Together with Real Estate 114, we looked back on the real estate market in 2020.

“The first half of this year, balloon effect and panic buying phenomenon”

This year, a series of real estate measures were announced, starting with the 2.20 real estate measures, 6.17 real estate measures, 7.10 supplementary measures, 8.4 supply measures, and 11.19 jeonse measures.

In particular, in the first half of the year, a balloon effect appeared in areas where low- and mid-priced apartments of less than 900 million won were concentrated due to the strengthening of lending regulations, and apartment prices in the so-called Nodo River (Nowon, Dobong, Gangbuk) and Sooyong (Suwon, Yongin, Seongnam) rose significantly.

It seemed that the house price was temporarily caught as a sale to avoid the heavy transfer tax was released in June, but the panic buying craze immediately caused the house price to jump. The sales volume of apartments also recorded 102,628 transactions nationwide in July this year, recording the second highest monthly transaction volume since the actual transaction survey began in 2006. The number of apartment sales was 11,7812 in November 2006, a record high.

|

It jumped more than three times this year than last year.

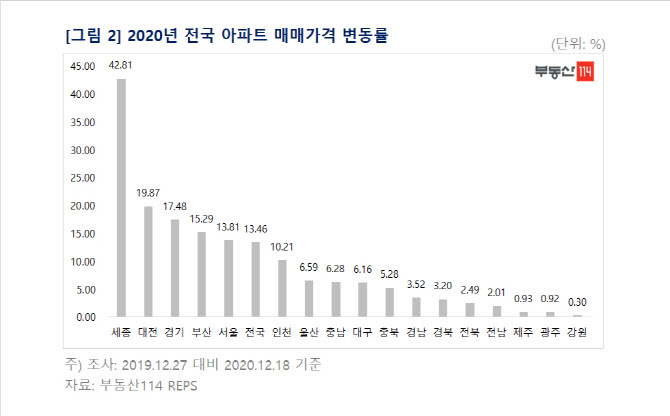

According to Real Estate 114, the nationwide apartment sale price in 2020 rose by 13.46%, recording an increase of nearly three times higher than the rate of change in 2019 (4.17%).

In particular, 17 metropolitan cities also rose at the same time. By region, Sejong rose 42.81%, showing the largest rise. Prices have risen significantly as issues such as continuous influx of population, improvement of settlement conditions, reduction of apartment occupancy volume, and relocation of administrative capital to Sejong City are combined. Daejeon rose 19.87%, recording the second highest increase rate. As apartment prices continued to rise due to the inflow of investment demand, Daejeon was designated as an adjustment target area (all Daejeon) and speculative overheating districts (East, Middle, West, Yuseong-gu) in the 6/17 real estate countermeasures. The uptrend continued in the second half of the year due to favorable developments such as promotion.

The game went up 17.48%. Hanam rose the most due to the expectation of the opening of the first stage section of the Hanam Line and the subscription to the third new city. The rise in acceptability was large due to Mars and the balloon effect, which led to sales demand due to a lack of jeonse sales.

Busan rose 15.29% on the back of the bullish pre-sale market, and in Seoul, Nowon, Dobong, Gangbuk, and Gwanak, Dongdaemun, and Jung-gu, with good access to business facilities, led the price increase by 13.81%.

Gangwon, Gyeongnam, Gyeongbuk, Chungbuk, Jeonbuk, and Ulsan, which declined last year, turned upward in 2020 as occupants declined and the local economy partially recovered.

|

‘All-time high’ rise in the total set value… 12.47% increase nationwide

In particular, the nationwide charter market for apartments, which showed a stable trend, rose 12.47% this year, increasing the increase. In particular, the Seoul jeonse market, which had been relatively stable for four years from 2016 to 2019, has suffered a shortage of jeonse sales in 2020 due to the implementation of the new lease law, increasing demand for subscriptions, strengthening actual living requirements, and converting jeonse to monthly rent. As I lost, I increased the width.

By region, Sejong, which fell in 2019, rose 34.59%, showing the largest increase. The jeonse price has risen significantly due to the improvement of settlement conditions and a decrease in occupancy. Sejong City has had an average of 13,000 apartments occupied over the last five years (2015-2019), but this year has significantly decreased to 5,600. Next, apartment rental prices rose in the order of Daejeon (17.61%), Gyeonggi (17.16%), and Seoul (14.24%). Overall, the uptrend was maintained without off-season even during the summer vacation season due to the lack of chartered sales. Gangwon, Gyeongnam, Busan, Chungbuk, and Gyeongbuk, which declined in 2019, also turned to an uptrend in 2020, and all 17 metropolitan cities across the country also ended on an uptrend.

|

2021?… “I keep going up, but I don’t know the double digits”

In the apartment market in 2021, the rise in jeonse prices arising from an imbalance in supply and demand for jeonse is expected to act as upward pressure on sales. It is expected that the jeonse property will continue to be locked due to the influence of the new lease law, and low interest rates and abundant liquidity are expected to act as upside factors.

If the jeonse crisis prolongs, the conversion of mid- to low-priced apartments in parts of Gyeonggi-do, including the suburbs of Seoul, is expected to stimulate housing prices in the metropolitan area. Decreased occupancy volume is also one of the anxiety factors. In 2021, the nationwide apartment occupancy volume was 273,649 households, a decrease of about 25% compared to 362,815 households in 2020. This is a 30% decrease from the average supply volume in the last five years (2016-2020).

After the supply of apartments peaked at 45,9879 households in 2018, the supply line of 300,000 households will collapse in 2021. By district, 155342 households will be supplied in the metropolitan area, and 4,6156 households and 72151 households will be occupied in the five metropolitan cities and other regions, respectively.