![[김현석의 월스트리트나우] Technology stock'Moment of enlightenment' has come... Eyes on Cash Wood](https://i0.wp.com/img.hankyung.com/photo/202102/01.25474597.1.png?w=560&ssl=1)

Technology stocks are shaking sharply as interest rates rise in earnest. On the 22nd (local time), the Dow rose 0.09% on the New York Stock Exchange, but the S&P 500 fell 0.77%, while the tech stock-oriented Nasdaq fell 2.46%.

This is due to rising interest rates. The 10-year Treasury bond yield soared to 1.393% annually this morning. It is the highest level since February of last year. Market participants are amazed as the faster-than-expected rise continues. Some are even concerned that the taper tantrum that appeared in 2013 could be re-enacted.

![[김현석의 월스트리트나우] Technology stock'Moment of enlightenment' has come... Eyes on Cash Wood](https://i0.wp.com/img.hankyung.com/photo/202102/01.25474598.1.jpg?w=560&ssl=1)

The biggest factor is Joe Biden’s US administration pushing a $1.9 trillion in stimulus package. As President Biden’s speech to the congressional postponement, which was expected this week, was postponed last week, observations are growing that Wall Street will release an “ultra-large package” worth 3 trillion dollars in addition to an infrastructure deal. Originally, I expected only the Democratic Party’s position to be presented in a speech at the Yeondu Textbook, but delaying this means that discussions with the Republican Party are progressing.

President Biden announced a $1.9 trillion US relief plan on January 14th, and in February announced that he would announce a’recovery plan’ focused on the infrastructure sector.

![[김현석의 월스트리트나우] Technology stock'Moment of enlightenment' has come... Eyes on Cash Wood](https://i0.wp.com/img.hankyung.com/photo/202102/01.25474594.1.jpg?w=560&ssl=1)

As a result, Wall Street banks are constantly raising their projections for US economic growth. On that day, Bank of America increased the growth rate of US gross domestic product (GDP) this year from 6% to 6.5%. It also increased from 4.5% next year to 5%. The reason is that the size of the stimulus package, which was originally estimated at $1 trillion, is expected to grow to $1.7 trillion. In the case of JP Morgan, the US is expected to show a’V’-shaped recovery and grow higher than in China from the third quarter of this year.

![[김현석의 월스트리트나우] Technology stock'Moment of enlightenment' has come... Eyes on Cash Wood](https://i0.wp.com/img.hankyung.com/photo/202102/01.25474592.1.jpg?w=560&ssl=1)

For the first quarter right now, the Federal Bank of Atlanta is projecting a GDP now of 9.5%. Morgan Stanley estimates 7.5% and Goldman 6%.

Here, the vaccine effectiveness is also summarized as being certain. In the UK, where vaccination began on December 8 last year, a survey of 5.4 million people found that hospital admission rates for elderly people vaccinated with Pfizer and AstraZeneca vaccines decreased by 85% and 94%, respectively. As a result, British Prime Minister Boris Johnson announced a roadmap to lift all blockades by June 21 in four stages, starting with most students attending school on March 8.

![[김현석의 월스트리트나우] Technology stock'Moment of enlightenment' has come... Eyes on Cash Wood](https://i0.wp.com/img.hankyung.com/photo/202102/01.25474603.1.png?w=560&ssl=1)

All of this can speed up the economic recovery. This can stimulate inflation and accelerate interest rates.

Investors’ anxiety over rising interest rates focused on technology stocks rather than the entire stock market. On that day, Apple fell 2.98%, Microsoft 2.68%, and Amazon 2.13%, and Tesla plunged 8.55%. In the case of Tesla, the stock price returned to the level at the end of September. Both Apple Teslas fell below the 50-day moving average. In addition, high-value technology stocks such as Peloton 9.99%, Zoom 5.49%, Plug Power 13.04%, Fuel Cell Energy 11.62%, and Nio 7.92% also plunged.

On the other hand, travel-related stocks such as American Air 9.42%, Delta Air Lines 4.53%, and Carnival 5.61% surged, while banking stocks and energy stocks also increased significantly. The so-called’reflation trade’, betting on economic recovery and inflation, is prominent.

![[김현석의 월스트리트나우] Technology stock'Moment of enlightenment' has come... Eyes on Cash Wood](https://i0.wp.com/img.hankyung.com/photo/202102/01.25474596.1.jpg?w=560&ssl=1)

It is also negative for the overall valuation of the stock market in that if interest rates rise, the investment attractiveness of stocks is halved compared to bonds, but it can pose a risk, especially for high-growth technology companies that have benefited from low interest rates. The relative attractiveness of future growth to investors will also diminish.

The 10-year Treasury bond interest rate has moved from 1.35 to 1.36% from 10 am on the same day. In Europe, it is known that Christine Lagard, the head of the European Central Bank (ECB), said at a plenary session of the European Parliament that “we are closely watching the movement of long-term nominal Treasury yields. After Lagarde’s remarks, 10-year Treasury yields in Germany, France and Italy fell, and so did the United States. It was thanks to Lagarde’s remarks that the Dow index, which had fallen sharply in the beginning of the market, turned upward and found stability.

![[김현석의 월스트리트나우] Technology stock'Moment of enlightenment' has come... Eyes on Cash Wood](https://i0.wp.com/img.hankyung.com/photo/202102/01.25474600.1.jpg?w=560&ssl=1)

Market participants are paying attention to the testimony of Fed Chairman Jerome Powell held in the US Senate at 10 am on the 23rd (12pm KST). I want to make a remark similar to Lagard.

According to Bloomberg, senators are expected to question whether speculative phenomena in asset markets such as bitcoin are due to the Fed’s easing monetary policy. What will Chairman Powell say?

On several occasions, Chairman Powell has emphasized the principled position of maintaining a easing policy, saying that there is no continuous inflation trend. The asset bubble also showed an unprecedented appearance that “it can be understood in low interest rates.”

Most Wall Street doesn’t think Powell will change this position. The economic resumption has not yet begun, as there is no reason to tweak monetary policy. Fed President Thomas Barkin Richmond said that the recent rise in interest rates is not a problem, and long-term interest rates are still low. He explained that there is no fundamental change in inflation expectations, and that the disinflation headwind remains.

![[김현석의 월스트리트나우] Technology stock'Moment of enlightenment' has come... Eyes on Cash Wood](https://i0.wp.com/img.hankyung.com/photo/202102/01.25474618.1.jpg?w=560&ssl=1)

However, if Powell’s stance appears to be completely onlooked, the rise in interest rates could accelerate. A Wall Street official said, “If it’s the same atmosphere these days, it’s not working for interest rates to move 10-20bps (1bp=0.01% points) in the next few days,” he said. . He added, “I look forward to pressing the rise in interest rates once and for all,” he added. Some of the markets are interested in whether to give hints that they will take action, such as expanding long-term bond purchases, if government bond yields rise further.

It is also a problem if such remarks are excessive. As concerns about premature tapering, etc. increase, the financial markets may be more fluctuating.

In any case, the market is predicting that interest rates will continue to rise for the time being. Economic activity will start in earnest from April to May, and large-scale stimulus measures will come out.

At the end of this week, the House of Representatives may first pass a fiscal stimulus package. House Speaker Nancy Pelosi said on the 18th that “the House aims to approve stimulus next week.”

If interest rates continue to rise, technology stocks can continue to negatively impact. In fact, energy rose by about 20% and banking stocks by about 18% this year. However, FANNG is not working hard. Facebook has fallen by more than 15% from its all-time high, while Apple has fallen by 11% and Amazon by 10%.

It was found that the Bill Gates Foundation sold all of its shares in Alibaba and Uber, which had been held in the fourth quarter, and reduced Apple’s holdings in half. Some are already reducing their technology stocks.

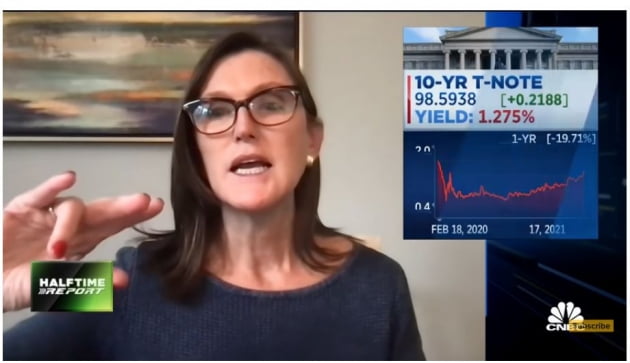

Cash Wood of Arc Investment, known as’Queen Cash’ and’Money Tree’ among American ants, appeared on CNBC on the 18th. Regarding the’possibility of a technology stock correction due to interest rates’ at the time, she warned that technology stocks would be adjusted and that there could be panic in the stock market.

![[김현석의 월스트리트나우] Technology stock'Moment of enlightenment' has come... Eyes on Cash Wood](https://i0.wp.com/img.hankyung.com/photo/202102/01.25474601.1.jpg?w=560&ssl=1)

“If interest rates rise sharply,” Wood said, “we’ll see a stock revaluation, and I think our portfolio will of course be a prime candidate for this revaluation.” “Over the past 20 years, the P/E of the S&P 500 has tended to peak at 20-25 times. Value seems to be peaking now. I agree that there will be a revaluation of the stock price.” “It can cause fear.” According to the fact set, the current S&P 500 has a P/E of 22.2x.

However, she strongly defended the tech stocks of her arc funds. “We’ll use that adjustment to focus our portfolio by buying more stocks we’re convinced of. I think in the long run, given the strong growth trajectory of the stocks held by our five innovation platforms (funds), the growth rate is It’s so strong that their P/E will grow much faster than most investors currently expect. That’s our source of confidence.”

The stock price may fall in the short term, but we are using it as an opportunity to buy more. In fact, when Palantier recently fell for six straight trading days until the 18th, Wood invested 6.8 million shares ($172 million) to buy more. As a result, the stock price rebounded more than 15% on the 19th. But that day, Palantier fell by 3.45% again.

Wood’s Arc Fund has already flowed close to $8.2 billion in January and nearly $7 billion in February. As a result, Arc Investment’s five active listed index funds (ETF) assets under management have exploded to $58 billion.

![[김현석의 월스트리트나우] Technology stock'Moment of enlightenment' has come... Eyes on Cash Wood](https://i0.wp.com/img.hankyung.com/photo/202102/01.25474595.1.jpg?w=560&ssl=1)

They focus on innovative technology stocks. For this reason, when the purchase volume was expanded through the recent inflow of funds, the stakes in 25 companies already exceed 10%.

A Wall Street official said, “Because Wood’s fund has intensively purchased some technology stocks, it could be a big blow if technology stocks plummet. If the performance deteriorates, the demand for repurchases will surge and we may face a vicious circle of having to sell technology stocks again. . If this situation occurs, the decline in technology stock prices may accelerate.

On that day, Wood’s representative fund, ARK Innovation ETF (ARK Innovation ETF), fell 5.79%.

![[김현석의 월스트리트나우] Technology stock'Moment of enlightenment' has come... Eyes on Cash Wood](https://i0.wp.com/img.hankyung.com/photo/202102/01.25474589.1.jpg?w=560&ssl=1)

Reporter Kim Hyun-seok [email protected]