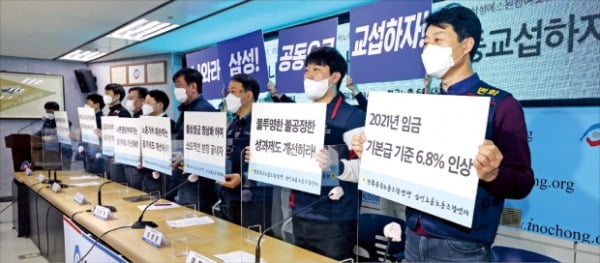

As wages have risen drastically, mainly for information technology (IT) and large corporations, industry concerns about inflation are growing. The photo shows the Samsung Group Labor Union Solidarity demanding a large wage increase on the 8th of last month. yunhap news

The winds of raising salaries and incentives that started in the game industry are spreading to large companies. There are observations that the rate of increase in the minimum wage, which remained at a low level for two years, could also increase again this year. There is also an analysis that the wage increase may lead to inflation, which increases inflation as a result of the economic recovery.

According to the Bank of Korea on the 28th, Korea’s expected inflation rate for March this year rose 0.1 percentage points to 2.1%. This means that the consumer price increase rate is expected to record 2.1% for one year. The expected inflation rate was 1.8% until January this year, but rose further in March after it rose to 2.0% in February. The expected inflation rate of 2.1% is the highest since July 2019. The rate of increase in consumer prices is also falling. It increased from 0.5% in December last year to 0.6% in January this year, and soared to 1.1% in February.

Economists believe that inflation could increase further. This is because the January-February figures did not reflect the wage increase of information technology (IT) companies and large corporations. This year, game companies have increased their annual salary by 8 to 20 million won, and Samsung Electronics has also decided to increase its average annual salary by 7.5% this year.

“Wage increase without productivity improvement… just jump in prices and eat up industrial competitiveness”

The burden of corporate labor costs increases, leading to a decline in employment and investment.

“Congratulations on the wage negotiation for Electronic A. Let’s go to the wage’rice cake’ (soaring).”

‘Blind’, an anonymous bulletin board exclusively for office workers, talks about wage increases of companies every day. The main content is that our company also has to raise wages. The expectation that wages will increase is spreading. However, if wages rise without increasing productivity, companies are forced to reduce employment, investment, and production. There is also a growing concern that inflation may rise and national income may decrease.

○Inflation pressure increases

The Bank of Korea calculated the wage level outlook for January-March this year at 112. It was the highest after February (116) last year, just before the Corona 19 crisis. If this index exceeds 100, it means that more people predict that wages will increase in the future.

The desire to raise wages this year began in the game industry. Game companies such as Webzen (20 million won) and NCsoft (13 million won based on development jobs) Nexon (8 million won) Netmarble (8 million won) and Vespa (12 million won) have raised their wages by 8 to 20 million won this year. Samsung Electronics and LG Electronics also decided to raise their annual salaries by 7.5% and 9.0%, respectively. Workers are bewildered by the successive wage hikes.

This is the result of a competition for talents in which game and Internet companies compete for developers and data analysts. In addition,’Generation MZ’ (Generation Millennials + Gen Z born after 1995) shared company information such as wages and incentives in real time through SNS and requested a wage increase also had an impact.

Some analysts say that the spreading demand for wage hikes can increase inflation (continuous inflation) pressure. This is the result of the recent rising prices of raw materials and agricultural products, and the government and the BOK released money in response to the Corona 19 crisis. There is concern that if wage increases are added to this, inflation will increase even further in the future.

However, it is pointed out that a wage increase without productivity improvement will result in a side effect of raising prices while undermining industrial competitiveness. Professor Park Young-beom of the Department of Economics at Hansung University said, “If the wage increase continues, it will lead to the demand for wage increase from workers of the same type or similar business type.” Said.

The labor cost burden of companies is relatively increasing. The labor income share, which is the share of labor income such as wages, in the total national income, was the highest ever at 65.5% in 2019. Compared to 63.5% in 2018, it jumped 2 percentage points. This is because operating surplus, which means corporate profits, etc., declined 6.9% in 2019, while worker wages (employee compensation) rose 3.4%.

○ Job income may decrease

There are also concerns that jobs and income will decrease if demand for wage increases continues throughout the industry without improving productivity. This means that the minimum wage can be raised sharply, causing another problem. The Moon Jae-in administration raised the minimum wage by 16.4% in 2018 and 10.9% in 2019. In the aftermath, small businesses and self-employed people, where minimum wage workers mainly work, have significantly reduced their employment. According to the National Statistical Office, in 2018, small businesses with fewer than five workers and self-employed jobs decreased by 240,000.

There is also a growing voice that the industry as a whole needs to increase labor productivity with the exit of zombie companies. This means that labor productivity should be enhanced and the gap between wages, which is on the rise, should be narrowed.

According to the BOK’s’Financial Stability Report for March 2021′, the proportion of companies with an interest compensation ratio (operating income ÷ interest expense) less than 1x at the end of last year was 40.7% of the surveyed listed and unlisted companies (2175), which was 3.4 percentage points. Rose. If the interest compensation ratio is less than 1x, it means that the operating profit cannot even cover the interest expense. The proportion of companies with an interest coverage ratio of less than 1x is 30.9% in 2016, 32.3% in 2017, and 35.7% in 2018, which is increasing every year.

Increasing zombie companies are undermining the competitiveness and labor productivity of the entire manufacturing industry. According to the BOK, the labor productivity of zombie companies is only 48% of that of general companies. The BOK estimates that if the number of zombie companies does not increase, the labor productivity of general companies will increase by an average of 1.01%.

Reporter Kim Ik-hwan/Baek Seung-hyun [email protected]