Input 2021.03.19 15:29

According to the financial sector and financial authorities on the 19th, the Financial Services Commission decided on the’Supervisory Regulations on the Protection of Financial Consumers’ at a regular meeting on the 17th. According to this law, financial companies are required to comply with six principles when selling financial products: the conformity principle, the adequacy principle, the duty of explanation, the prohibition of unfair business practices, the prohibition of unfair solicitation, and the regulation of advertising. In case of violation, financial institutions are subject to punitive penalties up to 50% of the relevant income.

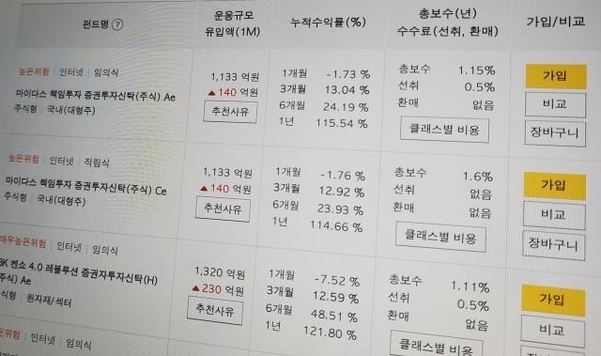

In the future, consumers must analyze their investment propensity to check financial product information on the bank’s Internet homepage or mobile application (app). After that, you can only view financial product information that matches your investment tendency. Even if there is a specific product you want, if it is different from your investment tendency, you cannot search itself. It follows the’conformity principle’ that prohibits the solicitation of financial products that are inappropriate for the consumer’s property and investment propensity.

It will be difficult for the time being to arrange the order of financial products based on the rate of return, interest rate, and loan limit within one’s investment propensity. This is because the financial authorities only recently made the judgment that the principle of’investment propensity analysis should be performed first and then only products that meet the propensity should be recommended’ even when consumers select specific criteria and search for products that meet the criteria. to be.

A bank official said, “After the financial authorities interpreted, the time remaining until the implementation date was too short to complete the computer development.” It will be possible to search only later,” he explained. An official of Bank B said, “In the case of non-face-to-face, the customer has to judge and select the product alone, because the explanation of the bank employee is not available. The more information must be provided, the more limited it is to consumers according to the law. “We have no choice but to provide only relevant information,” he said.

The principle that only financial products suitable for the results of the investment propensity test can be viewed is also applied to face-to-face environments such as branch offices. All past solicitations by banks, which could show customers a product that is one grade higher than their investment propensity, are prohibited. An official of C Bank said, “The phrase or terminology in the propensity analysis evaluation table is difficult, so few people in the general public can come up with an aggressive investment type.” did.

However, it doesn’t mean that you can’t access products that don’t fit your class at all. Customers can visit a bank to request a subscription for a specific financial product after accessing information on a specific financial product through blogs, cafes, and acquaintances, not through the recommendation of the bank. If a customer whose investment propensity is classified as a hedging type wants an aggressive investment type product, the bank must inform the fact that it is’inappropriate’. Nevertheless, if the customer wants, they can enter into a contract.

An official at D Bank said, “The information on financial products accessed through channels other than financial companies is more unreliable and inaccurate,” he said. “It is true that side effects are also concerned.”

The chaos in the field continues, but the financial authorities are not responding in time. The Financial Services Commission completed the legislative process by announcing the enforcement ordinance and supervisory regulations on the 17th, a week before the law came into force. The enforcement rules have not yet been finalized. The financial authorities have received only two responses to the question of each industry, asking whether it can be applied by taking actual examples, and the evaluation is dominant that the answer is still ambiguous.

A bank official said, “I was informed that the enforcement regulations will come out only at the beginning of next week, although the enforcement of the Financial Security Act is on the 25th. “It’s a situation” he explained. An official from the Financial Services Commission explained, “Because the enforcement bylaws include the format according to the regulations, it will not be a fatal factor.”

The financial authorities decided to reduce side effects, such as putting a six-month grace period and guidance period, and engaging in on-site communication in Buryaburya. From this day on, the authorities plan to hold a briefing session with each financial association and operate a support system for the settlement of the financial law by December. It is decided to hold monthly meetings of the Situation Group in preparation for enforcement of the Anti-Social Law, and to provide answers to on-site inquiries on the website of the Financial Services Commission and Financial Supervisory Service at any time.