|

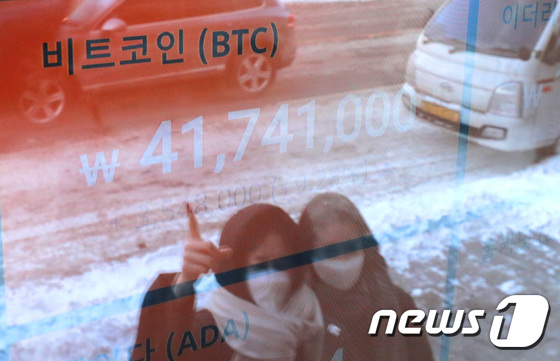

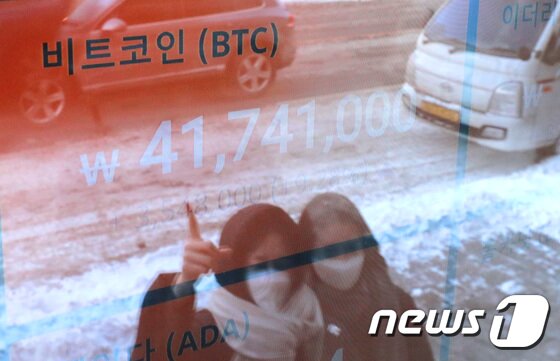

| On the 7th, when bitcoin surpassed 40 million won, the bitcoin market price is appearing on a market display installed in front of Bithumb, a domestic cryptocurrency exchange in Gangnam-gu, Seoul. 2021.1.7/News1 © News1 Reporter Seongcheol Lee |

# “Do I need a public certificate for bitcoin trading like internet banking or stocks? I created a K-Bank (Upbit real-name account issuing bank) account. What should I do now?” (Stock Investment Community)

# “Fortress bitcoin double-digit rise is a daily routine. I thought I would go up to 40 million won, but I don’t know. Is it better to invest in bitcoin instead of gold? I ask for the opinions of investment experts.” (Real Estate Investment Community)

Bitcoin surpassed 40 million won on the previous day, and then rose 4 million won in one day, recording a reported price of 44.8 million won as of 6:30 am on the 8th.

Accordingly, inquiries about how to buy and sell cryptocurrency are inundated by the domestic investment community. The online cryptocurrency community is overflowing with posts hoping to continue the bull market, such as’the origin of rice cake (a sharp rise in numbers)’ and’gazua’ (an exclamation point expressing positive expectations from investment).

◇”How do I buy and sell cryptocurrency?”… Interest in the investment community ↑

On the 8th, in the cryptocurrency community as well as the investment community such as real estate and stocks, you can easily find posts asking how to buy cryptocurrency and how to sign up for a trading site. Prospective investors are expressing their willingness to buy by leaving inquiries such as’how to remit KRW to the trading site’ or’recommend a stock with high investment value’.

The cryptocurrency community, which was on a downtrend along with the cryptocurrency industry stagnation, has also revived. 153 posts appeared on the cryptocurrency community’s’Cobak’ sleep answer board as of 4 pm. All of these posts were posted this day.

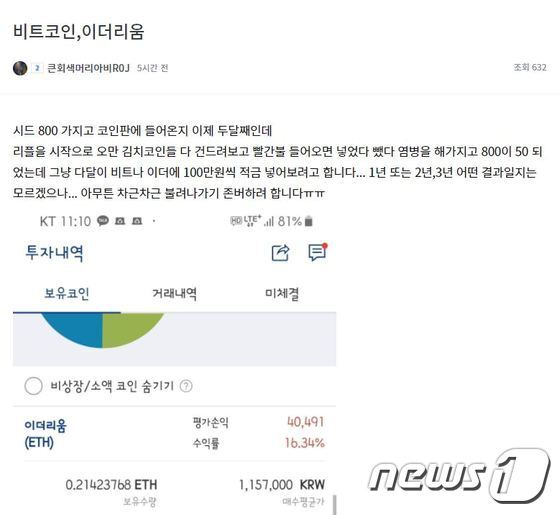

Investors who have invested in bitcoin for a long time are expressing their joy in realizing profits, saying,’Zonber (the slang term to keep without selling) wins’. Posts verifying profits are also found.

As Bitcoin exceeds 40 million won, investors who have left the market after disposing of their cryptocurrency will return. One user who left a post on the coin board said, “I stopped investing in cryptocurrency two years ago after seeing a large profit, but I came back after hearing that bitcoin has exceeded 30 million won through a recent real-time search query.” I’m going to start” he said.

|

| Bitcoin and Ethereum investment posting on the 7th cryptocurrency community’Cobak’ © News1 |

As investors’ buying trend is growing, the market cap of the domestic cryptocurrency trading industry is also increasing. According to Upbit, the current cryptocurrency market cap has increased more than five times compared to October 2017. Looking at the global market as a whole, the market cap of Bitcoin alone is 6936.1334 million dollars (about 754 trillion won), a figure that closely follows the Tesla market cap (about 779 trillion won).

In this way, the domestic blockchain industry, which has hampered development along with the rapid rise in cryptocurrency, is also regaining business vitality. An official from a domestic blockchain developer said, “As the market price of Ethereum rises along with Bitcoin, we are able to focus on project development again.” “As experts are expecting to rise to the right for the time being, the industry’s expectations are high.”

◇”Bitcoin goes 100 million won” vs”If you’re fooled again, you’re a fool”… The best price outlook

As the bitcoin price is soaring, the perspective on the future market is also sharply divided. It is expected that bitcoin will grow explosively this year, and that the cryptocurrency industry is a “league of their own” and there is a high possibility of a crash tomorrow.

Seo-joon Kim, CEO of domestic venture capital (VC) Hashed, also predicted that Bitcoin will grow significantly this year. He predicted, through his social media (Medium), that “(Bitcoin) will become a bigger trend as a hedging of quantitative easing by central banks.” He said, “I expect a steady and solid bull market this year,” he said. “Bitcoin’s price will challenge $100,000 (about KRW 18.8 million).”

On the other hand, there are many voices concerned about the signs of overheating in cryptocurrency investment, saying, “If you are fooled once, you make a mistake, but if you are fooled twice, you are stupid. In particular, the US Securities and Exchange Commission (SEC) filed a lawsuit against the third largest cryptocurrency Ripple co-founder on the 22nd of last month, and some point out that “there is still risk in cryptocurrency investment.”

On the 21st of last month, the US SEC sued two Ripple co-founders for selling undocumented securities. The SEC evaluated that “Ripple is not a currency, but a stock-like security.” The co-founders are protesting that the SEC’s complaint was fundamentally wrong, but the SEC is said to be collecting the data necessary for the Ripple complaint from Wall Street.

An official in the domestic investment industry said, “Bitcoin market prices are rising due to several good news that started in the United States, but if you look at it, the US cryptocurrency market is darker than ever,” he said. “You need to know how to differentiate between currency and cryptocurrency as a financial infrastructure solution.”

Another official in the financial investment industry analyzed, “Because the price of bitcoin is not as grounded as stocks, but purely according to the movement of the operational forces, this craze is expected to subside quickly.”

|

| © News1 DB |

◇Bitcoin 40 million won era opened

On the 27th of last month, Bitcoin has surpassed 30 million won for the first time in the history of trading, and is continuing a new record by breaking the 40 million won mark. Altcoins (cryptocurrencies excluding Bitcoin) such as Ethereum are also on the rise along with the general cryptocurrency Bitcoin.

According to the cryptocurrency trading site Upbit, as of 7:30 am on the day, bitcoin is trading at 44.6 million won, up 9.5% from the previous day. Bitcoin, which was traded at Upbit on January 1 of last year for 8.3 million won (closed price), has risen more than five times in the new value for just one year.

Cryptocurrency is increasing in demand as Bitcoin emerges as one of the’safe assets’ in the aftermath of a novel coronavirus infection (Corona 19). In addition, as individual investors as well as institutional investors enter the cryptocurrency market, the rise is steep.

Furthermore, in October last year, a global payment and remittance company, PayPal, started payment, transaction and storage services using major cryptocurrencies such as bitcoin, and central banks of various countries accelerated research on digital currency. The expectation is growing.

The recent submission of a legal interpretation opinion to the use of stablecoins in the commercial bank settlement system by the Currency Supervisory Service (OCC) under the US Treasury Department is fueling investors’ buying tax.

SK Securities researcher Han Dae-hoon said, “Fidelity and JP Morgan have successively launched cryptocurrency services, which has accelerated the pace of global financial companies.” It looks quite different from the department.”