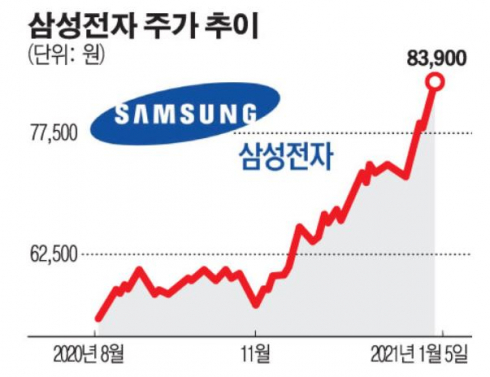

▲ Samsung Electronics closing price trend.

Samsung Electronics began the era of 500 trillion won in market cap on the 5th. The share price is on an upward rally as expectations for special dividends add to the memory semiconductor boom.

According to the Korea Exchange on the 5th, Samsung Electronics ended the market at 83,900 won, up 1.08% (900 won) compared to the previous trading day. It is the highest price ever based on the closing price. The previous day’s stock price soared to 84,400 won during the intraday, changing the 52-week reported price.

The market cap also exceeded 500 trillion won. As of the close of the market, the market capitalization of Samsung Electronics is estimated at KRW 50,864.8 billion. The share of the total market cap is 23.62%. If Samsung Electronics Woo is included, the total market capitalization of Samsung Electronics’ stock exceeds 560 trillion won.

Stock prices are raising their expectations by raising their target price one after another. This is because the prospects for improvement in the semiconductor industry and expectations for dividend expansion remain valid. There were also places looking into the era of ‘100,000 electrons’.

On this day, Hana Financial Investment raised the target price of Samsung Electronics from 86,000 won to 111,000 won. This is the highest level among target stock prices suggested by stock prices. On the 4th, Kiwoom Securities also raised it to 100,000 won to reflect the improvement in the DRAM industry.

Kim Kyung-min, a researcher at Hana Financial Investment, said, “The target price of 111,000 won means the target market capitalization of 660 trillion won.”

In addition, we judged the dividend outlook positive. He explained, “The amount of annual dividends for the past three years is 9.6 trillion won, and it is highly likely that the annual dividend of 20 trillion won will be maintained for several years.” .