A couple who built a three-story multi-family house in 1996 (excluding piloti). A few years later, the rooftop water tank room (about 9㎡) was removed and a rooftop room of about 30㎡ was built there. The room on the 3rd floor where Mr. A and Mrs. A resides was small, so it was used as a storage room for various household items and miscellaneous items and as a study room for children.

After that, Mr. A, who sold the building in 2015, was notified by the National Tax Service to pay more capital gains tax in 2019. This is because a multi-family house with three floors or less is considered to be a single house, but since the building is actually a four-story building, the reason is that Mr. A should be viewed as a multi-household owning a’multi-family house’ rather than a’multi-family house’. Since the rooftop room’s area exceeds one eighth of the total building area, it should be included in the calculation of the number of floors, and should be considered as the fourth floor instead of the third floor.

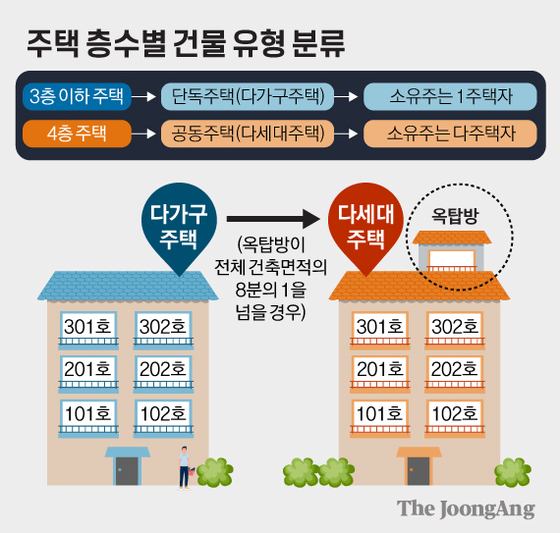

Classification of building types by number of floors in the house. Graphic = Reporter Kim Young-ok [email protected]

Mr. A objected to this and asked the Tax Tribunal for a judgment. Mr. A argued that “the rooftop room cannot be viewed as a house because it does not have heating and cooling, water and sewage, and cooking facilities, and it is not an independent housing type.”

If the total area exceeds 1/8, it is included in the number of floors.

However, the Tax Tribunal said last month, “The area of the rooftop room exceeds one-eighth of the building area and is included in the number of floors under the Building Act. Since the rooftop room is a house with one fence, there is no reason to consider the independence and functionality of the house with only the rooftop room itself.” He dismissed Mr. A’s request for judgment.

A growing number of cases have to pay an additional transfer tax later because of the’rooftop room’ that was built additionally like Mr. A. It was after the Seoul Regional Tax Office started to check whether there were any cases of evading tax, taking advantage of the fact that multi-family housing is subject to tax exemption from one household and one house in 2018.

According to the National Tax Service on the 13th, the requirements for multi-family housing under the Building Act are 19 households or less, and the floor area of the house is less than 660m2, and the number of floors used as houses (excluding basement floors) is less than 3 floors. In multi-family housing, the entire building is regarded as one house, just like single-family houses. 1 You can earn rental income while holding the status of a homeowner.

On the other hand, in the case of multi-family houses, the area standard is 660㎡ or less, which is the same as the multi-family house, but the standard for the number of floors is ‘4 stories or less’. This is classified as a’communal housing’, so the owner is considered a multi-household, and various transfer tax special cases cannot be received. The tax authorities classified rooftop rooms built in excess of the standard area in a three-story multi-family house as a house according to the tax law, and treated a three-story building as a four-story building, resulting in heavy transfer tax.

Relevant Tax Trial Claim Decisions Increased Since 2018

In fact, from 2019 to last month, for this reason, a total of 15 cases were decided by multi-family home owners requesting a tax trial. This is the reason for the sudden increase in the number of judgment decisions for requesting transfer tax and tax trials from a total of three during the nine years from 2010 to 2018. In December 2019, multi-family home owners held a rally in front of the Seoul Regional Tax Office, saying, “Because of one rooftop room, we were subject to a 70% transfer tax and a 5~1 billion won tax bomb.”

However, the National Tax Service is in a position that there is no problem according to the’real taxation principle’ that the calculation of the tax base should be based on the actual content rather than the format. The Tax Tribunal also gave most of the hands of the National Tax Service in the request for a related judgment.

An official from the National Tax Service said, “The relevant taxpayers say that the rooftop room is an unlicensed building that has not been recognized by the local government, and therefore it is unfair to be recognized as a formal housing. It was justly taxed,” he said.

.

Sejong = Reporter Son Hae-yong [email protected]

![]()