Automobile Industry Association Survey Results… Parts industry “need to improve government financial support measures”

▲ Survey on the impact of disruption in supply and demand for automotive semiconductors in the parts industry (Source = KAMA)

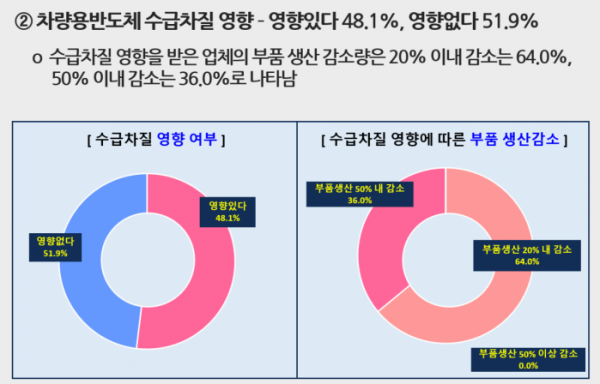

The shortage of automotive semiconductors is also affecting suppliers. Nearly half of the parts makers are cutting production, and it is found that they are having difficulty in raising operating funds.

The Automobile Industry Federation conducted a survey on vehicle semiconductors targeting 53 first- and third-tier suppliers and announced it at the ’14th Automotive Industry Development Forum’ on the 6th.

According to the survey, 48.1% of parts makers answered that they were affected by the disruption in supply and demand for semiconductors for vehicles. For 36% of affected companies, parts production fell by less than half.

There is also a problem of financing due to the decrease in production. 20% of parts makers said they needed financing within the first half of the year, and some said they needed it within one month.

The parts industry emphasized that the government’s financial support measures need to be improved, such as expanding the scale of financial support (39.0%), easing financial support standards (39.0%), and shortening the processing period (14.6%).

The industry predicts that the impact of the disruption in supply and demand for automotive semiconductors will continue until the second half of the year. 16% of companies said that the aftermath will remain until next year.

The association announced that it would review the current status of semiconductor supply and demand disruptions by company and recommend financial support measures required by the parts industry to the government. In addition, it plans to expand corporate exchange meetings between the automobile-semiconductor industry, discover a cooperative model, and even promote localization.

In the short-term, the government suggested easing the P-CBO (corporate bond-backed securities) standard, expanding the loan limit, and providing financial support, long-term low-interest special financing programs, and the creation of a semiconductor special investment fund for vehicles. In the mid- to long-term, he suggested that domestic contract manufacturers need to support facility investment taxation, nurture manpower and commercialization infrastructure, and support R&D funding.

Chairman Man-ki Chung said, “For companies that are experiencing liquidity difficulties while overcoming the difficulties in supply and demand for semiconductors through expanding cooperation with the Taiwanese government, the government and the financial sector need preemptive financial measures.” If possible, he said he would replace imported goods with domestic ones. This crisis could be an opportunity for our automotive semiconductor industry to leap forward if used well.”