(Financial Committee)

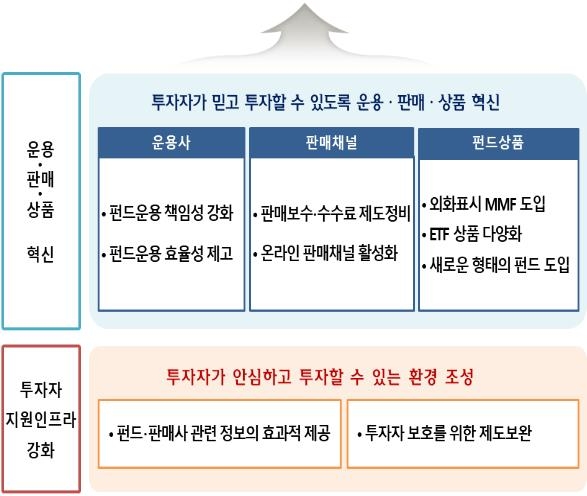

The financial authorities decided to introduce a’performance-linked management fee’ public offering fund in which management fees are set every three months in conjunction with fund management performance.

The government’s judgment is that in order to induce stable long-term investment by the public while attracting the money released on the market to the capital market, it is necessary to increase the investment attractiveness of public offering funds.

On the 31st, the Financial Services Commission held the Capital Division of the Financial Development Council and announced a plan to enhance the competitiveness of public offering funds.

The performance-linked management fee public offering fund decided to be introduced by the Financial Services Commission has a structure that increases the management fee if it generates excess profits quarterly compared to benchmark indices such as the KOSPI 200.

A certain percentage of the quarterly operating performance is reflected in the next quarter’s remuneration rate. The basic remuneration rate and the ratio according to the operating performance are determined, and the remuneration rate is determined by calculating it every quarter. For example, if the basic remuneration rate is 0.3% and the ratio based on management performance is 0.2 to 0.5% depending on the performance of the fund, if the fund performance is significantly higher than the benchmark index, 0.8% (0.3 + 0.5%), and significantly lower than the benchmark index. This is an expression of 0.5% (0.3+0.2%).

Until now, there have been performance-rewarded public offering funds whose management fees change according to their performance, but they were evaluated only when the fund performance was redeemed, and the basic performance fees were too low, so managers did not actively offer products.

For the current performance-based fund, if the basic management fee is 50% or less than that of the general fund, and the fund performs lower than the benchmark index, management fees cannot be received at all, so managers are not actively selling. Performance-based funds launched in 2017 were 14 funds as of the end of last year, with a set amount of only 22.5 billion won.

Financial Services Commission’s Capital Market Policy Officer Kim Jeong-gak said, “We introduced a performance fee fund in 2007, but it was not activated due to the burden of managers and sellers according to strict requirements.” “He explained.

It is also planning to allow public offering funds to change their investment strategies in a rapidly changing market environment.

The Financial Services Commission allows small-scale funds with an average daily deposit of less than 5 billion won to change investment strategies only with the board of directors of managers without holding a general meeting of beneficiaries (a meeting of investors, such as a general shareholders’ meeting of a company). However, two months before the meeting of the board of directors, investors must be asked to disclose their intention to change their investment strategy, and the objection must be below a certain level, such as less than 10% of the total number of accounts.

In addition, a foreign currency denominated money market fund (MMF) will be introduced to diversify public offering funds. It is to support foreign currency management to export companies through MMF investing in foreign currency short-term financial products such as short-term bonds.

It will also diversify ETF products by allowing the launch of bond-type ETFs with maturities. Fund disclosure information of the Financial Investment Association is provided to fintech companies and sellers so that investors can easily use fund comparison and analysis. Liquidity stress tests were conducted on open funds at least once a year and liquidity-related risk information was reported to the supervisory authority.

The Financial Services Commission said, “Regarding the amendments to the law, we will finish the legislative notice by April and complete the revision by the third quarter.