|

| Illegal spam that drives stock investment. Most of the calling numbers are also fake texts. © News1 |

Recently, as the stock market has been greatly revitalized, the number of investors jumping into stock trading with debts has increased, and illegal spam aimed at this has also been increasing rapidly. However, such spam messages are highly fraudulent, such as extorting usage fees in the name of recommending stocks, and investors need special attention.

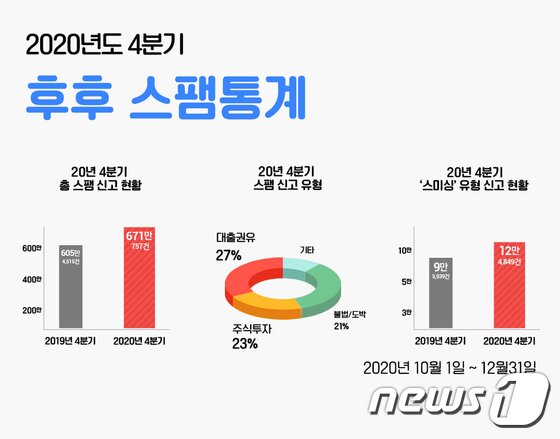

As a result of analyzing the statistics of spam calls and text messages reported by users in the fourth quarter of last year by Huhu & Company, which provides the spam blocking application’Hoohoo’ service,’stock/investment’ spam out of a total of 6.71 million spam reports, the largest increase compared to the same period last year. Showed.

A typical technique is to share unsubstantial investment information such as power stocks and operational stocks, or extortion of usage fees in the name of stock stock recommendations.

The number of reports of this type was about 1.54 million, an increase of 62% from the same period last year. In the second half of last year, the stock craze of individual investors led to an increase in related spam. The share of stocks and investments in all reports also increased, ranking second in the most reported types.

The number one report type is’loan solicitation’ spam. As for this type, a total of 1.82 million reports were received, an increase of 660,000 cases compared to the same period last year. This is the number that broke the highest number of reports of the same type since quarterly spam statistics were released.

Along with the boom in debt, the cessation of bank loans in the fourth quarter of last year seems to have had a decisive effect. When low-interest credit loans were blocked, third-party financial institutions and illegal loan business operations went viral.

In the report of’Smishing’, a fraudulent method that abused text messages, the influence of’young ties and debts’ was found. In the fourth quarter of 2020, smishing reports were 12,4849, an increase of about 30,000 from the same period last year.

In particular, smishing techniques are diversifying, not only by impersonating the former parcel delivery service and reception desk, but also by impersonating a letter to promote loans from savings banks and card companies.

Meanwhile,’illegal games and gambling’ spam, which ranked first in the annual report type for three years from 2017 to 2019, showed a slowing trend. The number of reports of this type was 1.41 million, ranking only in third place in the ranking of the most reported types due to loan recommendations and stocks and investments.

Heo Tae-beom, CEO of Huhu & Company, said, “Unlike illegal games and gambling, spam related to stocks and loans requires thorough attention as it can pretend to be an institutional financial institution.” If in doubt, you should install the Whoo app to check whether smishing.”

|

| Statistics of illegal spam statistics © News1 |