14bps down due to increased handling of non-face-to-face loans

Deposit margin 1.81%p, 3bp higher than the previous month

[서울=뉴스핌] Reporter Baek Ji-hyun = The household loan interest rate jumped 8bp (1bp=0.01%p) for a month, recording the largest increase since September 2019. On the other hand, credit loans declined as low interest rate loans increased.

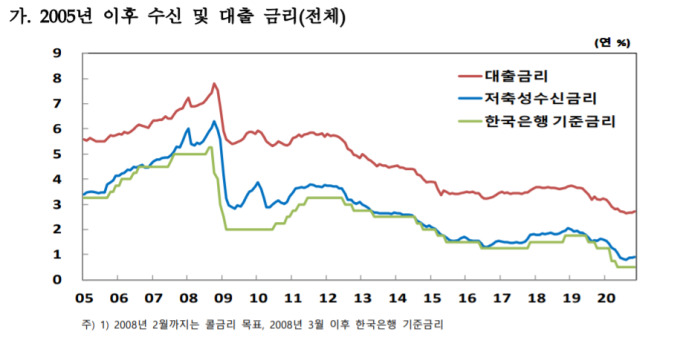

According to the’Weighted Average Interest Rate for Financial Institutions in November’ announced by the Bank of Korea on the 30th, the interest rate for new loans for deposit banks increased by 5bp from the previous month to 2.71% per year.

|

| [자료=한국은행] |

Household loans rose 8bp from the previous month to 2.72%. This is the biggest increase this year. Among them, interest rates for mortgage loans (+9bp), group loans (+11bp) and guarantee loans (+15bp) rose sharply due to rising market interest rates and efforts to manage the total amount of household loans by banks. Cofix rose 3bp from 0.87% in October to 0.90% in November. Bank bonds (5-year bonds) and CDs (91-day bonds) also rose 10bp and 3bp from the previous month, respectively.

On the other hand, the general credit loan interest rate fell 14bp MoM, despite the largest increase in credit loans. Prior to the government’s enforcement of regulations on high credit loans (November 30), demand for demand was on the rise, and loans rose to a record high.

The BOK analyzed that the decline in credit lending rates was due to the increased handling of non-face-to-face loans by high-credit borrowers. Song Jae-chang, head of the financial statistics team at the Haneun Economic Statistics Bureau, said, “High-credit borrowers are given preferential interest rates at banks, so interest rates are low. .

Song said, “It is true that the rise in household loan interest rates is the biggest this year, but we will have to look at various things such as market conditions whether the rise in loan interest rates will continue next year.”

The corporate loan interest rate rebounded 4bp, recording 2.71%. Large corporations maintained the previous month’s level as the proportion of high-credit borrowers increased despite the rise in the standard interest rate. Small and medium-sized enterprises (SMEs) rose 5bp from last month due to the impact of rising market interest rates.

On the other hand, the savings-type receiving rate based on the amount of new treatment was 0.99%, a mere 2bp increase from the previous month. Net savings-type deposits rose 2bps, led by term deposits, and market-type financial products, rose 3bps, led by financial bonds.

As the loan interest rate increased further, the difference in deposit interest rate based on the amount of new treatment increased 3bp from the previous month to 1.81%p.

In terms of balance, the receiving rate fell 3bps MoM and the loan rate fell 2bps. The difference in deposit interest rate increased by 1bp to 2.02%p.

Interest rates for non-bank financial institutions were generally maintained at the same level as last month. In terms of loan interest rates, mutual savings banks (-13bp) and Saemaul Geumgo (-9bps) fell, but credit unions (+6bp) and mutual finance (+2bp) rose. In the case of mutual savings banks, amid an increase in the overall size of credit loans, handling of medium-interest rate loans in the 10% range increased, while the proportion of high-interest rate loans of 20% or more decreased.