Despite the surge in stock prices, private equity funds are not getting out of the sluggish swamp. The balance of banknote sales, the largest seller, fell below 20 trillion won in the aftermath of the cessation of redemption that followed Lime and to Optimus. When individual investors turned away, the proportion of individuals in all private equity funds fell to the 4% level. There are also concerns in the industry that it could become a’private fund’ that is in crisis of death.

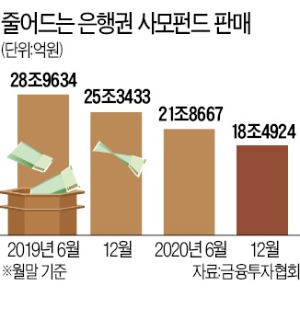

According to the Financial Investment Association on the 15th, the balance of banknote sales of private equity funds was 18,429.4 billion won as of the end of last year. The 20 trillion won wall was broken in 3 years and 8 months after April 2017. The sales balance, which increased to about 30 trillion won in July 2019, decreased by more than 10 trillion won in less than a year and a half. In the industry, there is an analysis that the private equity industry, which has grown rapidly since 2015, is in the worst situation despite the good news of a surge in stock prices. A representative of a hedge fund said, “There is a high possibility that there will be cases in which managers that have exploded since lowering the entry threshold of private equity funds will be closed from this year.” “There is also a movement to search for managers that are already for sale by law firms.” Told.

Another sign of a crisis is the scale of the new setting. According to the Korea Securities Depository, the size of newly established private equity funds last year fell 42.6% compared to the previous year. The newly established fund also fell 60.6% over the same period. This is the first time since 2015 that the size of the new setting has turned to a decline. Another factor in the crisis is that individual investors are turning away from private equity funds, which have fallen into a swamp of’distrust’ due to the suspension of redemption. Individuals continue to withdraw money from private equity funds. Private equity participation (investment funds) of individuals from 21,8684 trillion won in March last year decreased significantly to 17,6653 trillion won at the end of last year. Considering the fact that some of these are money that is tied to the suspension of redemption, it is analyzed that the phenomenon of individuals turning away from private equity funds is serious.

Song Hong-seon, a senior research fellow at the Capital Markets Research Institute, diagnosed, “New managers are continuing to appear in the private equity market, which is still on a deteriorating course in the midst of the booming stock market, but it will be difficult to survive unless consumer confidence is restored.”

Bank sales balance 20 yen collapse… Private equity struggle to survive

‘Boomerang’ with permission from government management company… The possibility of shutting down from this year increases

“I can sell a private equity fund at times like this and get paid. Who will take the risk? Instead of private equity funds, there is a growing awareness among private bankers (PBs) for funds that will not cause problems, such as Chinese-related funds, or selling them.”

This is the atmosphere of a bank window these days, as explained by a management industry official. In short, it is a phenomenon of avoiding private equity funds. In many places in the industry, there is a saying that “there is no way to live right now.” Of course, some say that “the private equity industry is on its way back to normal.” It is a process in which the distrust of self-initiated self-employment is resolved by selling private equity funds through banks like public offering funds.

27% deposit in banknote sales balance

The figure of the private equity industry in a pit is also confirmed by numbers. According to the Financial Investment Association, the sales balance of private equity funds in banking sectors decreased by 27.28% from the previous year in December of last year. The 20 trillion won mark was broken for the first time since April 2017. This is the effect of a series of repurchases as the newly established private equity fund plunged last year and the stock price surged. One investor said, “The private equity fund recovered the principal and immediately redeemed it.”

The sales balance of private equity funds is decreasing, centering on large banks that have actively sold private equity funds. Shinhan Bank’s private equity fund set up as of December last year fell 62.98% in one year to 1.697.5 billion won. During the same period, the size of Woori Bank and Hana Bank decreased by 46.89% and 44.42%.

The industry is concerned that this year will be even more difficult than last year. This is because the investment threshold has risen. As a follow-up measure for the private equity crisis, the government has raised the threshold for general investors from 100 million won to 300 million won. The requirements were strengthened after five years after lowering the minimum investment amount from 500 million won to 100 million won in 2015, after extensive deregulation was initiated.

“In fact, the consignment is rejected”

The immediate market blockage is also a big blow to the private equity industry. This is because major banks are refusing the consignment service. As the disciplinary level of the banks that sold Lime and Optimus funds is being discussed, banks who are concerned about useless sparks are coming out in the manner of “avoid private equity funds.” A hedge fund official said, “It is a reality that small and medium-sized managers are asking for performance from a trustee bank, but in the case of small and medium-sized managers, it is difficult to meet the conditions required by the banks. said.

In the industry, there is a growing sense of crisis that the size of new private equity funds, which turned to decline last year, will shrink further this year. Last year, the size of newly established private equity funds decreased by 42.6% compared to the previous year. This is the first time since 2015 that the size of the setting has decreased.

There are also managers that close their doors. Jungwoo Asset Management applied for voluntary closure last year due to poor management last year. At the end of last year, the financial authorities decided to cancel the registration of Monolith Asset Management’s specialized private equity investment business. This is because equity capital did not meet the minimum operating capital standard.

In some cases, the merger and acquisition plan was broken. In April of last year, Samsung Asset Management announced a plan to merge with Samsung Hedge Management, an affiliate in charge of hedge funds. However, in July, three months later, it was announced that the merger plan would be suspended indefinitely. At that time, the industry interpreted, “It would have been judged that there was no real benefit for Samsung Management to take hedge management due to the rapid contraction of the private equity market.”

Managers looking for a bow

It is also a bad news that the direct investment craze continues. A representative of an asset management company confessed, “There are cases where high-income investors who have invested in private equity funds have hired stock masters in Jaya to directly invest in stocks without going through an asset management company.” .

This sense of crisis is also prevalent in the public offering fund industry. This is due to the spread of distrust in asset management companies. In fact, about 1.46 trillion won of money has been lost in the last year from domestic equity funds.

Asset managers are looking for new ways to survive, such as reorganizing their organizations. It is also a countermeasure to the crisis that many managers have jumped into the ETF, which is attracting customers recently. An official from the management industry said, “We are entering the ETF market by crying and eating mustard while lowering commissions one after another, but even that is not easy.”

Song Hong-seon, a senior research fellow at the Capital Market Research Institute, said, “In order for the fund market to revive, it will take the same time in the long run. Said.

■ Private equity

A fund that raises funds through private equity from a small number of investors (49 or less) and manages them in stocks and bonds. Unlike public offering funds, there are no restrictions on investment targets and investment weight, so you can freely invest in stocks, bonds, real estate, and raw materials.

Reporter Jaewon Park/Beomjin Jeon/Hyungju Oh [email protected]