The choice for the rich with more than 1 billion won in financial assets was stocks rather than real estate. This is the result of analysis by Hana Bank Hana Financial Management Research Center through an online survey. Based on the results of the survey in December last year, the institute published the ‘2021 Korea Wealth Report’ on the 8th. More than 700’rich people’ with financial assets of 1 billion won or more and 1400’popular wealthy people’ with financial assets of 100 million to 1 billion won participated in this survey.

Investigation of 2,100 people with financial assets of 100 million or more

More than half of last year’s stocks increased

“I will keep my current asset composition” 51%

“There is no real estate tax response plan” 38%

According to the report, about half of the respondents (53% of the rich and 48% of the wealthy in the public) increased their share of stocks after the outbreak of the new coronavirus infection (Corona 19). Last year, 23% of the wealthy made more than 10% of their financial assets. They cited direct stock investment (49%) and equity-type funds (13%) as the cause of high returns. Responses to invest directly in stocks increased from 12% last year to 36% this year. The preference for equity funds jumped from 14% to 21% over the same period. The rich answered that they plan to cover 39% of their living expenses (8,400,000 won per month) after retirement with pensions.

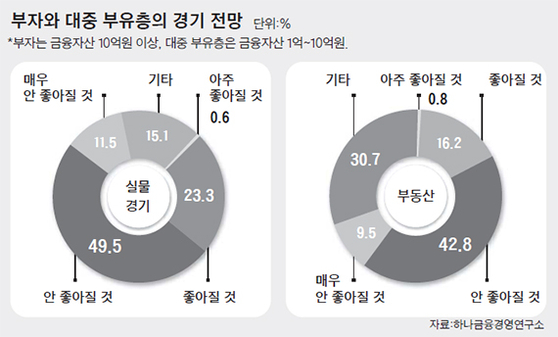

Economic outlook for the rich and the masses

The negative outlook for this year’s real estate market was dominant. More than half (52.3%) of the rich and the masses said that the real estate economy will not improve this year. Only 17% of respondents said that the real estate economy will improve. Regarding the real game, 61% of the respondents said’it will not improve’. On the other hand, 23.9% predicted that the real economy will improve.

More than half (51%) of the rich said they would keep their current asset composition. It can be interpreted to mean that instead of rushing to increase or decrease the proportion of investment in stocks or real estate, we will take a careful approach while looking at the market conditions. 23% of respondents said,’We will keep the large composition of the portfolio (distribution of investment assets), but change the details.’

18% of respondents said they would reduce the proportion of real estate and increase financial assets. On the other hand, only 8% of respondents said they would reduce financial assets and increase the proportion of real estate. This figure was the lowest in the survey in the last five years, the institute explained. In particular, 29% of high-value asset prices with more than 5 billion won in real estate assets responded that they would’reduce the proportion of real estate’ because of the tax burden.

In response to the growing real estate tax burden, 31% of the rich and the public were considering giving. The percentage considering the sale was 26%. The higher the price of real estate owned, the more preferred a gift than a sale. 38% of respondents said that there is no clear countermeasure to the tax burden.

Lee Soo-young, a research fellow at the Hana Financial Management Research Institute, said, “The interest of the rich and the public tends to shift to financial assets rather than real estate.” Regarding the method of investing in financial assets, he added, “It is expected that we will actively pursue profits through domestic and foreign stocks, stock index-linked products, and equity-type funds while maintaining a certain proportion of short-term financial products and deposits.”

The richest people’s annual income was more than 200 million won (46%). By income category, business income (34%) and earned income (33%) accounted for a similar proportion. 29% of the rich who responded to the survey had assets of 5 to 10 billion won. Asset holdings of 3 billion to 5 billion won were 31%. In the income of the wealthy in the masses, earned income accounted for the largest share. One in three (33%) of the wealthy in the masses had a gross household income of 100 million to 200 million won per year.

Reporter Jiyu Hong [email protected]

![]()