‘Inflation fear’ hit the stock market… Is it a premature concern?

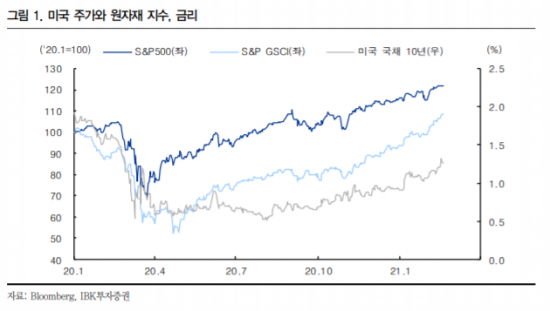

[아시아경제 지연진 기자]’Fear of inflation’ hit the stock market. With the recent surge in oil and commodity prices and rising US Treasury yields, expectations for an economic recovery are shifting to fear of inflation. There is a growing possibility that the U.S. will implement additional stimulus measures worth $1.9 trillion, and as the corona19 vaccination begins in earnest, signs of economic recovery are detected everywhere, and the liquidity feast that has supported the recent stock market is ending.

US West Texas crude oil (WTI) rose 1.8 percent to $61.14 per barrel from the previous day on the 17th (local time). Brent oil also rose 1.8% to $64.43 per barrel from the previous day. Both WTI and Brent are the highest in 13 months. Although crude oil prices were slightly adjusted for next month, it is analyzed that the burden of a steep rise remains as the cold wave continues in the northeast and central and south regions of the United States. Demand this year due to economic recovery and stimulus effectIt is a view that the win pressure will not be small. In fact, raw material prices such as iron ore are on the rise.

but

As concerns over inflation and monetary tightening following the economic recovery have grown, the stock market has also entered a correctional market. The domestic KOSPI has fluctuated around the 3100 line this month, and the US market is the same. However, it is analyzed that concerns about inflation and monetary tightening are premature.

In order for the fear of inflation to become a reality, the intensity of inflation needs to be high enough to put a burden on the economy and corporate profits, but it is not yet that level. Ahn So-eun, an analyst at IBK Investment & Securities, said, “If you look at the US case from 1999 to 2000, stock prices continued to rise until the economic and profit indicators fell due to the accumulated inflation. Considering that, the upward trend of the economy and profits is expected to continue, and the current trend of the stock market will not change despite concerns about inflation.” Looking at the past phase of reflation (increased inflation and stock prices), he said, in the period of full-fledged economic recovery and inflation, It is reported that industries such as energy and industrial goods dominate.

However, there are some opinions that we should be wary of rising raw material prices. Park So-yeon, an analyst at Korea Investment & Securities, said, “The minutes of the US FOMC (Federal Open Market Committee) showed consensus on continued purchase of bonds, but concerns about financial stability and valuations were also revealed.” I am concerned,” he said.

Reporter Ji Ji-jin [email protected]