◀ Anchor ▶

The tricks and tricks of getting money to buy real estate from parents and not paying taxes are becoming more and more sophisticated.

When I tracked down a landlord who bought a multi-billion-won apartment even though he didn’t have much income, it turned out that the money his father gave was turned into money earned by selling things online.

Reporter Lee Yoo-kyung reports.

◀ Report ▶

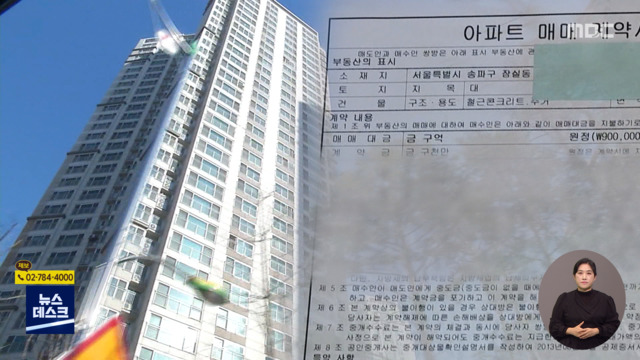

Mr. A who came back after studying abroad and bought an apartment worth 1 billion won.

When the tax authorities asked for the source of the money, it explained that it was “money earned by selling miscellaneous goods online while studying abroad.”

But it was a lie.

Looking at the transaction details, all the depositors who bought the goods are acquaintances of Mr. A’s father.

When my father sent money to acquaintances, he sent the money to Mr. A as if they were buyers.

Mr. A also said that the money he borrowed from his acquaintance went into buying an apartment, but this money was also sent by his father to his acquaintance.

There have also been cases of using an employee’s salary account to avoid paying the gift tax between the couple.

Mr. B, the director of the academy, recently bought several houses including an apartment worth 2 billion won in Gangnam, Seoul.

The secret of Mr. B, who had a small academy income, raised billions of won in funding was her husband.

If her husband in the financial industry sends more money than his monthly salary to the academy employees’ accounts, the employee subtracts his salary and returns the remaining amount to Mr. B.

[김태호/국세청 자산과세국장]

“We found a transaction suspected of tax evasion, such as being suspicious of making a false loan contract with a relative or not clarifying the source of the acquisition funds.”

Foreigners were also caught.

A Chinese in their thirties bought 10 apartments in Gangnam, Seoul, etc. with money received from their parents abroad, but was caught by doing so-called ‘Hanchigi’ in order not to pay the gift tax.

In this way, the National Tax Service has initiated a tax audit on more than 350 people suspected of tax evasion, such as rental business owners who concealed their donation in the process of purchasing real estate or reduced their sales.

In particular, the IRS stressed that in the case of suspected gift tax evasion, it will investigate not only the person who owes the money, but also the person who owed the money, and in the case of the borrowed money, it will check to the end whether or not the person pays it directly.

This is Yookyung Lee of MBC News.

(Video coverage: Kwon Hyuk-yong / Video editing: Komu-geun)

MBC News awaits your report 24 hours a day.

▷ Phone 02-784-4000

▷ Email [email protected]

▷ KakaoTalk @mbc report