Intel, a general semiconductor company in the United States (IDM), announced that it will suddenly enter the semiconductor foundry (consignment production) business. We are interested in how it will affect Taiwan’s TSMC and Samsung Electronics, the world’s first and second largest foundry operators. Intel, which is just in the stage of business development, will not have a significant impact on the market right away. However, in the long run, it is highly likely to emerge as a strong competitor.

However, in the case of some foundries, it is observed that Intel will also disclose plans to cooperate with external operators such as TSMC, forming a subtle three-strong composition. This is the reason why Samsung Electronics has become complicated.

◇ Samsung Electronics·TSMC Threat? Intel with a hand

According to industry sources, on the 24th, Intel announced its semiconductor production-related plan’IDM 2.0′ and invested about 20 billion dollars (22.67 trillion won) to construct two additional fabs (factory) in Arizona, where its main factory is located. And the foundry business is also in full swing.

Intel’s semiconductor production-related plans are largely divided into three categories. In-house production, outsourcing (outsourcing), and foundry. Among them, TSMC, a foundry leader, and Samsung Electronics, who are struggling to grow a foundry, are paying attention to outsourcing and foundry plans, in which positive and negative influences directly approach.

In the case of outsourcing plans, the market drew attention as Intel announced last year’s results in January and announced that it would expand the foundry volume.

Samsung Electronics also officially expressed its expectations for this at the time in its earnings conference call (telephone conference). However, this is the first time Intel has revealed the name of an external company that will entrust its core business-related orders. It was not Samsung, but TSMC from Taiwan.

Intel plans to produce semiconductors related to CPU (central processing unit) in cooperation with TSMC. This is part of Intel’s 2023 CPU roadmap. It is said that the timing of TSMC receiving Intel’s supply and starting production is from 2023. Intel plans to introduce CPU products in semiconductors designed based on 7-nano process.

However, in addition to TSMC, Intel is expected to use other foundry companies such as Samsung Electronics. Heo Ji-soo, a researcher at Daishin Securities, said, “Pat Gelsinger’s CEO said that some of the CPU product lineups to be released in 2023 will use TSMC.” I did” he pointed out.

An Intel official also said, “It’s been the first time that an external foundry has been used, but this is the first time the name of a partner has been revealed.”

Then, what will be the relationship between Samsung Electronics and Intel? Samsung Electronics released a press release all over the world highlighting its partnership with Intel on the 25th after Intel unveiled its semiconductor production plan.

He announced that he would cooperate closely with Intel, saying that he would bring high-capacity DDR5 memory to the computing market. In this regard, Intel’s Vice President Carolyn Duran (VP) also said, “Intel is working closely with Samsung Electronics to introduce DDR5 memory compatible with Sapphire Rapids, an Intel Xeon Scalable processor.”

An official from Samsung Electronics also said, “When Intel makes a CPU platform, Samsung’s DRAM must be inserted, and when Samsung makes a laptop, we buy Intel’s platform and add our products.” In the semiconductor industry, competition and cooperation were mixed.”

◇ The composition of the foundry competition

Intel’s foundry business plan could pose a threat to Samsung or TSMC. It is true that Intel has been in the foundry business without much publicizing it, but it is because it is trying to do it properly with a signboard this time. Earlier, Intel won US government projects or worked for some private companies, but the scale was insignificant.

An Intel official said, “Some reports say that Intel closed the foundry business while doing business, but it has never been folded.”

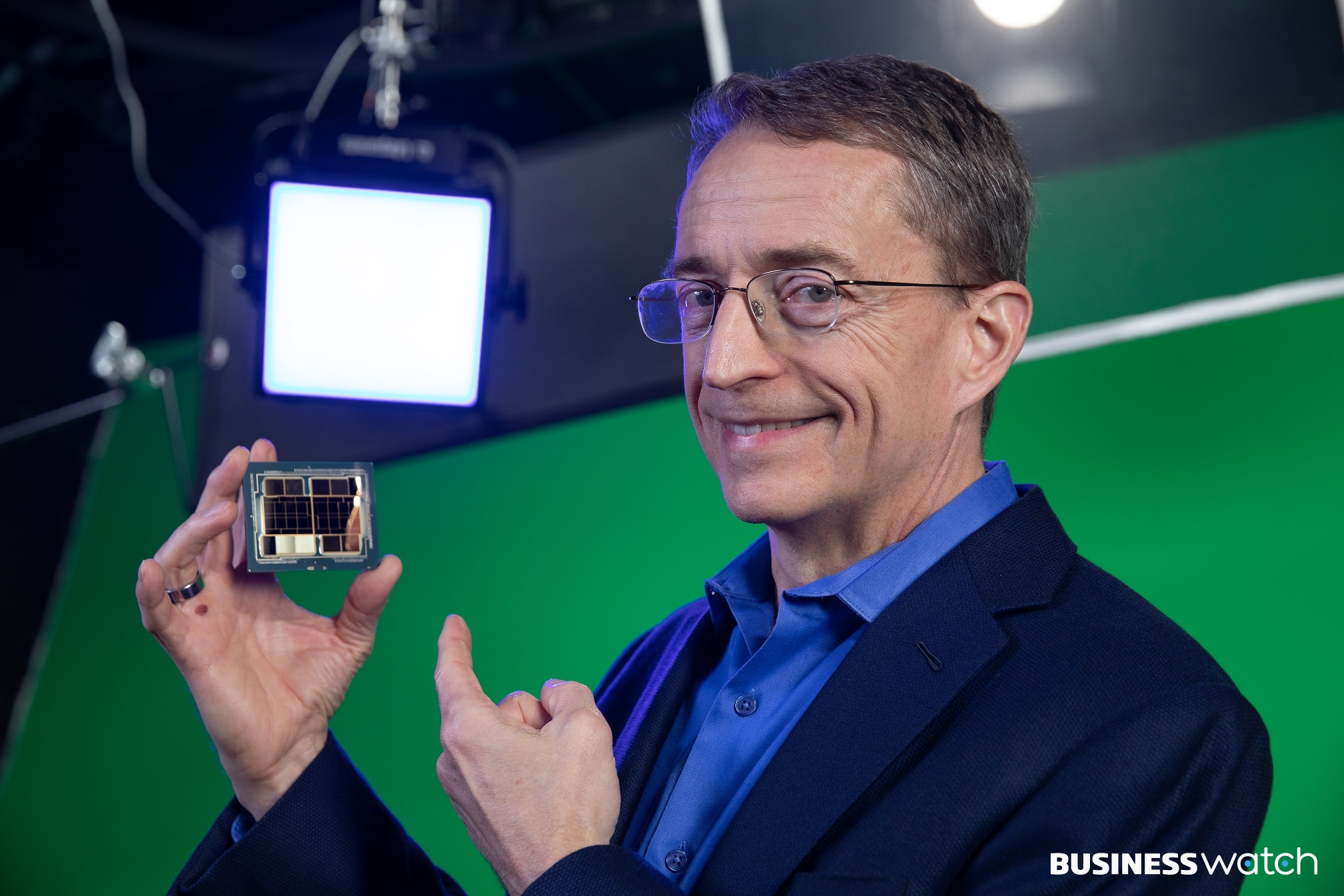

Accordingly, Intel decided to create a new foundry business unit (Intel Foundry Service) and appoint the head of the division to the president level. Through this, the idea is to promptly respond to the exploding foundry demand. Intel CEO Pat Gelsinger observed that “the foundry market will be worth 100 billion dollars (about 113 trillion won) by 2025, even if conservatively taken.”

Partners and competitors such as Amazon, Microsoft, Google, and Qualcomm are showing positive interest in Intel’s plans. Gelsinger said, “A lot of companies have already supported the establishment of Intel’s foundry service,” said Gelsinger.

As such Intel’s business plan came out, not only TSMC, which decided to receive the volume, but also Samsung Electronics faced a complicated situation. This is because the situation has come to rush into competition as well as cooperation.

Right now, Samsung Electronics needs to reorganize its semiconductor factories in the United States. This is because the Austin plant in the US still has problems with normal operation due to the aftermath of the cold wave. The plan to expand the plant in the region has not been progressing until now.

Domestic experts are paying attention to Intel’s potential. However, it is observed that it will not pose a major threat to Samsung Electronics or TSMC right away. Heo Ji-soo, a researcher at Daishin Securities, said, “Even if Intel has a foundry business, there is a possibility that it will entrust a large amount to TSMC or Samsung. It is undeniable that Intel faces repeated delays in process.

Rather, it is expected that competition over semiconductor production equipment will intensify with the addition of Intel. As reflecting this, the stock price of ASML in the Netherlands, which makes extreme ultraviolet (EUV) equipment, ended up 3.5% in the NASDAQ market on the 24th.