NH Investment & Securities(12,400 0.00%)Silver 12th Huzel(197,700 0.00%)On the other hand, the target price was raised from 250,000 won to 265,000 won, saying that high growth is expected due to the start of exports of botulinum toxin products to China. We maintained our BUY rating.

Researcher Gwan-Jun Na said, “We completed supply of 5 billion won worth of initial supply in the second week of last month,” and “We also completed additional orders in China larger than the initial supply in late December.” It is expected to supply the second volume in the first quarter of this year. Retibo, a botulinum toxin formulation, was expected to be officially released in China from March to April.

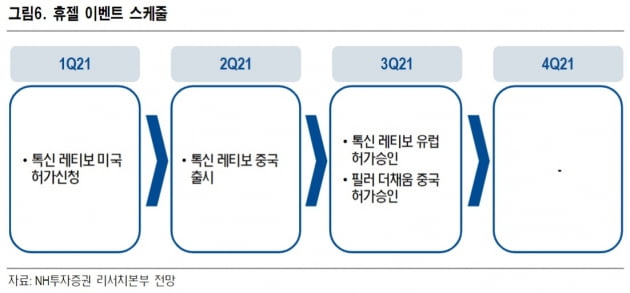

In addition, it is judged that there are a number of upside drivers, such as Retibo’s application for US item license in 1Q and approval in Europe in the second half of this year.

Based on consolidated financial statements in the fourth quarter, sales were expected to reach 61.3 billion won, up 13.4% year-on-year, and operating profits increased 37.1% to 24 billion won, meeting market expectations. He expected to achieve an excellent operating margin following the third quarter by expanding exports of profitable toxins.

Researcher Na said, “The effect of reflective profits related to competitors will continue and will offset the effect of 2.5 steps of social distancing.” It is estimated that exports will also grow, reflecting Chinese volume.

Reporter Minsoo Han [email protected]

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution