Input 2021-02-24 17:23 | Revision 2021-02-24 17:58

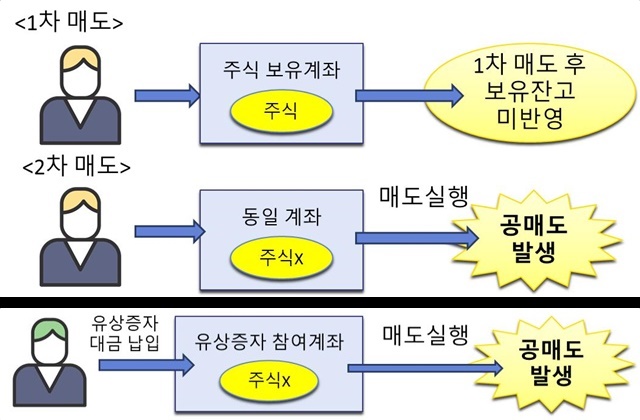

▲ A case of neglect of balance management (above), a case of incorrect listing date of a new stock with a capital increase (below) ⓒ Financial Supervisory Service

The Securities and Futures Committee of the Financial Supervisory Service announced on the 24th that it has decided to impose a total penalty of 685 million won on 10 overseas financial companies that violate the ban on short selling without borrowing under the Capital Markets Act.

It was revealed that a violator, such as a financial company based overseas, sold securities it did not own (violate the non-borrowing short sale ban) in the process of trading domestic listed stocks from January 2018 to July 2019.

The main types of violations are ▲ cases of neglect of balance management ▲ cases of misretention of stocks ▲ cases of intentional violations for the purpose of loss compensation.

First of all, it is the case that the stocks sold are not reflected in the balance even though the stocks are sold and the stocks are not held. He misunderstood that he had it and submitted a second sell order (second sell). In addition, shareholders who participated in the capital increase can sell new stocks only after they have been listed after paying the capital increase. There is also a case of submitting a sell order due to the incorrect listing and stocking date of new stocks.

In common, Jeung Seon Committee judged that the order was submitted due to a marked lack of basic caution as a financial investment company, such as not checking the quantity available for order before submitting a sell order. It was reported that there was a serious violation as a financial company, and a fine was imposed.

Instead of actually owning a stock, you can only acquire a gain on the stock price through a difference settlement transaction (CFD). Nevertheless, this is a case of submitting a sell order for a stock that it did not own because it was mistaken for owning it.

Financial institutions should ensure that they have adequate internal controls to prevent errors in the ordering process and that the stocks to be sold are normally held in their accounts. The Jeung-Seon Committee determined that there was a serious violation in submitting the order due to a marked lack of a duty of care.

There have also been cases of intentionally submitting a non-borrowing short sale order and buying and paying the sold stock through overtime mass trading. The target of the measure was an overseas trading brokerage company that conducted a non-borrowing short sale of the stock to compensate for the loss to the counterparty, but was caught through the Korean Exchange and financial authorities.

The Jeungsun Committee imposed a fine for deliberately impeding the financial order of the financial company’s basic obligations.

In the future, the financial authorities plan to strengthen the detection of violations of the non-borrowing short sale ban every six months to one month. In the case of a violation of the short selling laws and regulations detected, we will promptly investigate and take action.

From April 6, it is mandatory for short-selling investors to keep short-selling lending transaction information for five years. Upon request from the financial authorities, the obligation to submit the data is imposed. The level of sanctions is also strengthened, such as penalties and penalties for illegal short selling (violation of the non-borrowing short selling ban).

Press releases and article reports [email protected]

[자유민주·시장경제의 파수꾼 – 뉴데일리 newdaily.co.kr]

Copyrights ⓒ 2005 New Daily News-Unauthorized reproduction, redistribution prohibited

Vivid

Headline news Meet the main news at this time.