Foreigners are buying domestic bonds. The spot market has entered a clear buying trend, centering on long-term stocks, and the futures market is in an atmosphere of gradually decreasing the size of selling. The market for interest rate volatility, which has raised the financial market uncertainty, is also expected to ease.

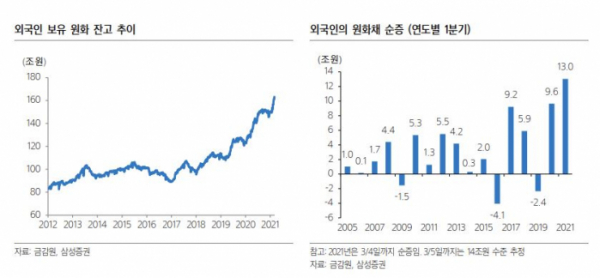

According to Samsung Securities on the 8th, Korean bonds currently held by foreigners are 164 trillion won. Compared to 150 trillion won at the end of last year, it increased by about 9.3% in two months.

Looking at the monthly scale, the net purchase scale was raised to 3.800 trillion won in January and 11.2 trillion won in February. In March, it bought 5.4 trillion won worth of bonds in 4 trading days. The average daily net purchase has increased significantly from 300 billion won to 1 trillion won.

Kim Man-man, a researcher at Samsung Securities, explained, “If you look at the bonds that foreigners are buying, it has expanded to the long-term period compared to January or February, including 10 and 20 years of KTBs in March.”

The amount of net selling in the futures market is shrinking. This year, foreigners have recorded net sales of about 95,000 contracts for 3-year government bond futures, and about 40,000 contracts for 10-year government bond futures.

In particular, in the last week of February, when the 10-year US Treasury bond yield exceeded 1.5% for the first time this year, foreigners net sold 28,000 3-year Treasury bond futures and 13,000 10-year Treasury futures.

However, since last week, foreigners have only sold 6724 contracts for 3-year government bond futures and 54 contracts for 10-year government bond futures. The scale of net selling has significantly decreased. This is why there are expectations that government bond yield volatility will ease.

Researcher Kim said, “In the KRW bond market, foreigners show a tendency to invest in the mid- to long-term.” “If the foreign selling tax in the futures market can be seen as the cause of the recent rapid rate fluctuations, the market with high volatility will close to some extent along with the appreciation of the foreigners’ selling of futures Situation”.