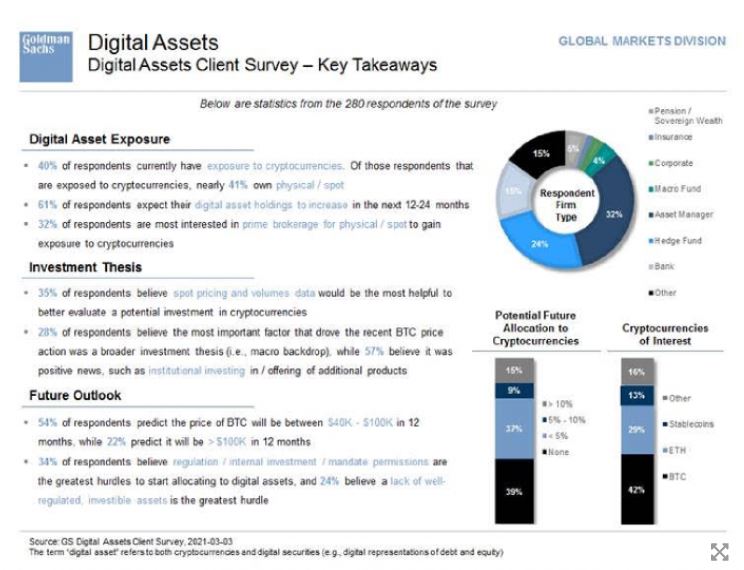

The Goldman Sachs Digital Asset Division conducted a survey of 280 customers. 40% of respondents were investing in cryptocurrency. 54% of respondents forecast that the price of Bitcoin will be between $40,000 and $100,000 in the next year.

One-third of them took regulations and permits as their biggest obstacle to investment. 57% said they are paying attention to the inflow of institutional investors such as Tesla and MicroStrategy.

Beincrypto said, “Goldman Sachs tells customers that cryptocurrency is not an asset. It hasn’t been a year since I said, “It’s not a suitable investment,” he said.

Goldman Sachs revived the Bitcoin trading desk. In 2018, when Bitcoin fell from $20,000, it withdrew the related department. According to The Block, Goldman Sachs has resumed its bitcoin trading desk in the middle of this month. We plan to start trading derivatives first rather than Bitcoin. Goldman Sachs is also exploring ways to provide bitcoin consignment products with third-party consignees.

Meanwhile, Bloomberg News reported that “Bitcoin will reach $100,000 by the end of the year,” citing Galaxy Digital founder Mike Novogratz.

Bloomberg information strategist Mike McGlon said in a report on the 2nd, “The grayscale reverse premium is a sign that Bitcoin is preparing for another rally. The decline in the grayscale premium means that the bitcoin correction is over.” Bitcoin will move forward with a goal of $100,000.”