Issues such as uncertainty of profit calculation and equity of foreign companies

“As the uncertainty in the business environment grows, careful review is required”

The National Federation of Entrepreneurs (Chairman Huh Chang-soo, hereinafter the FKI) has recently raised voices about the introduction of the’profit sharing system’ according to Corona 19, especially in the political world, and stated that a careful review is necessary as the uncertainty in the corporate environment increases.

According to the FKI on the 17th, the currently emerging profit-sharing system is a method in which companies that have benefited from Corona 19 contribute part of their profits to society to help the victims.

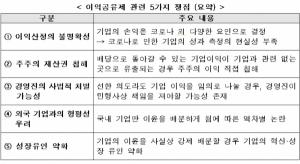

With the introduction of the benefit-sharing system, the FKI has pointed out five major issues such as △ uncertainty in profit calculation △ infringement of shareholders’ property rights △ judicial punishment by management △ concerns about equity with foreign companies △ weakening incentives for growth. to be.

First of all, the premise of the benefit-sharing system according to Corona 19 should start with a clear assumption that it has benefited from Corona 19, but the FKI argues that it is close to impossible to clearly distinguish the relevance of companies.

In addition to Corona 19, a company’s profit or loss is determined by various factors such as global economy, product competitiveness, marketing capabilities, market trend changes, and exchange rates. In other words, it is difficult to clearly determine whether corporate profits are due to COVID-19 or other factors.

Currently, platform and non-face-to-face companies such as semiconductor and home appliance conglomerates, Kakao, and the People of Delivery are being discussed as targets for the introduction of the profit-sharing system. In the case of electronics industry companies, bold facility investment and R&D were not preceded by looking forward to the future, but it is highly likely that they were cut off from the competition before benefiting from Corona 19. Sales of online platform companies are affected by the distribution trend of conversion to online shopping from before Corona 19.

The FKI was concerned that the benefit-sharing system could violate shareholder property rights. Based on the Win-Win Cooperation Act, the performance-sharing system, widely implemented by large companies, is a system that shares the results of joint cooperation between large companies and partner companies, such as developing new products, improving productivity, and reducing costs. On the other hand, the benefit-sharing system is a concept of sharing the profits of large companies that benefit from Corona 19 and non-face-to-face and platform companies with small and medium-sized businesses and small business owners who are suffering damage.

In a capitalist society, shareholders are the claimants for residual income from business activities. The FKI pointed out that if some of the corporate profits that can be returned as dividends go to companies or small business owners that are not related to the company, there will be a problem that directly infringes shareholder interests.

In addition, in the situation where a number of systems that make it difficult for companies to manage smoothly, such as the multiple representative lawsuit system and the strengthening of minority shareholder rights, have recently been introduced, the risk of litigation by companies may increase.

In addition, even with good intentions, if corporate interests are arbitrarily shared, management may be exposed to civil and criminal responsibilities. In fact, in the case of the Supreme Court, when a director decides to make a donation, it is a violation of the manager’s obligations unless a sufficient review is made on all conditions such as the nature of the donation, the impact on the purpose of the company and the public interest, the value of the amount, and the relationship between the company and the donor. It is judged that it corresponds to.

The possibility of reverse discrimination with foreign companies cannot be excluded. The FKI argued that the profit-sharing system is likely to be applied only to domestic companies, excluding foreign companies such as YouTube, a video platform, and Netflix, a leader in OTT. This is because even applying foreign companies could lead to international disputes. Already, a number of domestic companies have been autonomously pursuing mutual living with small businesses suffering from Corona 19 through advertising cost reduction, fee reduction, and technical support.

In the meantime, he pointed out that if the profit-sharing system is promoted, it may act like a quasi-tax limited to domestic companies, resulting in a problem of competition from foreign companies at different starting lines. In particular, they were concerned that domestic companies could become more disadvantaged in competition with foreign companies that have an overwhelming market share.

The FKI argued that the benefit-sharing system could weaken corporate profit-seeking and innovation incentives. The compulsory return of profits undermines a company’s motive for pursuing profits, while the anti-market profit distribution method can dampen economic vitality such as innovation activities.

In addition, it was revealed that the existing autonomously promoted commerce and life activities could be contracted or trade-off in a uniform manner required by the politics.

Copyright © Shin-A Ilbo Unauthorized reproduction and redistribution prohibited