Household debt increased by nearly 126 trillion won last year alone, showing the second increase on an annual basis. Due to the government’s failure in real estate policy, the demand for ‘Yeongkeul’ (grabbing the soul) to prepare housing and jeonse funds soaring, the demand for ‘debt investment’ to invest in stocks in debt, and the demand for loans due to life tragedies related to Corona 19 are complex. It is interpreted as having an influence.

Some are also raising concerns that the surge in household debt will be a ambush that shocks the real economy. Interest rates in the market continue to rise this year due to concerns over the expansion of deficit government bonds. It is analyzed that there is a possibility that the burden of interest expenses on households will increase, leading to a contraction of private consumption and poor loans.

○ Household credit increased by 125.8 trillion

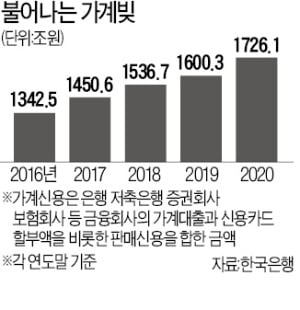

According to the statistics of’Household Credit for the 4th Quarter of 2020′ released by the Bank of Korea on the 23rd, the balance of household credit at the end of last year reached a record high of 1726 trillion KRW. Household credit is the sum of household loans from financial companies such as banks, savings banks, securities companies, insurance companies, etc., plus sales credits such as installments of credit cards.

Household credit increased by 12.8 trillion won per year last year. This is the largest increase in four years since 2016 (139 trillion won), when household debts surged to a record high due to deregulation of loans including the mortgage loan ratio (LTV).

Looking at the fourth quarter of last year alone, household credit increased by 44.2 trillion won. In terms of quarterly growth, it was the third largest after the fourth quarter of 2016 (46 trillion won) and the third quarter of 2020 (44 trillion won).

The surge in household debt last year was due to the fact that it raised borrowings from all directions to buy stocks and real estate. The range of borrowings to raise rented house prices and rents has increased. According to KB Real Estate, the average selling price of apartments in Seoul in December of last year was 4,033 million won per 3.3 square meter, up 20.3% (681 million won) from December 2019 (3352 million won).

The demand for funds to buy stock was also great. Individual investors net bought 47,4884 billion won worth of stocks in the securities market last year. It also actively invested in public offerings. In the process of applying for a public offering stock for SK Biopharm in June of last year and Kakao Games in August, margins of KRW 30,988.9 billion and KRW 57,554.3 billion were gathered.

○ Soaring household debt, economic ambush?

Among household credits, household loans, excluding sales credit, reached a record high of 163.2 trillion won at the end of last year. The annual increase amounted to 12.5 trillion won. The increase in household loans in the fourth quarter of last year (44.5 trillion won) was the largest since the start of statistics in 2003 based on quarterly increase.

Among household loans, home mortgage loans increased to 910 trillion won, an increase of 67.8 trillion won a year. Looking at the fourth quarter of last year alone, it was about 20.2 trillion won. The increase was larger than in the third quarter of last year (1.7 trillion won).

Other loans, including credit loans, rose to 719 trillion won at the end of last year, an increase of 57 trillion won from the end of the previous year. The largest increase on an annual basis. In the fourth quarter, the increase was higher than in the third quarter (22.3 trillion won), with an increase of 2.4 trillion won. In the fourth quarter of last year, the financial authorities began to tighten regulations on credit loans, but the trend continued.

When looking at household loans by window, the number of banks increased by 82.2 trillion won. Insurance companies and other financial institutions increased by 35.9 trillion won.

Experts pointed out that increased household debt could act as a ambush for the Korean economy. Bond yields, which started to rise from the beginning of October last year, continue to rise this year due to concerns about the government’s expansion of deficit government bonds. The 3-year Treasury bond rate, which was at 0.84% per year at the end of September last year, exceeded 1% per year at 1.02% per year on the 22nd. The 10-year Treasury bond rate surged by 0.50 percentage points from 1.43% per year to 1.92% per year over the same period.

If the market interest rate rises, the burden of repaying the principal and interest of the loan increases, reducing household spending and, in severe cases, can lead to an increase in lending insolvency.

Kim Sang-bong, professor of economics at Hansung University, said, “If the government’s financial support provided immediately after the Corona 19 outbreak ends in a situation where market interest rates rise, there is a possibility that some vulnerable household debts will become insolvent and affect financial stability.”

Reporter Kim Ik-hwan [email protected]