The economy is showing a modest recovery in Corona 19, but concerns have emerged that the’financial imbalance’ is growing as housing prices are rising and debts are rising rapidly. Amid expectations of an economic recovery and an increase in government bond issuance, rising market interest rates stimulated lending rates to rise, and a debt bomb is emerging as an economic detonator.

|

◇ Loans increase due to 2030 households buying homes on debt

In the March Monetary Credit Policy Report, which is published quarterly, the BOK predicts that household loans will increase for the time being, saying, “The increasing proportion of home sales transactions under 30s with high loan dependence will serve as a factor in increasing housing-related loans.”

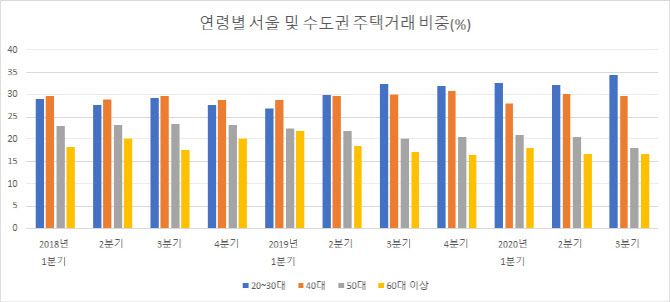

The share of home sales by 2030 households was only 29.1% until the first quarter of 2018, but accounted for 34.3% in the third quarter of last year. It surpassed the sales ratio of those in their 40s (29.7%), 50s (18.2%), and 60s (16.6%). Since most of them are new to society, they rely on loans for a large portion of the money that goes into buying a home. According to the BOK, from January to September last year, the share of borrowings from financial institutions among those in their 30s (29.1%) and 20s (26.1%), compared to those in their 40s (22.0%), 50s (16.7%), and 60s or older (9.2%). It was a high level.

According to the Bank of Korea and the Financial Services Commission, the balance of household loans for banking sectors as of the end of February was 101.3 trillion won, an increase of 6.700 billion won from a month ago (99.84 trillion won), reaching the 1,000 trillion won range. Household loans from all financial sectors increased by 9.5 trillion won, up 8.5% from a year ago. This is the largest increase since 2004. The number of mortgage loans increased by 7 trillion won. Other loans, including credit loans, also increased by 1.8 trillion won.

Han Eun predicted that “the pressure to increase household loans will continue for the time being, taking into account the recent housing transactions, the demand for funds related to Corona 19, and the increasing demand for borrowings from individual stock investments.”

If interest rates rise, the ‘investment success myth’ may be obscured.

Last year, while interest rates were low, rising housing and stock prices triggered an increase in loans, resulting in an increase in the number of’younger debts’. In short, as housing and stocks rose, they seemed to have succeeded in investing. According to the BOK, stocks rose 63.8% at the end of December last year (compared to the end of March), and housing prices rose 9.3% at the end of last year (compared to the fourth quarter of the previous year). The BOK analyzed that the housing price was due to the reduction in the supply of new apartments (the number of occupied units in Seoul from 49,100 units last year → estimated to decrease to 297,700 units this year), a decrease in sales due to expectations of rising prices, and a shift in demand for jeonse. It is also characterized by a large increase in the sale price of mid- to low-priced housing in the metropolitan area, where there are few loan regulations and the tax burden is not large.

However, as interest rates are rising this year, this situation can change at any time. The 10-year Treasury bond interest rate has steadily increased since August of last year, rising 0.74 percentage points from the end of July last year to the 11th (2.036%). This is due to the issuance of approximately 186 trillion won worth of government bonds, such as the increase in US government bond yields in line with expectations for economic recovery such as vaccine supply and stimulus measures, and the 4th disaster support payment. Accordingly, the weighted average interest rate for household loans at deposit banks rose 0.21 percentage points during this period to 2.83% in January.

Nevertheless, as a result of the National House Price Trend Survey in February this year, the sale price continued to rise with 0.89% higher than the previous month, and household loans increased accordingly, which means that the risk of debt investment is even higher.

The BOK said, “The recent rise in housing prices is closely linked to the increase in private debt, which could act as a risk factor for the financial system and macroeconomics in the future.” When the price of a house rises, the amount of debt that you have to pay to buy it increases, and both are showing a synergistic effect.

The BOK also warned, “If the asset rise continues in a situation of high economic uncertainty due to the re-proliferation of Corona 19, asset inequality and financial imbalance may intensify.” He added, “We need to pay attention to the possibility that the risk of financial imbalance will accumulate in future monetary policy operations.”