Bank of Korea report… “Need a premium rate system reflecting future risks

On the afternoon of September 9, 2020, farmers are looking at apples that fell on Typhoon Highsun in an apple field in Hasong-ri, Hwabuk-myeon, Yeongcheon-si, Gyeongsangbuk-do. In this 1,650 square meter (about 500 pyeong) apple field, half of all apples at the time fell. [연합뉴스 자료사진]

(Seoul = Yonhap News) Reporter Seong Seo-ho = Amid frequent natural disasters due to climate change, a suggestion was made to change accident insurance to a mandatory subscription method in Korea.

On the 6th, the BOK Financial Stability Bureau Manager Jeong Ki-young and Park Seong-woo, the investigator, said in the report on the 6th,’The Current Status of Domestic and Overseas Disaster Insurance Systems and Improvement Tasks for Response to Climate Change’ (BOK Issue Note).

![[한국은행 제공. 재판매 및 DB 금지]](https://i0.wp.com/img2.yna.co.kr/etc/inner/KR/2021/04/06/AKR20210406077200002_03_i_P4.jpg?w=560&ssl=1)

[한국은행 제공. 재판매 및 DB 금지]

In Korea, disaster insurance is divided into crops and livestock (Ministry of Food, Agriculture, Forestry and Fisheries), aquaculture products (Ministry of Oceans and Fisheries), and storm and flood damage (Ministry of Public Administration and Security).

However, since it is not compulsory, the subscription rate is generally low, and the risk distribution effect of insurance is limited due to the fact that high-risk groups mainly subscribe.

In addition, due to the method of calculating insurance premiums based on past accident damage cases (experience rate), insurance premiums do not reflect actual disaster risk, and the differential rate system is generally simple.

![[한국은행 제공. 재판매 및 DB 금지]](https://i0.wp.com/img1.yna.co.kr/etc/inner/KR/2021/04/06/AKR20210406077200002_02_i_P4.jpg?w=560&ssl=1)

[한국은행 제공. 재판매 및 DB 금지]

“If you consider the trend of climate change, the experience rate system is difficult to reflect the possibility of deepening natural disasters, so insurance premiums may be set lower than the appropriate level.”

The current national reinsurance method also has a problem that it can increase the fiscal burden. In the current storm and flood insurance, if the loss ratio exceeds a certain level, the government compensates for it.

From the government’s point of view, although the reinsurance fee received in exchange for reinsurance is relatively low, the cost to be borne in case of a disaster is infinite.

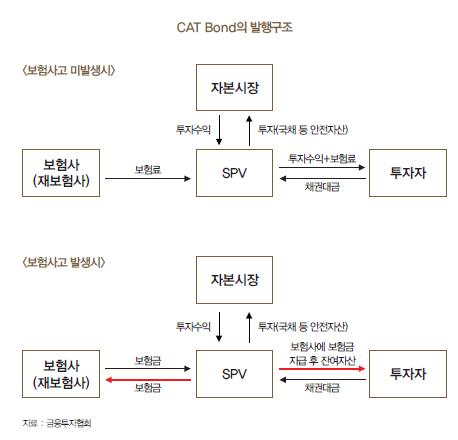

“In order to increase the efficiency of disaster compensation and insurance operation, it is necessary to change the subscription of accident insurance from a voluntary subscription method to a mandatory subscription method.” It is necessary to build and introduce Catastrophe Bonds as a means of distributing the risks of private insurers,” he stressed.

Catastrophe bonds are bonds issued for the purpose of transferring the risk of accident insurance payments to the capital market. If a disaster that satisfies the conditions set at the time of issue of bonds does not occur, bond investors can make investment returns. If the conditions are met, the insurance company that issued the bond uses the amount of the bond issuance as a resource for the payment insurance payment, and the investor receives the remaining assets after payment of the insurance payment.

“Generally, the issuer of disaster bonds is a special purpose organization (SPV) established by the insurance company, not the insurance company that sold accident insurance.” In order to do so, it requires permission from the Financial Services Commission, so the procedural transaction cost is higher than the benefits of issuing bonds.

He added, “The establishment of SPVs for issuance of disaster bonds should be relaxed from the permit system to the reporting system, and the establishment requirements and procedures should be simplified.”

![[한국은행 제공. 재판매 및 DB 금지]](https://i0.wp.com/img0.yna.co.kr/etc/inner/KR/2021/04/06/AKR20210406077200002_01_i_P4.jpg?w=560&ssl=1)

[한국은행 제공. 재판매 및 DB 금지]

Unauthorized reproduction-prohibition of redistribution>

2021/04/06 12:00 sent