cacao(544,000 +8.37%)Hit an all-time high. Various favourites interlocked. Big tech companies such as Alphabet and Facebook, which are Google parent companies, recorded the highest price side by side on the 5th (local time). Two trees, owned by Kakao, are promoting listing on the NASDAQ market, which is a material for revaluation. It was also good news that the Japanese webtoon and web novel platform’Piccoma’, operated by Kakao Japan, was selected as the world’s fastest growing content app. Kakao has been evaluated for showing weakness in the global market compared to its rival, Naver, but the expectation that it will overcome this by investing in Piccoma has been reflected.

Bitcoin beneficiary

Kakao closed the deal at 544,000 won, an increase of 8.37% on the 6th. It’s the best price ever. On this day, foreigners net bought Kakao shares worth 330 billion won, leading the stock price to rise. The previous day in the New York Stock Exchange, American big tech companies such as Alphabet, Facebook, and Microsoft (MS) recorded record highs side by side.

It is also expected to benefit from the bitcoin craze. Mirae Asset Securities predicted that Kakao will be the biggest beneficiary of the bitcoin craze in Korea. This is because Dunamu, which operates the cryptocurrency exchange Upbit, is promoting listing on the NASDAQ. Upbit is the number one company that accounts for more than 70% of the domestic cryptocurrency transaction value.

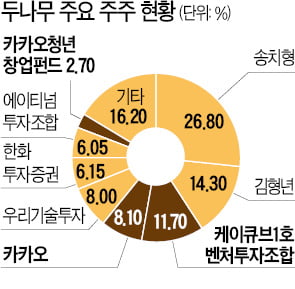

Kakao directly or indirectly owns about 23% of Dounamu. Kakao owns 8.10%, Kakao Ventures’ K Cube 1 venture investor 11.70%, and Kakao Youth Startup Fund 2.70%.

The rumor of Dunamu’s listing on the NASDAQ has been steadily raised since last month. As the US’s largest cryptocurrency exchange, Coinbase’s direct listing on Nasdaq, has been decided, there is an analysis that interest in the listing of Doona has grown. Coinbase will be listed on the NASDAQ on the 14th. It is the first listed company among cryptocurrency exchanges. The Wall Street Journal (WSJ) predicted that “Coinbase (as a direct listing) will get about $1 billion in cash.”

Included in expected 1Q earnings

Mirae Asset Securities analyzed that it expects a double-footed earnings surprise for Kakao’s earnings this year. Kim Chang-kwon, a researcher at Mirae Asset, said, “If the virtual currency craze is maintained at the current level, it is expected to contribute more than 100 billion won in equity method gains this year.”

According to F&Guide, Kakao’s 1Q sales and operating profit are estimated to have increased by 42% and 77% YoY, respectively. Research Fellow Kim said, “The performance of Kakao Pay, Kakao Bank, and Piccoma in the first quarter is remarkably increasing.” As the proportion of the company increases gradually, the performance will improve significantly.”

IP business overseas expansion

The content business is also paying off in overseas markets. According to App Any, a global app research company, Piccoma, a Japanese webtoon and web novel platform operated by Kakao Japan, was ranked as the third-largest app in the first quarter of this year compared to the previous quarter. By excluding game apps, it surpassed global content apps such as Disney Plus (4th) and HBO Max (5th).

It is also active in the expansion of intellectual property (IP) business territories. Kakao is promoting the acquisition of Radish, a global web novel platform. It is a paving stone to secure story contents to be used in movie, drama, webtoon, etc. Some analysts say that Naver’s acquisition of the world’s No. 1 web novel platform, Whatpad, is a matchmaker.

At this point, the good news of par value division overlapped. Kakao decided to divide the face value of 5 to 1 at the regular shareholders’ meeting on the 29th of last month. The transaction will be suspended for 3 days from the 12th, and will be listed in installments on the 15th. Although the par value split does not directly lead to the stimulus of the share price, it can have a positive effect on the share price as it increases the accessibility of individual investors. Kakao’s share price rose 11.59% in six trading days on expectations of a par value split.

Reporter Jae-yeon Ko [email protected]