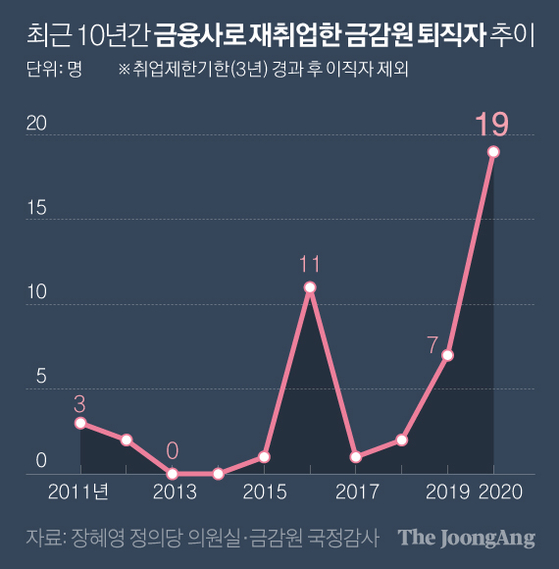

It was found that 19 retirees from the Financial Supervisory Service last year re-employed at a financial company that was under supervision. On an annual basis, it was the highest in the last 10 years. If you include retirees who went to large law firms, there are 35.

Financial Supervisory Service retirees’ turnover surged last year

19 banks and securities banks, the largest in 10 years

Large law firms also compete for recruitment of practitioners

Concerned about the impact on the inspection and supervision of financial authorities

According to the data submitted by the Justice Party lawmaker Jang Hye-young on the 8th from the Financial Supervisory Service, 28 employees of the Financial Supervisory Service have been employed by the Public Service Ethics Committee for three years since 2018, when FSC Chief Yoon Seok-heon took office, and then transferred to financial companies. Of these, 19 (68%) relocated last year when the private equity crisis such as Lime and Optimus broke out. It is the largest since 2011. According to the annual average (2.8 people) for the last 10 years, it is more than 6 times as many. Seven out of 19 moved to savings banks. Five of the securities firms that were subject to sanctions by the Financial Supervisory Service were re-employed last year. KB Securities, who suffered as a lime fund seller, plans to appoint Min Byeong-hyun, former vice president of the Financial Supervisory Service, as a new audit committee member at the shareholders’ meeting this month.

Financial Supervisory Service retirees who re-employed as a financial company in the last 10 years. Graphic = Reporter Park Kyung-min [email protected]

Most of the standing auditors of commercial banks were dominated by FSS. Hana Bank appointed former FSS General Bank Inspection Bureau Cho Sung-yeol as a standing audit committee member at a general shareholders’ meeting in March last year. Last year, Woori Bank selected Jang Byung-yong, former FSS savings bank supervisor, for a standing auditor held by a private person (former KB Capital CEO Oh Jeong-sik). KB Kookmin Bank (Executive Auditor Jae-Sung Joo) and Shinhan Bank (Executive Auditor Huh Chang-Eon) also extended their term of office as a standing auditor, former FSS executive, by one year at the end of last year. A senior financial industry official said, “After the private equity crisis, the number of senior FSS executives has been remarkably increasing.” “It is because of the expectation that these will serve as a communication channel or a windshield between financial companies and authorities.”

It is not just financial companies that have entered the battle for the FSS manpower. As disputes and lawsuits intensify due to the post-storm of private equity funds, large law firms are also active in hiring FSS personnel. As a result of the JoongAng Ilbo confirmation, 16 FSS retirees have moved to the five largest law firms (Kim & Jang, Gwangjang, Yulchon, Pacific Ocean, and Hwawoo) from last year to the present. It is more than 10 people who were recruited by the top five law firms in the two years from 2017 to 18. In particular, 11 of the 16 people who went to the top five law firms last year were lawyers. An industry official said, “Unlike the practice of hiring executive-level personnel (of the Financial Supervisory Service) as advisors, these days, we are working hard on scouting practitioners (lawyers).”

FSS retiree headed to a large law firm. Graphic = Reporter Park Kyung-min [email protected]

As the number of FSS retirees who choose to act as financial firms and large law firms increases, concerns are growing that it may negatively affect the inspection and supervision functions of the financial authorities. The more shields there are, the more dull the’sword (sanction)’ can be. An accountant from the Financial Supervisory Service who wanted to remain anonymous said, “If there is an executive from the Financial Supervisory Service in a financial company that went through field inspections in the past, it will be a burden.”

It is also revealed in numbers. According to the report’Economic effect of re-employment of financial companies by financial authorities for personnel from financial authorities’ published in 2019 by a research fellow at the Korea Development Institute (KDI) Lee Ki-young, “The soundness is not improved by re-employment of a financial company from the Financial Supervisory Service. The likelihood of receiving it is reduced by about 16.4%.” An official in the financial consulting industry pointed out, “The greater the sanctions pressure from the financial authorities, the better the overall treatment, resulting in a contradiction that facilitates re-employment at financial companies.” Rep. Jang Hye-young said, “Reemployment at an audited organization after a supervisory authority employee retires is a factor that limits supervisory work beyond the issue of public office ethics,” he said. “A thorough re-employment review is necessary even to enhance the effectiveness and reliability of financial supervision.” Insisted.

Reporter Yeom Ji-hyun [email protected]

![]()