S-Mark accused the prosecution and took measures such as designating an auditor to Kosun Bio and Apool.

At a regular meeting on the 8th, the Securities and Futures Committee announced that it had imposed a fine on Seegene, a KOSDAQ-listed company, for violating accounting standards.

According to the Jeungsun Committee, it was investigated that Seegene, a manufacturer of medical supplies, voluntarily carried out excessive quantities of products that exceed the actual order volume from 2011 to 2019 to the agency and recognized all of them as sales, and over or understated sales, cost of sales, and related assets. .

The Jeungsun Committee decided to impose a fine on Seegene (final decision by the Financial Services Commission), three years of appointment of an auditor, recommendation to dismiss an executive in charge and six months to suspend work, and to improve internal control.

Seegene is Korea’s representative new coronavirus infection (Corona 19) diagnostic kit company.

Seegene’s market capitalization is 4,7247 billion won, which is the 5th place on the KOSDAQ.

It was investigated that S-Mark, an unlisted corporation (subject to submit a business report), misappropriated the capital increase funds after falsely describing the purpose of use of the funds on the stock report, and falsely recorded available-for-sale securities for the purpose of concealing this.

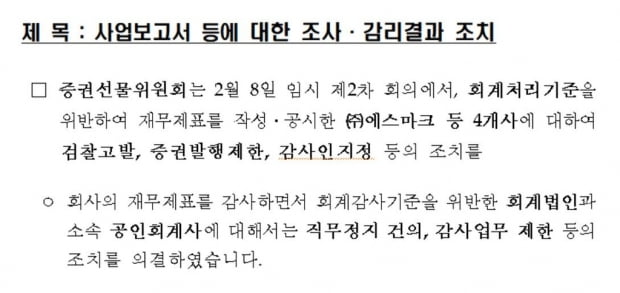

The Jeungseon Committee decided to accuse Smark to the prosecution.

It also imposed measures such as a one-year limit on the issuance of securities, a penalty of 16 million won (former CEO), a fine of 60 million won, and a three-year auditor designation.

It was revealed that unlisted corporations, Cosun Bio (formerly Hyunsung Vital) and Apool, underestimated or overestimated the provisions for bad debts for accounts receivable.

Kosun Bio was subject to sanctions such as 10 months for issuance of securities, 36 million won for negligence, 3 years for auditor designation, and 8 months for Apool issuance limit, and 2 years for auditor designation.

While auditing the financial statements of these companies, the Jeung Seon Committee voted for measures such as suspension of work and restrictions on audit work to accounting firms and chartered accountants who violate the standards for accounting audit.

/yunhap news

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution