Daily Sports

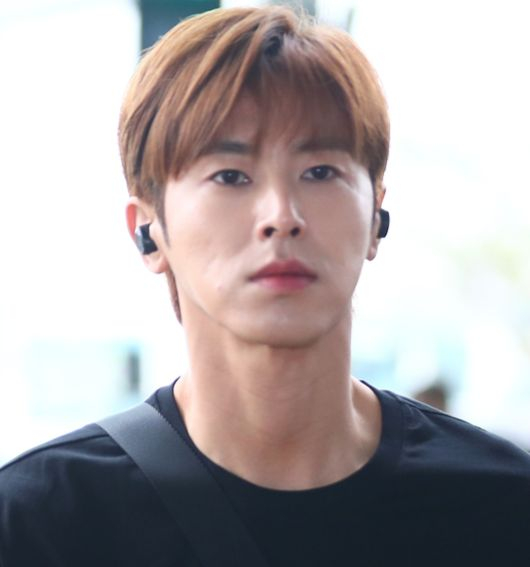

TVXQ’s Yuno Yunho (Jeong Yunho) has been cracked down by the police for violating the quarantine rules, and the fact that he owned the building as a family corporation is belatedly becoming a hot topic. It is with the fact that Yunho Yunho said in the past that he would not become a building owner.

Recently, in various online communities, “Yuno Yunho bought a building as a family corporation in 2016. It is not wrong to buy a building, but when I commented that it would be burdensome to talk about this, the account was blocked.”

In 2016, Corporation A purchased a building in Pungnap-dong, Songpa-gu, Seoul for 16.3 billion won. Yunho Yunho’s father and the representative of the corporation have the same name. It seems unlikely that the representative’s address is the same as Yunho’s home address. It is also reported that before 2016, Corporation A was a company that had nothing to do with the rental business.

It is not illegal to buy real estate as a family corporation. However, it is pointed out that it is an expedient to break through the loopholes of the system.

When a real estate corporation owns a house, the acquisition tax and property tax are reduced and the mortgage recognition rate is applied higher than that of an individual. In the case of multi-homed people, the burden of comprehensive real estate tax can be greatly reduced, and capital gains tax can also be subject to a much lower tax rate. Individual multi-homeowners are subject to a transfer tax of up to 62%, whereas homes purchased by incorporation are not included in the calculation of the number of private homes. Even when calculating the tax, corporate-named houses are not included in the number of individual houses, which can significantly lower the tax.

The problem is that the acquisition of real estate using corporations is not limited to tax savings, but is abused as a means of tax evasion. In fact, the National Tax Service launched a tax audit last year when more and more people attempted to evade tax in the form of establishing real estate corporations. Among them, he bought an apartment along the Han River and three foreign cars worth KRW 4 billion, but in some cases he purchased a house under the name of the company he operated to avoid investigating the source of funds.

Meanwhile, Yunho Yunho apologized at the end of last month when it was discovered that he was arrested while having a drink at a bar in Cheongdam-dong, Gangnam-gu, Seoul.

Reporter Lee Ga-young [email protected]

![]()