[서울=뉴스핌] Reporter Seung-Dong Kim = The Financial Supervisory Service is planning to strengthen the supervision of alternative investment assets for insurance companies.

On the 22nd, the Financial Supervisory Service announced the status of overseas alternative investment by insurance companies and the direction of future supervision.

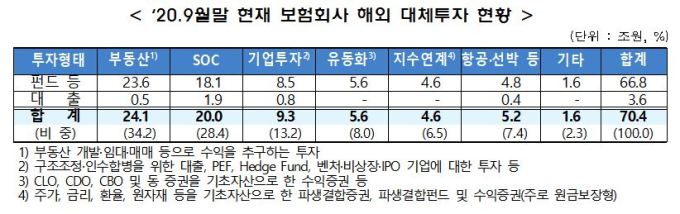

At the end of September of last year, the amount of overseas alternative investment by insurance companies was 70 trillion won, which is 6.5% of total assets (1087 trillion won). It is analyzed that the investment was mainly made in an indirect way, such as buying a fund rather than a direct investment.

|

| [서울=뉴스핌] Reporter Kim Seung-dong = Financial Supervisory Service, Corona 19 Impact…Insurance companies strengthening alternative investment supervision 2021.02.22 [email protected] |

The alternative investment types are real estate-related investments of KRW 24.1 trillion (34.2%), SOCs of KRW 20 trillion (28.4%), and investments related to corporate acquisitions and restructuring of KRW 9.3 trillion (13.2%).

Investment targets include offices: 1.09 trillion won (15.5%), power generation and energy 8.5 trillion won (12.1%), aircraft and ships 4.900 billion won (7.0%), and acquisition financing of PEFs, etc. to be.

Investment areas are mainly distributed in developed countries such as 26.8 trillion won (38.1%) in the US, 6.5 trillion won (9.2%) in the UK, 2.7 trillion won (3.8%) in France, and 6.800 billion won (9.7%) in Europe. . In particular, 63.4% (15.300 trillion won) of overseas real estate investment (24.01 trillion won) invested in offices, hotels, and complex facilities is concentrated in the US.

New investment is shrinking after 15 trillion won in 2018, and especially in the middle of 2020, to 6.6 trillion won, a significant decrease due to the effects of Corona 19. With 68.3% (48.100 trillion won) of the investment balance coming to maturity after 2030, the impact of short-term economic fluctuations is relatively limited due to long-term investments over 10 years.

However, foreign alternative investments maturing this year is 4.4 trillion won, of which 2 trillion won is real estate-related investment, which poses risks related to recovery of investments in case of deteriorating rental and sale conditions.

Accordingly, the Financial Supervisory Service is planning to reinforce the inspection standards related to alternative investment in the management status evaluation of insurance companies, and differentiate the soundness supervision according to the risk of each investment type.

An official from the Financial Supervisory Service said, “We will prepare and implement the’best standards for risk management for insurance companies’ alternative investments.'” “He said.