Last year, 923 violations of the Foreign Exchange Transaction Act were caught… Fines for negligence, prosecution, etc.

(Seoul = Yonhap News) Reporter Nam-kwon Kim = The Financial Supervisory Service said on the 25th that individuals and companies are not well aware of their reporting and reporting obligations under the Foreign Exchange Transaction Act, and are often receiving penalties such as fines, warnings, and police notifications.

Under the current Foreign Exchange Transaction Act, individuals and businesses must report to the governor of the Bank of Korea or the Minister of Strategy and Finance in advance when making capital transactions. This includes foreign direct investment, overseas real estate acquisition, monetary loan, securities acquisition, overseas deposit, and gift.

In particular, foreign direct investment or overseas real estate transactions are obligated to report by transaction stage (acquisition, disposal, etc.) even after the initial report.

In the case of violations cited by the Financial Supervisory Service, A residing in Korea remitted $30,000 to a local subsidiary in Vietnam, and was imposed a fine for remittance without revealing that it was the foreign direct investment fund to the head of the foreign exchange bank.

Foreign direct investment is subject to reporting in front of the head of a foreign exchange bank even if only one dollar is invested, unlike general capital transactions in which reporting is exempted if the annual transaction amount is less than 50,000 dollars.

Mr. B bought a real estate in Canada with 200,000 dollars of international student expenses remitted to his child studying abroad in Canada, but he had to pay a fine for not reporting it to the head of the foreign exchange bank.

Even if you remit money overseas through legal procedures such as foreign student expenses, if you acquire overseas real estate, you are subject to a separate report to the head of the foreign exchange bank.

When making capital transactions through a bank, it is better to inform the purpose and details of the transaction in detail and receive accurate information from the bank on the reporting and reporting obligations under the Foreign Exchange Transactions Act, and then remittance abroad.

[금융감독원 제공]

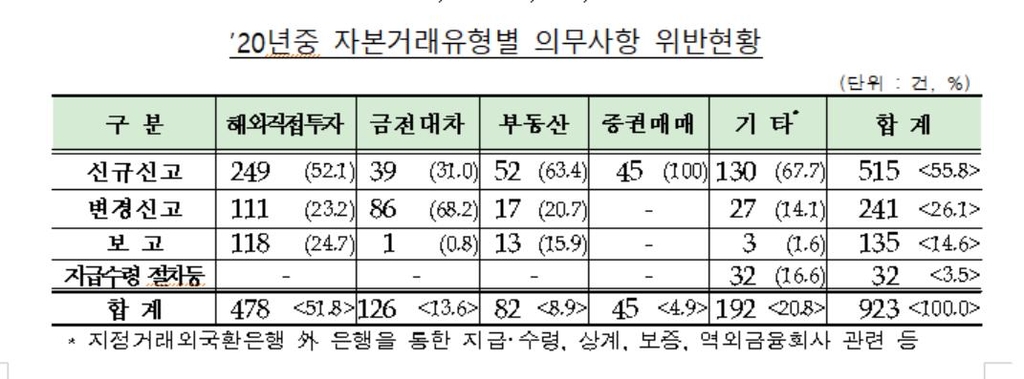

Last year, 923 cases were detected for violating foreign exchange transaction laws.

Among them, companies accounted for 515 cases (55.8%) and individuals accounted for 408 cases (44.2%).

By type, foreign direct investment was the largest with 51.8% (478 cases) of the total. This was followed by 13.6% (126 cases) of monetary loans, 8.9% (82 cases) of real estate investment, and 4.9% (45 cases) of securities trading.

The FSS took administrative sanctions (penalty fines and warnings) for 871 violations last year and notified 52 cases to the prosecution.

Unauthorized reproduction-prohibition of redistribution>

2021/03/25 12:00 sent