Input 2021.01.14 09:11 | Revision 2021.01.14 09:46

I would like to increase the proportion of Samsung Electronics now, but that is also not easy. In general, public offering funds managed by fund managers have a fixed weight that can contain a single stock. Even if Samsung Electronics’ stock price soars due to the’restriction on the incorporation of publicly-funded funds’, fund managers are forced to look at Samsung Electronics far and wide. One fund manager complained, “It is difficult to buy more Samsung Electronics because the stock price is so high.”

For active public offering funds, according to the Capital Markets Act (Capital Markets and Financial Investment Business Act), the proportion of certain items in the fund must not exceed 10% of the total assets under management. As an exception, stocks that exceed 10% of the market capitalization of the stock market may be invested in the proportion of the market capitalization. Accordingly, Samsung Electronics can cover the share of Samsung Electronics’ market cap in the KOSPI index.

These restrictions on the incorporation of publicly funded funds became an’operational shackle’ for fund managers who manage active funds. The reason why Samsung Electronics is unable to include more Samsung Electronics even though Samsung Electronics’ stock price is high is because of the rule.

According to the Financial Investment Association, the share of the market capitalization of Samsung Electronics in the securities market at the end of December last year was 23.16% of common stocks and 2.96% of preferred stocks, a total of 26.12%. With Samsung Electronics Samsung Electronics Woo (005935)This means that the proportion in the fund should not exceed 26.12%.

One fund manager complained, “We need to pursue excess performance compared to the market benchmark (BM), but as Samsung Electronics’ stock price rises, it is in a situation where the yield is lower than that of so-called’all-in’ investors.”

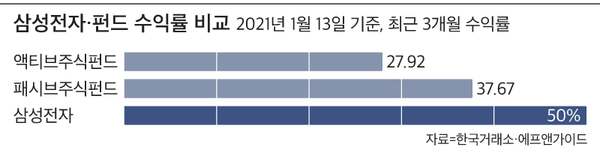

According to F&Guide, a financial information provider, as of the 13th, the total active equity fund of all domestic equity funds in the last three months was 27.92%. During the same period, Samsung Electronics’ yield was about 50%, and the total passive equity fund was about 37.67%.

In the KOSPI 200, Samsung Electronics has a larger share of the market capitalization, so Samsung Electronics will have a larger share than active funds. As a result, in the recent large-cap rally centered on Samsung Electronics, the passive fund yield that follows the KOSPI 200 is inevitably better.

Fund repurchases, which have been in line recently, are also a headache for managers. As the bull market continued, more and more investors repurchase funds for direct investment. According to F&Guide, a financial information provider, as of the 12th, the set amount of total 562 domestic active stock funds has lost 9261 billion won in the last month. In the last day alone, it was reduced by 10 billion won.

An asset management industry official said, “If the number of investors repurchasing funds increases, fund managers must sell the stocks contained in the fund at a certain rate to prepare for redemption.” There is no choice but to make more profits,” he said.

Another fund manager said, “Even if it is a fund that can contain more Samsung Electronics within its weight limit, there is also a valuation problem whether it is right to buy stocks at a high price at this time when Samsung Electronics recorded the highest price.”