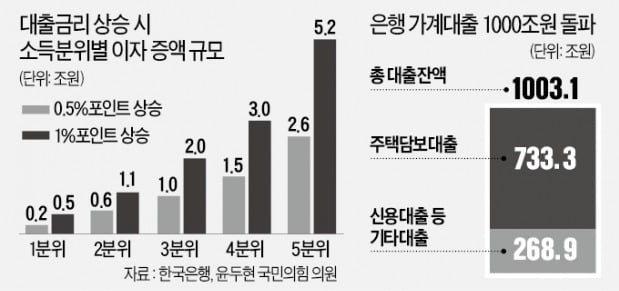

It was found that even if the interest rate on loans increases by only 1 percentage point in the future, the additional interest owed to the entire household will increase by 12 trillion won per year. In the aftermath of Corona 19, not only the self-employed who used emergency loans, but also the general public who are engaged in ‘Young Cull (attracting souls)’ and ‘Investment in debts’ are expected to increase. Excluding the top 20% (fifth quintile) with the highest debt, the middle class and low-income class are expected to bear a burden of 6.6 trillion won, which is more than half of the increasing interest.

○ Interest burden for self-employed people increased by 5.2 trillion won

According to data submitted by the Bank of Korea to Rep. Yoon Doo-hyun of the National Assembly’s Political Affairs Committee on the 14th, when the interest rate on household loans such as home mortgage and credit loans rises by 1 percentage point, the additional interest that households must pay is KRW 1.18 trillion. It’s the scale.

As of the end of last year, the total domestic household credit (loan) balance was 1630 trillion won. The share of financial liabilities by income quintile was 3.9% in the 1st quintile (20% lower in income), 9.4% in the 2nd quintile (20~40%), 17% in the 3rd quintile (40~60%) and 25.6% (60~80%) in the 4th quintile 5 It is 44.1% of the quartile (the top 20% of income).

The Bank of Korea estimates that 72% of all household loans are variable-rate loans that adjust interest rates every three to six months. This household loan balance was multiplied by the rate increase (1 percentage point) to calculate an additional interest burden of KRW 1.18 trillion. It was found that the top 20% (fifth quintile) with the most loans had to pay an additional KRW 5.2 trillion. The remaining 1st to 4th quartiles will have to pay an additional 6.6 trillion won of interest.

One bank’s credit manager said, “Currently, the minimum interest rate for mortgage and credit loans is in the middle of 2% per year. If the interest rate rises by 1 percentage point, the total interest rate increases by more than 30% for those who have to pay a loan at the lowest interest rate.” He explained.

It is estimated that the interest burden of self-employed persons increases by KRW 5.2 trillion when the loan interest rate jumps by 1 percentage point. The analysis is that self-employed people have a higher proportion of non-bank loans with higher interest than household loans, so the burden per person will be greater.

○ Loan interest rates likely to continue rising

Household loan interest rates have been steadily rising since the fourth quarter of last year. The minimum credit lending rate of the four major banks, Kookmin, Shinhan, Hana, and Woori, rose from 1.99% per year at the end of July last year to 2.61% per year as of the 11th. During the same period, the interest rate on mortgage loans also increased by 0.3 percentage points. This month, banks are raising interest rates on mortgages following credit loans. Shinhan Bank has raised the interest rate of the Judamdae and jeonse loan loans by 0.2% from the 5th, and the Nonghyup Bank removed the preferential interest rate of the Judamdae from the 8th. Woori Bank is also considering an increase in the interest rate for jeonse loans with the main dam. The interest burden of those who bought a house by adding a’Young Kul’ loan increases.

There is also a high possibility that interest rates will rise further in the future. The 6-month-maturity bank bond rate (AAA grade), which is mainly used by banks to rate credit loans, rose from 0.619% per annum at the end of July last year to 0.792% per annum on the 12th. The interest rate of AAA-grade bank bonds has risen by 0.04 percentage points over the past two weeks as expectations for an economic upturn and inflationary pressure have increased recently.

An official from the bank said, “The rate of interest rate rise is not enough for consumers to feel the burden yet.” “According to the measures of the financial authorities, financial companies are removing various preferential interest rates and raising the additional interest rate, so the interest burden on financial consumers will increase for the time being.” Expected.

Reporter Daehoon Kim [email protected]

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution