Input 2021.04.07 06:00

“Is there any place to see the sea?”

I visited Samcheok on the 26th of last month. I put the sea at hand, but instead of the sea, I saw people entering the model house of an apartment in the back of the road. Who are the people who have visited the complex that has already been subscribed? When I looked at the visit date written to prevent the spread of Corona 19, it was outside of Seoul and Gyeonggi area.

As if they had promised, they looked for houses that weren’t satisfied with their subscription. An official from the model house said, “It was originally the most leisurely time, but recently, investors interested in unsold pre-sale rights have come and there is no way to do anything else,” said a model house official. “Even on weekdays, foreign investors often form groups.”

Investment funds are rushing to pre-sale rights in non-regulated areas. To get more attention from investors, there must be one more condition. It is the’unsold’ pre-sale right where the subscription competition rate was less than one to one. A model house official said, “It is because unsold pre-sale rights can be resold and are not included in the number of houses.” However, real estate experts pointed out that “investing with Uddon (premium) in mind is a significant risk.”

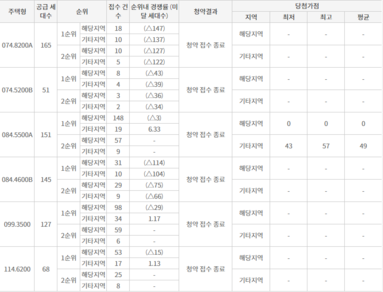

According to the subscription home on the 7th, the exclusive area of 74m2 and 84m2 of some types of houses fell short of the Doosan We’ve subscription in Samcheok Central. This is because those with real residents in mind prefer large flat water. An official from the model house said, “There are so many new apartments in Samcheok, and there are end users who want new apartments in the East Sea, which is directly in contact with Samcheok.

Cheon Mo (37), who visited the model house that day, said, “There is no burden because I only need to pay the down payment of 10 million won, and I was interested in reselling it until the balance was paid.” In the case of Mr. Chun, he said that he could expect additional benefits because his reconstruction apartment in Seoul was destroyed. If you acquire an alternative housing due to loss, you may be subject to a special exemption from capital gains tax on the premise that the conditions are met. The conditions for satisfying the exemption from taxation are: △ 1 house owner at the time of authorization for redevelopment and reconstruction projects △ 1 year or more residency after acquiring an alternative housing △ All households move in a new house within 2 years after completion and continue to live for 1 year or more △ Before completion or completion It is typical to transfer the replacement housing within the next two years.

The sales rights for 84㎡ of exclusive area for’Sokcho Theion Xi’, which were sold in Dongmyeong-dong, Sokcho-si, Gangwon-do last year, were also actually sold for 8955 million won (35th floor) in February. Even considering the fact that it is a high-rise house with a view of the sea, a premium of over 300 million won was added to the pre-sale price (475 million won). The current offer price is 800 million won for the 30th floor and above, and 600 million won for the 5th-10th floor. In the case of lower floors, the sale price increased by 120 million won from the pre-sale price (478.4 million won).

An official at a real estate agency near Samcheok said, “Donghae, Samcheok, and Sokcho all have similar atmospheres,” he said.

Except for Gangwon-do, the situation in other non-regulated areas is similar. An 84m2 pre-sale ticket for’Tangjeong Gwell City Prugio (C1 Block)’ located in Tangjeong District, Asan-si, Chungcheongnam-do, was traded for 76.8 million won in February. In 2019, it doubled the pre-sale price (352.6 million won).

The 84㎡ dedicated to’Gunsan Theotian City’ and’Yangsan Mulgeum Brown Stone’ also increased 1.8 times and 1.2 times the pre-sale price, respectively. The pre-sale price was 268.55 million won for The Ocean City, which was 478.55 million won, and the mass-produced Brown Stone, which had a pre-sale price of 365 million won, was signed for 446.76 million won.

Meanwhile, the reactions of local officials at Doosan We’ve in Samcheok Central were mixed. An official from a nearby A-certified brokerage said, “The sale price is about 1 million to 2 million won per 3.3㎡ cheaper than the pre-sale apartment planned in Donghae, and the location is good in Samcheok, so it is expected that end-users will also be interested.” “It seems to be a suitable investment for those who are concerned about the fall of the loan and want to see the effect of leverage (debt) with an intermediate payment loan.”

On the other hand, the official of the B-accredited brokerage company tilted his head. There will be no problem with setting up a charter, but it is questionable whether reselling will be easy. He said, “The rate of jeonse in Samcheok is up to 80%, and there aren’t many houses with two toilets, so I’ll be able to do it well.” I said it was blurred.

KB Kookmin Bank Chief Real Estate Expert Park Won-gap said, “Depending on whether or not it is included in the number of houses, the possession tax to the transfer tax is severe and there is a problem with lending. “Because it is a balloon effect, you have to be careful with investment. If you can’t sell after trying to resell, you have to keep it.”