Image enlarged view

[한국금융신문 한아란 기자] Beginning on the 28th, small business owners who have not yet received support funds will be able to apply for a special loan.

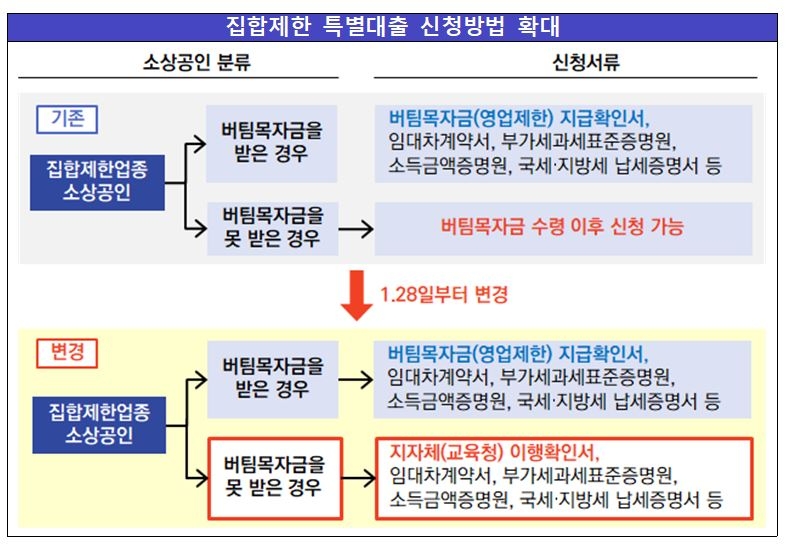

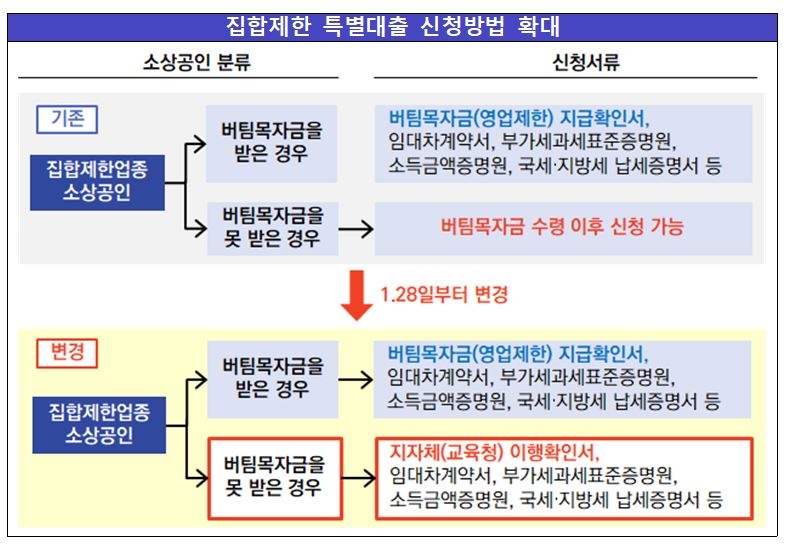

The Financial Services Commission announced on the 27th that it has improved so that small business owners in the collective restricted business can apply for special loans once they receive a confirmation of the implementation of the administrative order to prevent social distancing from local governments.

Currently, in order to apply for a limited group loan, there must be a confirmation of the payment of the supporting fund (operation limitation), but when a small business owner who has not yet received the supporting fee had difficulty applying for a special loan, the application method was decided to be supplemented.

Group limited special loan support targets are private businesses that have been subject to group restrictions (restriction of business) since November 24 last year and are currently signing a paid lease contract for their operating business.

Small business owners who have received the support fund can apply for a special loan by receiving a confirmation of the support fund payment as before.

Small business owners who have not yet received support funds can also apply for a confirmation of implementation issued by the local government.

However, the bank additionally checks and supports the sales basis. Average sales in 2019 or 2020 should be 1 billion to 12 billion won or less (1 billion won for food and accommodation, 5 billion won for wholesale and retail, 12 billion won for manufacturing).

The limit of support for group limited special loans is up to 10 million won. During the 5-year loan period (2 years deferred, 3-year installment repayment), the guarantee fee for the first year is exempted, and 0.6%, down 0.3% points, is applied in the second to fifth years. Interest rates are in the 2% range for six major banks, and 2-3% for other banks.

Group-restricted industries include 5 types of social distancing, including restaurants and cafes, indoor sports facilities, singing practice centers, direct sales promotion halls, and standing performance halls. There are 11 types of arcades, multi-rooms, study cafes, movie theaters, amusement parks, large supermarkets, department stores, and accommodation.

To apply for a loan, bring a business registration certificate, VAT standard certificate, national and local tax tax payment certificate, lease contract, and income amount certificate along with a confirmation of payment of supporting funds or a confirmation of implementation of local government (Education Office) at the bank office counter. .

Currently, applications can be made at 6121 branches of 12 banks nationwide, including Kookmin, Shinhan, Hana, Woori, Nonghyup, Gyeongnam, Gwangju, Daegu, Busan, Jeonbuk, Jeju, and IBK, which are currently handling the secondary support program for small businesses. Of these, five banks, including Corporate, Shinhan, Woori, Kookmin, and Daegu Bank, allow non-face-to-face reception and loans.

Confirmation of implementation of local governments can be applied to departments in charge of regional and basic local governments nationwide, and detailed reception areas can be found on the website of the Support Fund, the call center, and the website of the Small Business Corporation. In the case of academies, teaching schools, and reading rooms, a confirmation of implementation is issued by the Office of Education or Education Support, not the local government.

A total of 2648 cases (206.3 billion won) have been received until the 25th since the group-limited special loans took effect on the 18th. Of these, loans worth 72.7 billion won were executed.

Reporter Han Aran [email protected]