would have also affected.”

Banking corporate loans increased by 10 trillion won, turning upward from a decrease of 5.5 trillion won in the previous month. Loans to large corporations increased by 3.30 trillion won and loans to SMEs increased by 6.600 trillion won. SME loans are the largest increase since June 2009 as of January. Corporate loans usually tend to repay the loan in December and then re-loan in January.

On the other hand, bank receipts decreased by 1,210 trillion won. It turned down from an increase of 2.3 trillion won in the previous month. Deposits with temporary deposit and withdrawal decreased by 1.48 trillion won due to the withdrawal of corporate funds related to VAT payment. Term deposits fell by 4.4 trillion won, mainly from household and local government funds. The number of asset management companies increased by KRW 34.30 trillion, a month-on-month increase.