On the 28th, the Financial Services Commission and the Financial Supervisory Service recommended that bank holding companies and banks pay dividends within 20% of their net profit for a temporary period in order to maintain and improve their loss absorption capacity in response to Corona 19. Dividend includes interim dividend and treasury stock purchase.

However, dividends for holding companies of banks belonging to domestic bank holding companies are excluded, and IBK, Export-Import Bank, and Korea Development Bank, which are policy financial institutions where the government compensates for losses, are excluded from the recommendations. Accordingly, some banks such as SC First Bank and Citi Bank are the targets of dividend recommendations.

After the end of the recommendation, dividends can be voluntarily distributed as long as the capital adequacy is maintained.

An official from the Financial Services Commission said, “The financial soundness of domestic banks is good despite Corona 19, but preemptive efforts to increase capital are needed to cope with economic uncertainty.” “Based on the results of the Financial Supervisory Service’s stress test, banks to respond to Corona 19 And the bank’s capital management recommendations were resolved in this way.”

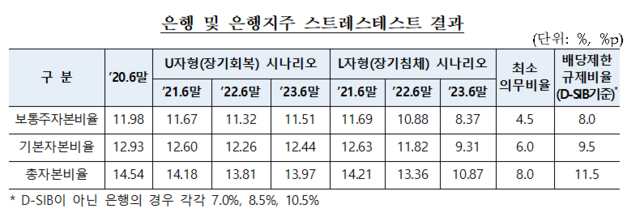

Financial Supervisory Service targets 8 bank holding companies (Shinhan, KB, Hana, Woori, NH, BNK, DGB, JB) and 6 banks (SC Cheil, Citi, Industrial, Enterprise, Import & Export, Suhyup) that are not affiliated with a domestic holding company. As a result of conducting a stress test using the U-shaped (long-term recovery) and L-shaped (long-term recession) scenarios, the bank’s capital ratio exceeded the minimum obligation ratio in all scenarios.

According to the banking supervision regulations, banks must maintain a common stock capital ratio of 4.5%, a basic capital ratio of 6%, and a total capital ratio of 8% or more.

However, in the U-shaped scenario, all banks exceeded the dividend limit regulation ratio, but in the L-shaped scenario, it was found that many banks did not.