Financial Services Commission “applies differently for each individual according to income and maturity”

‘Household debt countermeasures’ announced in March after detailed plans were confirmed

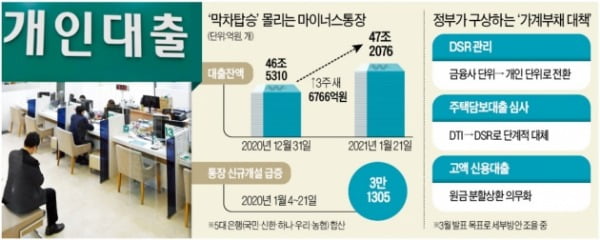

30,000 new banks opened this year,’Matong’↑

The Financial Services Commission is reviewing a plan to apply the amortization of principal credit loans, which has been discussed as the main content of measures for household debt, to large credit loans exceeding annual income. Concerned about the confusion in the loan market, the company decided not to create a uniform standard of’apply to all loans over 100 million won’.

The Financial Services Commission said “the details have not been confirmed”, but one thing is certain. The credit loan threshold is higher than it is now. At the bank’s counter, the’last car demand’ to receive loans in advance was excited, and only the negative bankbooks opened this year have exceeded 30,000.

○“Loans beyond repayment should be reduced”

According to the Financial Services Commission on the 24th, the’plan to advance household debt’ to be announced in March focused on borrowing money within the scope of the repayment capacity of the borrower. An official from the Financial Services Commission said, “It is necessary to avoid excessive loans by considering the borrower’s repayment capacity and loan period comprehensively, and to repay them in partial installments if it is likely to exceed repayment capacity.

The Financial Services Commission announced on the 19th in its New Year’s business plan that “we will consider a plan to mandate amortization of principal for credit loans over a certain amount.” In the case of a mortgage loan, the principal and interest must be paid off at the same time, but it is common for credit loans to pay only interest and continue to extend the maturity. In the future, the intention is to prevent excessive investment in stocks and real estate by changing credit loans to repay the principal and interest together, and with a ‘zero-up loan (a loan that is received at the maximum limit).

An official from the Financial Services Commission said, “It is not possible to set the standard for applying installment repayment as a loan amount, and income must be considered.” In terms of the amount of credit loans compared to income, it does not matter whether they are paid at once or divided if they are manageable, but the authorities recognize that if you borrow more than your income, you must put a brake on it.

○ Credit Loan’Everything’ becomes difficult

In addition to the income of the borrower, the loan period is also expected to be a variable. The maturity of a credit loan is usually extended in 1-year increments and can be up to 10 years. The Financial Services Commission said, “It is meaningless to oblige to repay in installments even for short-term credit loans.” It is predicted that it will be possible to obligate amortization if the maturity is prolonged through extension after not applying amortization at first. The Financial Services Commission said, “The specific criteria for amortization of credit loans have not been determined,” and “We will collect opinions from the financial sector and announce them in March.

Another key aspect of household debt countermeasures is to apply the total debt principal repayment ratio (DSR), which is managed at the financial institution level, on an individual basis. The Financial Services Commission’s plan is to gradually replace the total debt repayment ratio (DTI) used in mortgage loan review with DSR.

DSR is the value obtained by dividing the repayment of principal and interest for one year of all household loans including mortgage and credit loans by annual income. Now, since each bank only needs to match an average of 40%, the individual DSR can exceed 40%. This means that the DSR per person is applied collectively so that it does not exceed 40%. In this case, the credit limit for those who received mortgage loans etc. will naturally decrease. In addition, the introduction of the amortization of large credit loans has the effect of increasing the individual DSR as the numerator of DSR increases.

○’Matong opened’ 3 weeks, more than 30,000 new

Among these, many consumers are trying to secure a generous loan limit in advance. The Financial Services Commission decided not to retroactively apply the new system to credit loans received prior to the enforcement of the regulation.

The number of new credit loans made by the five major banks (Kookmin, Shinhan, Hana, Woori, and Nonghyup) with a negative bankbook (limit transaction loan or automatic bankbook loan) from the 4th to the 21st was counted as 31,305 cases. At the end of last year, 1,000 negative bankbooks were opened a day, and nowadays, more than 2,000 cases are being opened. The balance of negative bankbook loans of these five major banks increased by 6766 billion won in three weeks. A banking official said, “Before the loan regulations are strengthened, the number of people trying to break through the’Matong’ has increased a lot recently.” I did.”

However, the total credit balance of major banks is maintained at the level of the management target suggested by the authorities (maximum 2 trillion won increase per month). An official from the bank said, “The new Maton openings and balances are increasing, but the limit on new loans has decreased, so the overall manageable range.” The Financial Services Commission and the Financial Supervisory Service set monthly credit loan targets for each bank, and then submit and inspect the figures every day.

Recently, credit loans have risen rapidly when the government announced tightening regulations on loans, and then gradually declined when banks tightened new loans. In the two days since the 19th, when the plan to repay principal amortization for large credit loans was revealed, the credit balance of the five major banks increased by more than 700 billion won. When measures to strengthen DSR regulations for high-income people were announced in November last year, credit loans surged 1.5 trillion won for a week.

Reporter Lim Hyun-woo [email protected]