Input 2021.04.04 06:00

Prior to this, the Ministry of Land, Infrastructure and Transport plans to conduct a demonstration of the rent report system in five dongs, including Boram-dong, Sejong-si, Giheung-gu, Yongin-si, Gyeonggi-do, and Wolpyeong 2-dong, Seo-gu, Daejeon-si, in April. An official from the Ministry of Land, Transport and Maritime Affairs said, “It is a dimension of checking the system for reporting rent to cheonsei before the official implementation.”

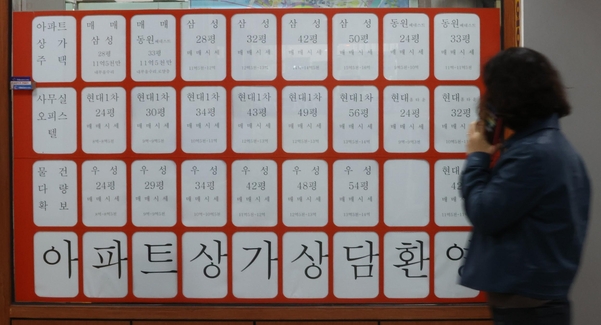

The rent transaction price for cheonsei, which was previously disclosed through the Ministry of Land, Infrastructure, and Transport system, etc., is information naturally collected in the process of receiving a fixed date by the tenant, and not all actual transaction prices are registered. For this reason, it was difficult for the tenant to grasp the exact price of the rent for cheonsei, and problems such as “ripping contracts” were continuously raised.

In addition, there were cases where the landlord refused to apply for a fixed date, so that the deposit was not protected. The Ministry of Land, Transport and Maritime Affairs is planning to report the actual transaction and automatically assign a fixed date through the rent to cheonsei system.

Experts mostly agree on the positive aspect that the introduction of the rent to cheonsei system strengthens the tenant protection system. However, we are concerned that it could become a new variable in the stabilization of the jeonse market as the taxation burden associated with lease contracts increases. It means that there could be a short-term shock to the rental market.

Professor Kwon Dae-jung of the Department of Real Estate at Myongji University said, “It is desirable that the system aims to make the rental market transparent and improve tenants’ rights and interests.” In order to solve the problem, there may be many cases of converting to a reverse or monthly rent.”

From the perspective of landlords, in addition to the burden of holding tax, which will be strengthened from this year, it is inevitable that the lease income tax is imposed, but there is a limit to the price hike due to the upper limit on the rent to cheonsei. Eventually, it is possible to respond with a rent increase.

Shinhan Bank Real Estate Investment Advisory Center Team Manager Woo Byung-tak said, “The key is to change passive taxation into active taxation,” he said. “When a new tenant is received in the short term, the cost will be passed on by not repairing the house, and the tax burden will increase in the long term. There is a concern that it will be steadily reflected in the rent to cheonsei price,” he said.

In the case of newlyweds who set up a rented house with the help of their parents, it becomes difficult to avoid gift tax as the rent to cheonsei system is implemented. According to the current tax law, for gifted property exceeding 50 million won within 10 years, ▲10% below the tax standard of 100 million won ▲Gift tax is charged for each section, such as: 500 million or less 20% ▲ 1 billion or less 30%. In the meantime, there were many cases of passing by without paying the gift tax properly while receiving some help from parents.

Dongguk University adjunct professor Ko Jun-seok said, “The rent has increased a lot, but if the gift tax burden is added, it will make it more difficult for young people to prepare a newlywed home.” “He said.

Seo Won-seok, a professor at the Department of Real Estate at Chung-Ang University, said, “Unlike the right to apply for contract renewal and the ceiling on rent for cheonsei, which caused a jeonse in the past year, the rent to cheonsei system is not a type that directly regulates, but it is not expected to have the same ripple effect.” “There is a possibility that there will be a’dead zone’ where the tenant lives without writing a charter contract at all in order to avoid the gift tax.”