|

The stock price of GameStop, a game machine retailer in the US stock market, plunged from $300 to $90 per share for two days in a row, and the so-called’Seohak Ant’ paid over 1.4 trillion won for the two trading days of this month. Appeared. It means that it sold about 33.8 billion won worth of net sales, but investors who bought 700 billion won are concerned about the loss.

Seohak ant paid more than $225.8 billion for AMC Entertainment, which was regarded as a purchase campaign by US individual investors along with Gamestop, but the stock also plunged by more than 40%.

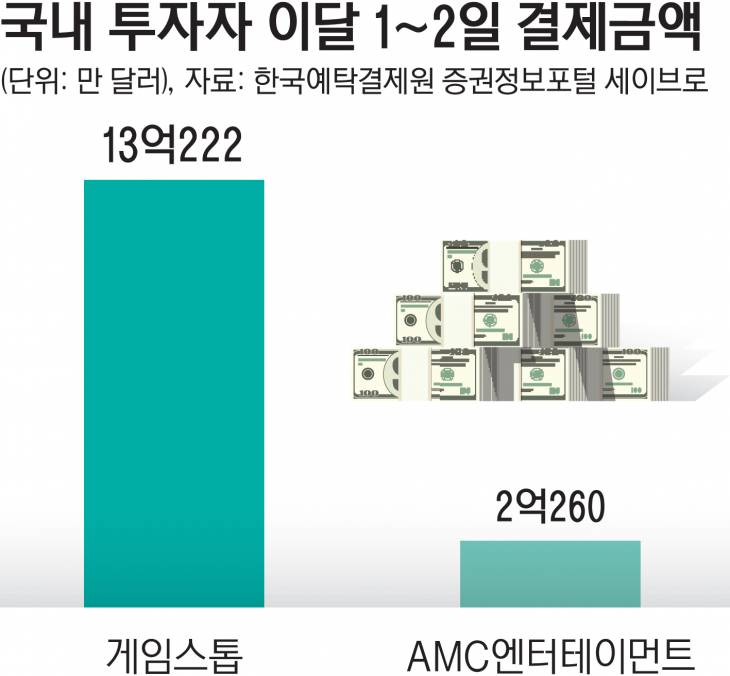

According to Savero, the Securities Information Portal of the Korea Securities Depository on the 3rd, this month (1st to 2nd), domestic investors net bought GameStop worth $1.32.2 million in the New York Stock Exchange. Converting this into Korean won is KRW 1.451.3 trillion. Among them, the purchase settlement amounted to $635.95 million (KRW 7087 billion7082 million), and the selling settlement amounted to $66.67 million (KRW 7425.63 billion), which is a net sale worth about 33.7 billion won.

During the same period, investors settled AMC Entertainment Holdings Class A of $22.6 million (approximately KRW 22.58 billion). Buy and settlement is $133,408 million (KRW 1495,3942 million), and Selling is $69.52 million (76.420 billion won), and the net purchase amount ($65.55 million, KRW 73.1 billion KRW) is more than Gamestop. AMC Entertainment is regarded as a stock in which US individual investors engaged in a buying campaign with GameStop to counteract the short selling forces.

Investors paid for Tesla ($534.6 million), Apple ($196.17 million), and Blackberry ($127.72 million), except for GameStop and AMC Entertainment Holdings Class A.

GameStop has increased more than 1000% compared to the beginning of the year and has been increasing its decline for two consecutive days. On the 2nd (US time), GameStop closed the deal at $90 per share on the New York Stock Exchange, a drop of $135 (-60%) compared to the previous trading day. AMC Entertainment Holdings’ Class A plunged $5.48 (-41.20%). Gamestop plunged 30.77% on the 1st, the day before. Gamestop’s share price rally is interpreted to have peaked as hedge funds surrendered and Robin Hood, a stock trading application, restricts GameStop trading.

The stock market is raising concerns about the game stop regardless of the East and West. BTIG’s Julian Emmanuel stock and derivatives strategist appeared on CNBC broadcast on the 1st (US time) and said, “If the option price of an asset rises excessively, it will peak and be slackened or sold out.” If you move the assets to, they will eventually sell you.”

Researcher Lee Jae-yoon of SK Securities emphasized, “It is very difficult to predict how far the stock price of the same stock will rise and when it will collapse. It is necessary to invest carefully considering fundamentals rather than just looking at forecasts of supply and demand or momentum.”

Reporter Eunhye Lee [email protected]

View other reporters’ articles>