Chinese authorities have virtually ordered the dismantling of Ant Group, a fintech subsidiary of Alibaba Group. While strengthening regulations on’big tech (large information technology company)’, it is analyzed that Ma Yun, founder of Alibaba and the largest shareholder of Ant Group, who directly criticized the financial policy of the authorities, was caught as a’demonstration case. Global investors who have invested trillions of won in Ant Group are also in trouble.

Dark clouds on the growth of Ant Group

According to Xinhua News Agency on the 28th, four institutions, including the People’s Bank, the Bank Insurance Supervisory Commission, the Securities Supervisory Commission, and the Foreign Exchange Administration Bureau, disclosed requirements for Ant Group. On the 26th, the financial authorities summoned the management of Ant Group and delivered the request. The form is’request’, but the substance is interpreted as’command’.

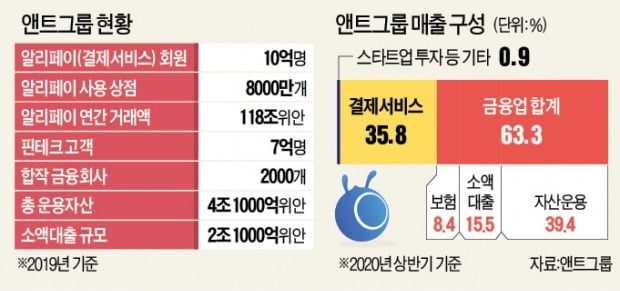

The financial authorities intensively ordered Ant Group to’go back to the payment business as a business’ and’to establish a financial holding company’. Ant Group is a company launched as Alipay, a payment agency service of Alibaba, China’s largest e-commerce company, which is its parent company. Alipay has expanded its reach to mobile payments and currently has 1 billion users in China. It is dividing the Chinese payment market with Tencent’s WeChat Pay.

Ant Group entered the financial industry based on the payment business and has grown into China’s largest business in micro-loans and online insurance. 63% of Ant Group’s sales of 72.5 billion yuan (about 12.18 trillion won) in the first half of this year came from the financial industry. The proportion of microloans is the highest at 39%. The payment service sales for the main business are only 35.8%. The business makes little profit because most of its sales are used to keep consumers and franchises. When consumers use the Alipay app, they make profits from microloans, li-chai (a Chinese-specific financial product), and insurance. There are so many Alipay users that many Chinese banks, securities companies, and insurance companies have alliances with Ant Group.

The order of the Chinese financial authorities is to separate the financial industry and establish a separate holding company. Since last month, China has established a financial holding company in a non-banking financial company with more than 100 billion yuan in financial assets, and introduced a rule requiring that if the holding company’s license is not obtained, the company sells shares or gives up management rights. One of the reasons why Ant Group’s listing was suspended early last month was because it did not get a license as a financial holding company.

In order to obtain a financial holding company license, 50% or more of the capital of affiliated financial subsidiaries must be invested. China also added a regulation that restricts the issuance of bonds to less than four times the capital stock when micro-loan companies raise loans. Ant Group issued bonds equivalent to 4.7 times its capital as of the end of June.

In order for Ant Group to meet the conditions of a financial holding company, it must significantly increase its capital. However, there are many prospects that it will be difficult for Ant Group, whose ugly hairs are firmly embedded in the authorities and even blocked the listing, to find new investors. This is why the authorities’ request to establish a financial holding company is actually interpreted as an order to withdraw from the financial industry. Ant Group said, “We will form a corrective work team to fully fulfill the requirements. We will immediately prepare a corrective plan and timetable, and we will continue to receive supervision and management instructions in the implementation process.”

China tightens regulations on conglomerates

Bloomberg News reported on the 27th (local time) that global investors who have poured trillions of won into Ant Group in anticipation of a’big hit’ are also suffering from nightmares. In June 2018, Ant Group attracted an investment of 14 billion dollars (about 15 trillion won) from a total of 10 institutional investors including Singapore and Malaysian sovereign wealth funds, Carlyle and Warburg. The value of the enterprise has increased from 150 billion dollars at the time of induction to 315 billion dollars at the time of listing promotion last month. We could expect more than double the profit.

However, concerns over massive losses are growing as the possibility of the Ant Group dissolution has been raised. Chun Soo-jin, CEO of Jeffreys Financial Group’s China Research, pointed out that “Ante Group’s payment business is already growing as it grows in China. If we focus on payment, our growth will inevitably weaken.”

As the Chinese authorities are planning to continue strengthening regulations on big tech, the future of platform companies that have secured monopoly status, such as Ant Group as well as parent company Alibaba, Tencent, which operates WeChat (Chinese version of KakaoTalk), and food delivery company Mei Tuan Ping It’s getting dark. At the Central Economic Operations Conference, which closed on the 16th, the Chinese leadership suggested strengthening antitrust regulations for large corporations as one of the key tasks next year.

Beijing = correspondent Kang Hyun-woo [email protected]