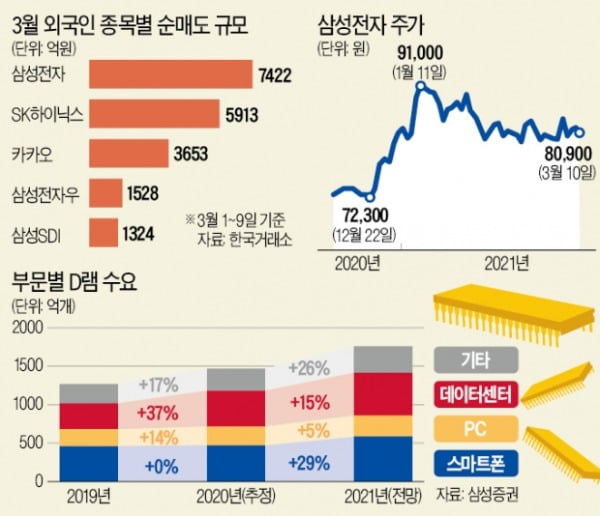

In March, foreign investors are selling Korean semiconductor stocks. It started right after the dollar index jumped at the end of last month (the strong dollar). Foreign investors will be sent to Samsung Electronics by the 9th of this month.(80,900 -0.61%) 74.2 billion won, SK hynix(133,000 -2.56%) It sold net sales worth 5913 billion won. In the market, the selling of foreign investors is not a judgment on the semiconductor industry, but rather as a’haircut’ of stocks that have risen a lot in the face of the strong dollar. Jeong Myung-ji, head of the investment information team at Samsung Securities, said, “It is a natural phenomenon that foreign investment funds that have entered emerging countries at the time of the weak dollar will pass through the strong dollar period and take profits. It was evaluated as having started some’haircuts’ for the second place.”

○ Concerns about set production disruption due to shortage

Samsung Electronics closed the transaction at 8,900 won, down 0.61% on the 10th. SK Hynix also fell 2.56% to 133,000 won. They fell 11% and 10% respectively from the year-round highs. When US technology stocks fell, they fell together, but when technology stocks rebounded, they did not rebound. The US Philadelphia Semiconductor Index surged 6.13% on the 9th (local time).

Some point out that foreign investors are expressing concerns about the semiconductor industry itself. First of all, there is a concern that smartphone production will be disrupted due to the shutdown of the Austin plant in the US and the non-memory’Shortage’ (short supply). However, in the market, even if the disruption in smartphone production becomes a reality, semiconductor prices will rise as customers try to secure inventory. Doh Hyun-woo, a researcher at NH Investment & Securities, said, “In the past experience, the positive impact of the price hike was greater than the loss caused by the decrease in shipments in this case.” “Recently, due to the shortage of supply, the foundry production cost has exceeded 15%, and the power semiconductor (PMIC) unit cost 20 It has risen by more than a percent,” he explained.

Next, there are concerns that semiconductor production will increase as manufacturers increase investments to cope with rising prices. Regarding this, Kim Sun-woo, a researcher at Meritz Securities, said, “Samsung Electronics is expected to invest in the mid-10 trillion won in DRAM this year, and the production growth rate is expected to be in the mid-10%.” Considering that, the increase in demand is still greater.”

○Announcement of increase in fixed transaction prices in the second quarter

The spot price of semiconductors has been steadily rising, and investors are also wondering that the fixed price of PC DRAM in February announced at the end of February remained flat. Park Yoo-ak, a researcher at Kiwoom Securities, said, “This is because the memory semiconductor contract was carried out on a’quarterly basis’ at the end of last year.” If semiconductor fixed transaction prices rebound in 2Q, earnings improvement is expected to be more dramatic, reflecting the’base effect’ in 1Q.

The last concern is how much demand for △smartphones △data centers △PCs, which are major demand sources for memory semiconductors, will increase this year. First, it is whether the demand for PCs, which has rapidly increased as it became a non-face-to-face society due to Corona 19 last year, will be maintained. Hwang Min-seong, a researcher at Samsung Securities, explained, “Many people considered the demand for PCs last year as temporary, but the demand continues this year.” This is not a temporary growth, but a structural growth.

Server companies’ investment, which had contracted in the second half of last year, is also reviving, although not as much as during the 2017-2018 Supercycle. Researcher Doh Hyun-woo said, “From the second quarter, server investment by North American companies will increase in earnest. Google plans to build a new cloud center in Madrid, Qatar this year.”

Researcher Hwang Min-seong said, “When the 2Q results are announced, there will be expectations for a decrease in cell phone sales due to supply shortages and an improvement in data center demand. Even if non-memory is sold less and more expensive, and memory semiconductors are sold more and a little cheaper, this year The semiconductor industry is positive.”

○“Time to promote hardware tech companies”

Market experts predicted that semiconductor fundamentals will receive attention once the adjustment is completed as expectations for the semiconductor industry have not declined. This is because foreign investors have been driven out by an external variable called the strong dollar, but the analysis is that the strong dollar will be a temporary phenomenon. Expectations for economic recovery are now concentrated in the US due to large-scale stimulus measures and increased vaccinations, but it is expected that Gyeonggi Province such as Europe will gradually recover.

Some analysts say that hardware companies will do well among tech companies during the economic recovery period. Myung-ji Jeong, team leader, predicted that, “If software companies that are less affected by the economy outperformed among tech companies last year, the share price of hardware tech companies will be remarkable as demand for IT devices and automobiles increase this year in the face of the economic recovery period.” Researcher Sunwoo Kim also evaluated that “the semiconductor upcycle has just begun, and it is not the time to discuss the end of the upcycle.”

Reporter Jae-yeon Ko [email protected]